The Australian superannuation sector has been subject to scrutiny from financial supervisors and policymakers over the past four to five years in search of changes that will improve efficiency, extend product choice and enhance the investment outcomes that these deliver to scheme members.

The Australian Royal Commission on Misconduct in the Banking, Superannuation and Financial Services Industry was established in 2017 to investigate misconduct and poor standards in the sector in question. Publishing its final report in February 2019, this Commission provided a series of recommendations designed to address “cultural failings” in the ‘super’, banking and wealth management sectors and provided the foundation for a package of reforms designed to meet the needs of investors and scheme members more effectively.

The report highlighted deficiencies in the governance and business culture of firms providing wealth management services, along with concerns about the fee structures and remuneration policies operated by those companies. It also highlighted failures by regulators (particularly the Australian Securities and Investments Commission) to protect investors’ interests by providing effective supervision of these activities.

The report highlighted deficiencies in the governance and business culture of firms providing wealth management services, along with concerns about the fee structures and remuneration policies operated by those companies. It also highlighted failures by regulators (particularly the Australian Securities and Investments Commission) to protect investors’ interests by providing effective supervision of these activities.

One consequence of this process review has been the launch in late 2019 of the Australian Prudential Regulatory Authority’s (APRA’s) MySuper Product Heatmap, which evaluates superannuation products according to their ability to deliver positive outcomes to scheme members, including their fees, investment performance and sustainability.

As part of this review, APRA has also been evaluating the importance of economies of scale in the ‘super’ industry. It advises that further consolidation may be required in this sector, indicating that larger superannuation funds are “typically better able to… provide good outcomes for its members now and into the future”1.

Responding to this point in its ‘Super Insights 2020’ report, KPMG observes that the ‘super’ sector has seen a number of mergers in recent years and, as a result, a number of Australia’s largest super funds have been able to increase their size even further (KPMG, ‘Super Insights 2020: The Superannuation Sector, Before and Beyond Covid-19’, May 2020).

“Post Covid‑19, we expect to see further mergers of funds/providers in the AUD50 billion+ space, creating an increasing number of mega funds in the future and a wider gap between these funds and the rest of the sector … [We also expect] to see mergers among medium-sized funds, largely in the sub‑AUD30 billion space. At June 30, 2019, there were five funds in the AUD20 billion to 30 billion space which could merge with each other or a number of smaller funds to make it to AUD50 billion,” it says.

“Post Covid‑19, we expect to see further mergers of funds/providers in the AUD50 billion+ space, creating an increasing number of mega funds in the future and a wider gap between these funds and the rest of the sector … [We also expect] to see mergers among medium-sized funds, largely in the sub‑AUD30 billion space. At June 30, 2019, there were five funds in the AUD20 billion to 30 billion space which could merge with each other or a number of smaller funds to make it to AUD50 billion,” it says.

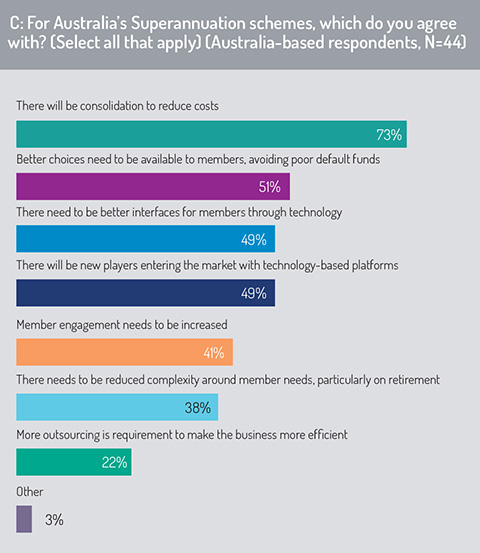

In keeping with these predictions, respondents to Funds Global Asia’s 2020 Australia survey anticipate that there will be further consolidation within the Australia ‘super’ marketplace to deliver scale efficiencies and to reduce costs (73%, fig C).

Additionally, respondents highlight the need for super funds to extend better product choices to scheme members, avoiding a situation where their work-based savings are held in underperforming default funds that deliver poor outcomes (51%).

Despite the continuing drive towards super fund mergers, respondents predict there is still an opportunity for new technology-driven platforms to enter the market, offering superior, digitally enabled outcomes and investor experience to scheme members (49%). In line with this sentiment, respondents highlight the importance of delivering a better interface to members through investment in technology (49%).

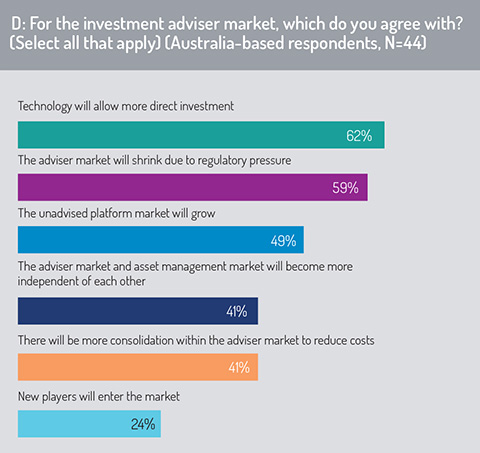

A number of similar conclusions emerge from respondents’ observations on Australia’s investment advisory landscape (fig D). The survey highlights the importance for wealth management firms of investing in technology to drive cost efficiency, to improve the investor experience and to support the digital preferences of younger generations of investors (62%).

The survey also predicts that Australia’s adviser market will consolidate (59%), with investors making greater use of asset managers’ D2C channels and unadvised investment platforms.

The survey also predicts that Australia’s adviser market will consolidate (59%), with investors making greater use of asset managers’ D2C channels and unadvised investment platforms.

These findings align with conclusions drawn by Australia-based respondents in last year’s survey. This predicted that, following the recommendations of the Royal Commission, the wealth management sector would be subject to divestment and consolidation, with a number of Australia’s largest banking groups reducing their ownership stake in this sector (Funds Global Asia, ‘The Impact of Technology on Investment Funds: Creating Business Opportunity through Innovation’: Australia edition, Autumn 2019, pages 8-9). Although the Commission stopped short of demanding an end to the vertical integration of financial product manufacture and financial advisory (or wealth management) units, it did report that many Australian financial institutions are “already taking steps to divest their wealth management”.

This 2019 survey also found that the recommendations of the Royal Commission may, over time, result in greater technology innovation in the investment funds segment. Its policy recommendations will require service providers to strengthen their risk-management procedures and to commit additional resources to risk assessment and regulatory compliance obligations.

This 2019 survey also found that the recommendations of the Royal Commission may, over time, result in greater technology innovation in the investment funds segment. Its policy recommendations will require service providers to strengthen their risk-management procedures and to commit additional resources to risk assessment and regulatory compliance obligations.

In direct terms, some companies will look to innovation in regulatory technology (‘regtech’) to help them meet this compliance responsibility. More generally, they will need to bear the cost of regulatory adaptation and will need to apply technology to deliver the efficiency improvements required to deliver these cost savings.

Impact of Covid-19

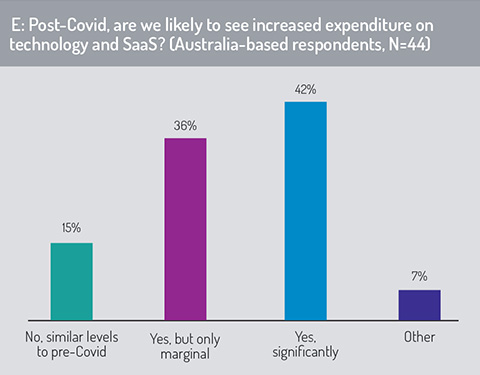

In responding to the Covid-19 pandemic, Australia-based respondents believe that the asset management industry is likely to increase its expenditure on technology (fig E). Almost four-fifths of respondents predict that technology investment will rise, with 42% believing this will be a sizeable increase. This may be accompanied by greater use of software-as-a-service (SaaS) delivery channels, whereby clients typically pay for service on a scaled basis according to usage. Software is typically hosted centrally (rather than ‘on premise’) and accessed via subscription or licence.

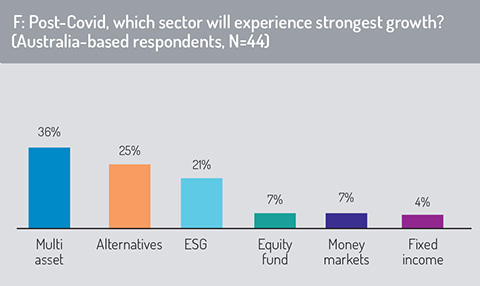

As Australian financial markets recover from the global pandemic, respondents expect strong investment flows into multi-asset products (36%), along with alternative assets (25%) and in ESG (environmental, social and governance) strategies (21%, fig F).

As Australian financial markets recover from the global pandemic, respondents expect strong investment flows into multi-asset products (36%), along with alternative assets (25%) and in ESG (environmental, social and governance) strategies (21%, fig F).

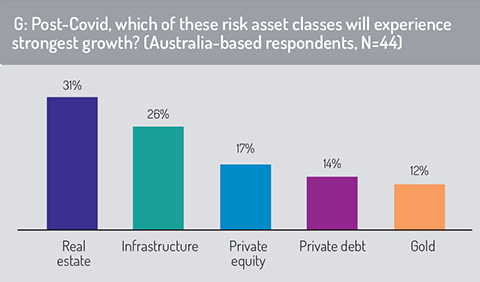

Looking more closely at allocations to real assets (fig G), almost one third of respondents to the Australia survey highlighted potential for strong growth in the real estate sector (31%), with investment in infrastructure funds also likely to be important as a source of return and as a hedge against inflation risk (26%).

1 – Australian Prudential Regulatory Authority, APRA Insights Issue 2, 2019, https://www.apra.gov.au/superannuation-australia-planning-for-change-sustainability-and-resilience

© 2020 funds europe