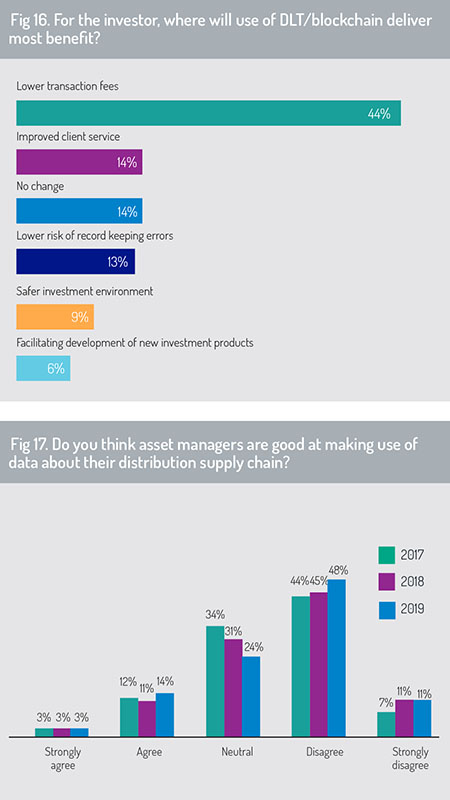

Repeating a question that was also included in the 2017 and 2018 surveys, we asked respondents whether asset managers are good at making use of data about their distribution supply chain (fig 17).

The results suggest limited improvement in the industry’s ability to apply this data effectively. In this year’s survey, 17% of respondents indicated that they agreed with this statement, of which just 3% agreed strongly. This is dwarfed by the number that disagreed – almost 60% of respondents said that the industry is not good at applying data on its distribution network, a figure that has risen slightly from last year.

Although a number of players have created solutions designed to help asset managers to monitor and report on their distribution sales – and to fulfil “target markets” requirements under MiFID II – the survey indicates that these are yet to feed through fully into concrete improvements in asset managers’ ability to gather, analyse and act upon insights available through their distribution supply chain data.

To meet their compliance obligations – and to evaluate their marketing and distribution strategies – asset managers may be required to seek information on end investors buying units in their fund products. We asked respondents to highlight the major challenges that asset managers face in obtaining data on their end investors. They were permitted to select more than one answer (fig 18).

Respondents indicated that primary obstacles arose from constraints in being granted access to data through their chain of intermediaries (61%) – whether driven by the EU General Data Protection Regulation (GDPR) or other data-sharing barriers – or due to lack of suitable technology (54%). This currently represents a more significant obstacle than lack of internal expertise (38%) or challenges of ensuring data is in the correct format (32%).

In commenting on why they require data to support their business activities, almost two-thirds of respondents said that they use data first and foremost to “understand the market” (fig 19). In line with our previous discussion, asset managers require data to monitor compliance across their distribution networks – to fulfil disclosure obligations under MiFID II or KYC/AML commitments, for example. Respondents also highlighted the need for data to benchmark the performance of internal sales teams or the performance of distributors across their global distribution networks.

In commenting on why they require data to support their business activities, almost two-thirds of respondents said that they use data first and foremost to “understand the market” (fig 19). In line with our previous discussion, asset managers require data to monitor compliance across their distribution networks – to fulfil disclosure obligations under MiFID II or KYC/AML commitments, for example. Respondents also highlighted the need for data to benchmark the performance of internal sales teams or the performance of distributors across their global distribution networks.

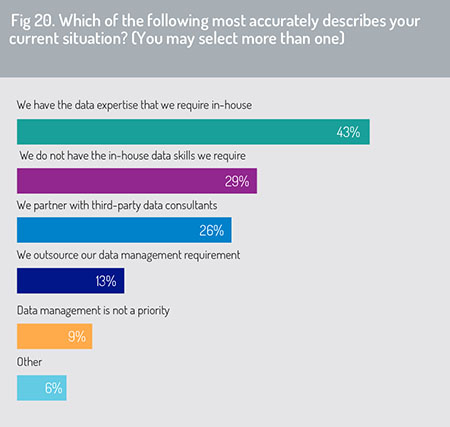

To evaluate how asset managers are managing their data requirements, we asked respondents to provide further details of their data strategies and the level of internal expertise on which they can draw. Respondents could select more than one answer (fig 20). The largest group of respondents (43%) indicated that they have the data expertise they require in-house and do not source skills externally from data management consultants. A smaller group (29%) said they do not have the data skills that they require internally.

For the latter group, outsourcing and partnering with specialist data consultants are the principal strategies that firms employ to manage this skills shortfall. Specifically, 26% indicated that they met this skills gap through partnership arrangements with third-party data consultancy firms, while 13% said they outsource their data management requirements.

Looking ahead

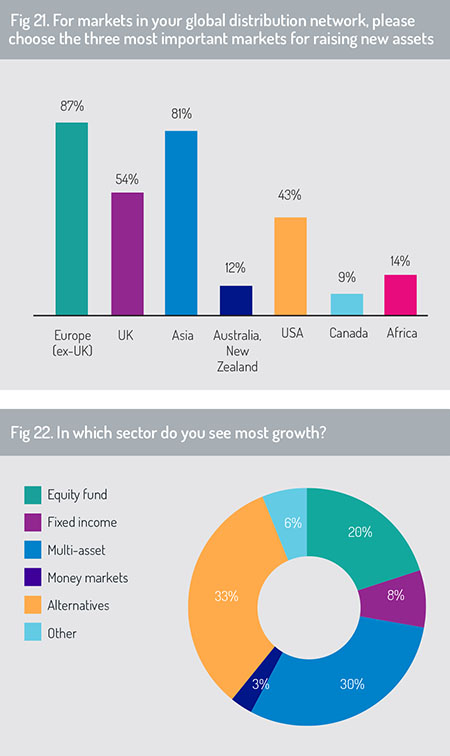

In concluding the survey, we asked participating firms to focus on their future sales opportunities and to predict which three markets or regions across their distribution networks will be most important for raising new assets (fig 21). The survey found that Europe (ex-UK) and Asia would be the dominant source of new asset flow. In respondents’ eyes, these locations appear to offer higher asset-gathering potential than a United Kingdom confronted by Brexit uncertainties, or a US market which appears to be stepping into the late stage of its current economic cycle.

In terms of asset allocation, respondents expect to see greatest opportunity for growth in alternative investments and in multi-asset strategies, with some respondents still positive about the opportunities that equity strategies can offer in current global economic and political conditions (fig 22).

In terms of asset allocation, respondents expect to see greatest opportunity for growth in alternative investments and in multi-asset strategies, with some respondents still positive about the opportunities that equity strategies can offer in current global economic and political conditions (fig 22).

Concluding thoughts

The survey reveals rising confidence in technology’s ability to deliver improvements in efficiency and cost management to the asset management industry. Distributed ledger technology is expected to have the greatest impact, along with solutions that capture advances in artificial intelligence and reinforcement learning.

Respondents told us that the application of DLT technology will deliver greater efficiency in fund trading and settlement. It may also result in a gradual restructuring of responsibilities along the fund value chain, leading to the potential displacement of some financial intermediaries from the distribution and post-trade process as a blockchain-based book of record is employed more extensively.

In exploring where the application of DLT will deliver the greatest benefit to investors, the survey finds that the dominant gain will be experienced through a reduction in transaction fees. Respondents currently appear to rank the cost-efficiency benefits of blockchain – and also potential improvements in client service – above the risk-management benefits that DLT may provide through lower risk of record-keeping errors or provision of a safer investment environment.

Respondents expect to see significant growth in direct-to-customer sales by asset management companies in the UK during the five years ahead. Independent financial advisers will retain an important role in supporting retail distribution in the UK, with retail investors continuing to require investment advice around pensions and retirement income, tax guidance, inheritance and a range of other areas. However, respondents suggest that D2C sales from asset management firms are likely to erode the percentage of UK retail fund sales conducted via IFAs over the coming five years.

Respondents expect to see significant growth in direct-to-customer sales by asset management companies in the UK during the five years ahead. Independent financial advisers will retain an important role in supporting retail distribution in the UK, with retail investors continuing to require investment advice around pensions and retirement income, tax guidance, inheritance and a range of other areas. However, respondents suggest that D2C sales from asset management firms are likely to erode the percentage of UK retail fund sales conducted via IFAs over the coming five years.

Over the past 12 months, a large majority of our respondents indicated that they had seen a rise in the cost of managing information on fund sales across their distribution networks. Looking more closely by respondent type, fund distributors identified the largest cost increases, but asset managers and fund administrators also highlighted a significant rise in the overhead associated with managing fund sales information.

In managing their business innovation, asset management firms are likely to find advantages in partnering with fund platforms, with online retailers (e.g. Alibaba, Amazon) and with financial technology specialists. Over time, however, the survey indicates that some of these partners may also become competitors and disruptors of the asset management industry. Given the commercial penetration and wide service portfolio that Alibaba and Amazon can already offer (including supply chain management, commercial brokerage and intermediary services, cloud services and IT networking), for example, it may be only a matter of time before these extend services more fully into the financial services arena.

However, we should not assume that this will be an easy transition. The pace at which this moves will be determined by whether BigTech firms and online retailers wish to compete with asset management or asset servicing companies which, until now, may have been customers or service partners. For buyers of investment services, it is still uncertain whether they will switch from existing suppliers to “disruptors” that they associate primarily with technology delivery or with retail merchandise distribution.

Also, this will demand significant research, investment and cultural adaptation by these disruptor firms themselves. The financial management industry has specialised delivery mechanisms, customer buying preferences and regulatory procedures. They may identify better returns, with less cultural adaptation, through diversifying their expertise into sectors other than financial services.

©2019 funds europe