Digital transformation has become a buzz phrase for the asset management industry. This implies innovation in business platforms and cloud-based services, along with control and scalability in how data is managed.

Digitalisation is enabling fund companies to bring greater efficiency to client service and process handling, but asset managers must remain customer-centred and responsive to the changing needs of millennials and younger generations. Asset managers are eager to present themselves as providers of investment solutions, rather than as sellers of investment products. But what does this mean in practical terms? And how does it shape strategy for investing in new technology platforms, communication interfaces and in more inventive client-service models?

Changing approaches to data engineering are supporting advances in data visualisation, real-time analytics and machine learning applications. Use of API-based architectures and application of cloud-based “as a service” delivery strategies is offering fund companies the opportunity to bring a new universe of solutions to their clients. But this also presents its challenges. Control over data access and contractual rights surrounding data commercialisation will be particularly important.

In the following sections, we evaluate respondents’ views on how these trends are driving technology investment and prompting shifts in distribution strategy within the asset management industry.

Technology application

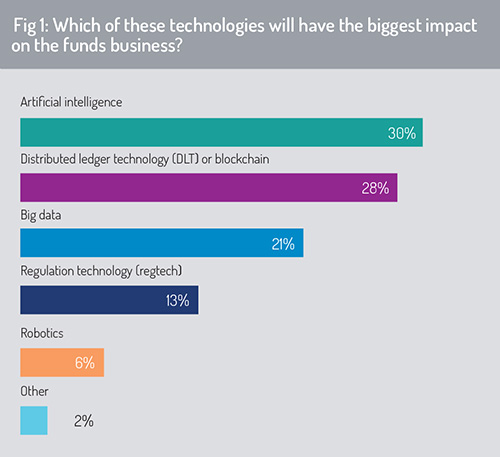

The survey asked participants to select, from a list of emerging technologies, which will have the largest impact on the asset management industry. This year’s results highlight the rising importance of artificial intelligence in the industry’s technology planning, with AI now appearing as the dominant response for the first time in this Europe and UK survey (fig 1). The percentage of respondents that identified AI as having most potential impact on the funds industry has risen from 22% in 2018, to 26% in 2019 and to 30% in 2020.

In the eyes of survey respondents, distributed ledger technology remains of major importance, although its percentage has dropped off slightly from 43% in 2018, to 36% in 2019 and to 28% in 2020.

The use of big data ranked third in terms of respondents’ priorities (21%, see chart). The ability to manage large data volumes and high data velocity is fundamental to a wide array of functions in the asset management industry – as an input to factor-based and quantitative investment strategies, for example, or for conducting customer segmentation analysis on an asset manager’s investors and prospects. It is also important in managing the data required to meet regulatory compliance obligations and for supporting performance attribution, predictive analytics and a wide range of AI strategies.

This is a skill that underpins effective delivery in many of the service areas addressed in this survey.

AI is finding increasingly wide application in the asset management industry, from use in client service applications, investment research analytics, regulatory and compliance software, to computer security and fraud detection. With this development, the need for efficient data infrastructure goes hand in hand.

DLT has been on the industry’s radar for almost a decade and respondents are now able to refer to more working use cases, such as Calastone’s Distributed Market Infrastructure, to evaluate the benefits this delivers to the market and to their customers (see further in the next section and Funds Europe and Calastone, ‘The Impact of Technology on Investment Funds’, 2019, pages 16-18). The market is becoming more discerning in identifying use cases where DLT is well suited and others where alternative options – a relational database or NoSQL data architecture, for example – may be appropriate to meet user requirements.

Large investments continue to be made in distributed ledger technology and the sector is now starting to mature. Some new entrants continue to enter the market, large financial companies continue to partner with DLT fintechs and there are also signs of consolidation. Blockchain companies have already exited the market, having struggled to sign clients or to secure the additional funding required to continue their development activities.

© 2020 funds europe