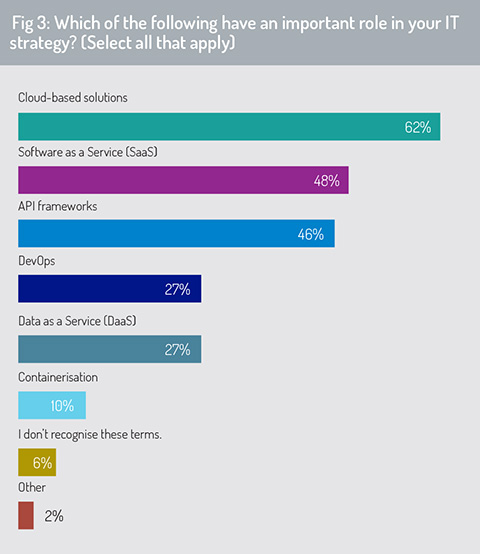

The survey asked respondents to identify, from a list of technology options, which currently play an important role in their companies’ IT strategies. Almost two-thirds highlighted use of cloud-based solutions – specifically use of public cloud and hybrid cloud in their technology strategies (fig 3). Respondents also highlighted the importance of Software-as-a-Service (SaaS) solutions and use of API (application programming interface) technology.

The financial services sector has experienced a sharp acceleration in the use of cloud services over the past five years, reflecting a comparable trend across the broader economy. A 2020 paper by UK-based industry body The Cloud Industry Forum, based on consultation with UK companies across large enterprise, SME and public-sector organisations, finds that 93% are now using cloud-based services in some form, with 71% of businesses planning to build new applications in the cloud in the future.iii

The potential benefits offered by cloud computing are widely publicised, providing opportunities to develop, host and run IT applications on demand with consumption-based pricing. This enables users to store data and run applications across multiple devices while offering scaling options to meet peaks and troughs in activity.

As one public cloud services provider put it: “We are helping thousands of organisations to successfully migrate significant workloads (such as applications, websites, databases, storage, physical or virtual servers, or entire data centres) to the cloud.

As one public cloud services provider put it: “We are helping thousands of organisations to successfully migrate significant workloads (such as applications, websites, databases, storage, physical or virtual servers, or entire data centres) to the cloud.

“These companies benefit from substantial IT costs savings, as well as improvements in productivity, business agility and operational resilience. They may migrate workloads from an on-premise environment, a hosting facility or from another public cloud.”

Barry Lee, business solutions director at Temenos Multifonds, observes that firms across the asset management industry are using public cloud provision in several different ways.

“Many asset servicing firms, and some fund managers, are looking to take advantage of the tools, analytics and scalability that cloud infrastructure can offer and to manage their own applications and data storage in a public cloud,” he says.

“Others, particularly smaller clients, may opt for a SaaS-based solution, a hosted solution managed by the service vendor (see box, next page).

“Through our SaaS services, Temenos provides a service layer on top of public cloud (e.g. Microsoft Azure, AWS, Google Cloud), which supports our hosted application, managing upgrades and software patches and ensuring optimised delivery of this solution through to the client.”

While public and hybrid cloud offers benefits in terms of scalability, load management and potential for users to translate fixed into variable costs, there are complexities in managing the transition from an on-premise architecture. Some firms have seen their cloud computing expenditure run well over budget in the early stages of this transition before their cloud usage is fully optimised.

New applications that are developed cloud native (i.e. designed to operate on cloud from inception) may be optimised to run in a cloud environment, but processes migrated from on-premise servers may need to be reconfigured to run efficiently and securely in a public/hybrid cloud environment.

New applications that are developed cloud native (i.e. designed to operate on cloud from inception) may be optimised to run in a cloud environment, but processes migrated from on-premise servers may need to be reconfigured to run efficiently and securely in a public/hybrid cloud environment.

Typically, a key part of this redesign will be to reconfigure monolithic applications, built on private servers and data centres, into smaller, independently developed modules that can be deployed more efficiently in a cloud environment.

A ‘microservices’ architecture builds and delivers IT projects as a series of small, self-contained modules or components. Each component has a single, specific purpose and fits with other modules, like building blocks, to create the bigger project. Embracing longstanding computing principles of ‘encapsulation’ and ‘low coupling’, each module should, as far as possible, be independent and can be replaced or upgraded with minimum impact on other modules and the wider IT estate.

If it is run in a microservices environment – through joined-up building blocks – these modules can run in the cloud in ‘containers’ (such as Docker, a commonly used platform for building, distributing and running containers) and with a container orchestrator (such as Kubernetes, which is owned and developed by Google) to optimise how these are deployed within the cloud.

Managing vendor relationships

Although some asset management houses choose to meet most of their trade processing, asset servicing and accounting requirements through in-house provision, others have chosen to outsource sections of the investment lifecycle, which they deem to be ‘non-core’, to an external provider.

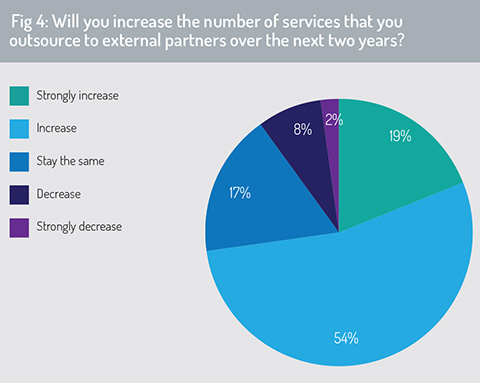

Almost three-quarters of respondents say that they will increase the number of services that they outsource, with 19% indicating this will be a strong increase (fig 4). This substantially outweighs the number of respondents – a tenth of the total – who say they will reduce the services they outsource to external partners.

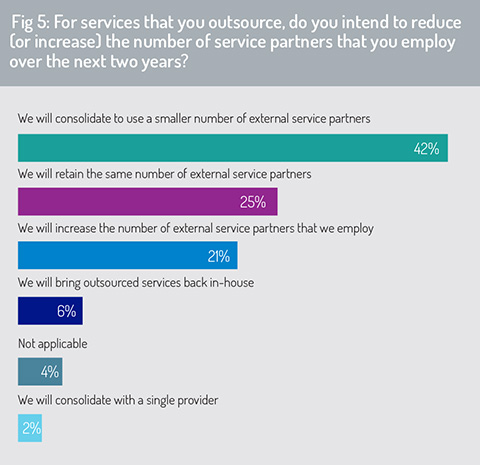

While respondents indicated they will increase the number of services that they outsource, they do not, in the majority of cases, intend to increase their number of vendor/outsource relationships (fig 5). On the contrary, more than two-fifths of respondents expect to consolidate their vendor list.

That said, there is no universal trend towards vendor consolidation across the industry. A quarter of respondents say they will retain the same number, and 21% say they will increase their number of external service partners – taking advantage of specialist skills these can offer to meet their service requirements.

That said, there is no universal trend towards vendor consolidation across the industry. A quarter of respondents say they will retain the same number, and 21% say they will increase their number of external service partners – taking advantage of specialist skills these can offer to meet their service requirements.

Commenting on these results, Barry Lee, business solutions director at Temenos Multifonds, says that asset managers are commonly seeking a comprehensive outsourced solution that meets many or all of their asset servicing requirements, including fund accounting and custody, middle-office services and often transfer agency.

The practice of ‘modular’ or ‘component’ outsourcing, where asset managers appointed multiple specialist providers to deliver individual services, is becoming less common. Asset managers are, in many cases, looking to reduce the number of vendor relationships from a governance and oversight perspective and also to achieve greater consistency of service.

To meet this commitment, asset servicers have been investing heavily in their strategic platforms and have been refining their global operating model in line with asset managers’ requirements. In fund administration, for example, leading service providers are now able to support asset managers’ business across a wide range of locations globally from a single global platform. This marks an advance on times past, where fund administrators often found it necessary to maintain a number of dedicated systems to support asset managers’ needs across different markets and asset classes.

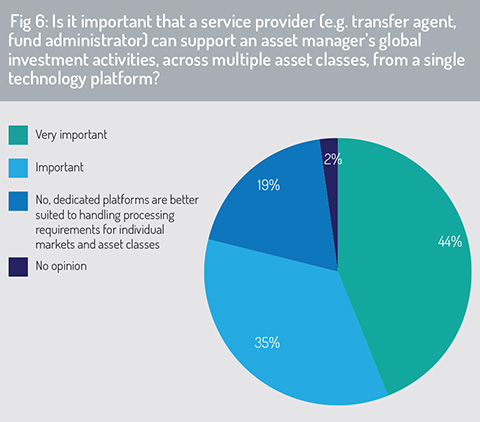

In line with this point, the survey asked respondents whether it is important that a service provider (e.g. fund administrator, transfer agent) can support an asset manager’s global investment activities, across multiple asset classes, from a single technology platform (fig 6). The answer was a resounding ‘yes’. Almost four-fifths of respondents said it was important that a service provider could meet this commitment, with 44% of these stating that this capability was ‘very important’.

“As a global business, fund managers wish to avoid receiving data and reports in different formats for different markets and needing to aggregate and reconcile that information,” comments Lee at Temenos.

“As a global business, fund managers wish to avoid receiving data and reports in different formats for different markets and needing to aggregate and reconcile that information,” comments Lee at Temenos.

“For the large asset servicers, a dominant theme over the past ten years has been to centralise and standardise their services around a global operating model, delivering consistency in data, reporting and client experience. Asset managers are looking to take advantage of this greater consistency, and potentially to consolidate their outsourced relationships, when they issue an RFP.”

These trends have, in turn, prompted asset servicers to review how they build their global operating model. “For a fund administrator that has built its operating model around Temenos Multifonds, for example, it makes little sense to be offering standalone services on legacy technology just to support one or two clients in certain markets,” adds Lee.

“Increasingly those clients are also being migrated on to the strategic global platform and asset servicers are decommissioning satellite platforms they have previously maintained to service specific elements of their global client business.”

© 2021 funds europe