The funds industry boasts 90% automation rates, so why is the fax machine still a ubiquitous presence? Nicholas Pratt examines the enduring appeal of this archaic technology.

Should nuclear obliteration descend on humanity, fax machines will likely survive, along with cockroaches. Despite all the advances of the past three decades, including the internet and digital technology, the fax machine is still a fixture in the funds industry.

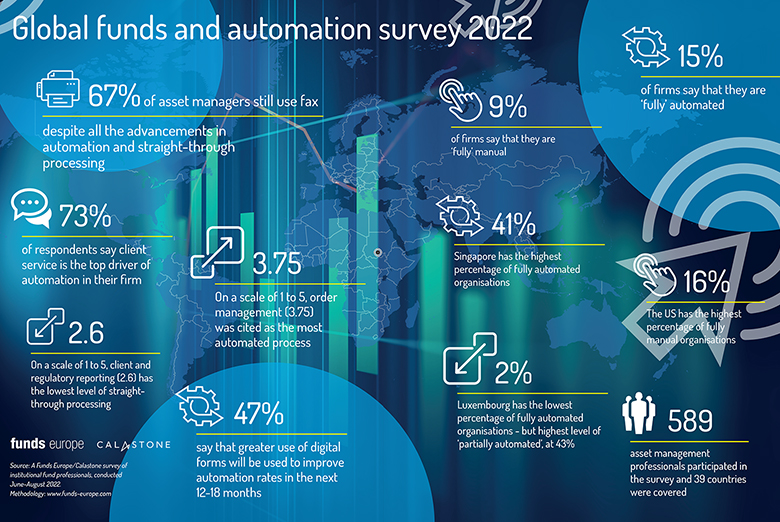

The Global Funds & Automation Survey was conducted to gauge the level of automation in the funds industry and how this varies in terms of regions and processes.

And despite respondents’ references to the use of robotics, blockchain and digital messaging systems as a means to promote more automation, the presence of the fax machine shows how much still needs to be done.

The 67% figure also serves as a reminder of just how often the fax features at the centre of important transactions, from fund orders to the transfers of multimillion-dollar footballers.

And it casts doubt on the idea that straight-through-processing (STP) percentage rates in the funds industry are overall in the 90s. In some areas, it might be. For example, periodic research by trade body Efama and bank messaging group Swift finds automation rates increasing over time. Among a cohort of transfer agents working in cross-border fund orders, the automation rate stood at 93% in Luxembourg and Ireland back in 2020.

“It seems strange to have that number of fax machines and still have [90%-plus] STP rates,” says Richard Clarkson, global head of solutions, FlexCube Investor Servicing, Oracle.

“It seems strange to have that number of fax machines and still have [90%-plus] STP rates”

The fax machine is the scourge of STP and a basic barometer for the level of automation in an industry. But the willingness to tolerate its stubborn presence in the funds processing chain is diminishing, not least because it is difficult to fully embrace new digital technology with a fax machine whirring noisily away in the background confirming orders.

According to Edward Glyn, head of global markets at funds network Calastone, the fax has no place in the asset management market of the near future, where private and professional investors will be digital natives.

“The funds industry is embarking on a massive process of technological change where convenience and immediacy will be at the forefront of the investor experience,” he says.

“Manual processes will not be acceptable to many, and even the fact that a financial institution might offer pre-millennial technology as a means of communication might raise reputational concerns,” says Glyn. “Distribution and supply chains are only as strong as their weakest link. It’s time to get rid of the fax as it will prevent the true benefits of the digital revolution in funds.”

First patent

It is not just the sound that is the problem with the fax machine. They are restricted in scale in that only a certain number of faxes can go across a phone line at the same time. Also, there is little verification of fax numbers, and the manual entry required gives room for human errors, and any physical output runs the risk of people misplacing it.

Even where faxes have been updated, there are drawbacks. When faxes are sent automatically and not scanned and received as digital images, the digital imagery is not optimal, and they can still be misread. Some firms have invested in optical character recognition, which reduces the need for re-keying, but the technology is not flawless, and details can be read incorrectly.

The fax machine has not always been a symbol of inefficiency. It also has a long history. According to technology historian Jonathan Coopersmith, a professor at Texas A&M University and author of The Rise and Fall of the Fax Machine, the first patent for a fax machine was granted in the UK in 1843, and the first commercial fax service was launched in Paris in 1865.

But it was not until the 1980s that the fax became a staple of the business world. “It was only then that a fax machine was affordable,” says Coopersmith. “It was also interoperable with other faxes because the manufacturers all followed the international G3 standard.”

It is easy to see why the fax was so integral back then, when the alternative was to send a letter or a telex. The fax was instantaneous (relatively), with a timestamp and a signature. The legal acceptance of a fax-based signature was a pivotal moment.

But why and how has the fax machine proved so enduring 40 years on? How can it still exist in the digital age? One reason, says Clarkson, is to do with the security concerns in the early days of emails back in the day. “Back 15 years ago, when people wanted to email instructions, it was a security concern, so faxes were used. So, it may be a hangover from that time.”

But why and how has the fax machine proved so enduring 40 years on? How can it still exist in the digital age? One reason, says Clarkson, is to do with the security concerns in the early days of emails back in the day. “Back 15 years ago, when people wanted to email instructions, it was a security concern, so faxes were used. So, it may be a hangover from that time.”

There is also the fact that much of the underlying infrastructure in the funds industry has been designed with the fax in mind. This has made it difficult to remove. The argument against removing legacy systems such as a fax machine is that it is costly and risky, like having open-heart surgery at an exclusive private hospital.

In addition, certain parts of the world have cultural attachments to the fax, says Coopersmith. Japan has a handwriting culture, for example, along with a number of small businesses and an ageing demographic, all of which lead to a reluctance to invest in new technology.

Unsurprisingly, the figures are noticeably higher in Japan than elsewhere. This is also true in Germany, where faxes are still widely used.

Faxes are also more common among hedge funds and the markets that domicile them, such as the Cayman Islands because transactions are low in volume but high in value.

Fax machines have also been retained by some organisations for disaster recovery and business continuity planning purposes, as a back-up means of communication should internet connectivity be compromised.

No alternative

But perhaps the main reason that the fax still endures in the funds industry is the lack of an alternative. As Clarkson says: “All transfer agents have yet to adopt a truly digital system, and that is why the fax is still there – there is no seamless alternative.”

Coopersmith agrees: “The fax machine is seen as a symbol of obsolescence and inefficiency, but why aren’t the competing systems as affordable and easy to use?”

It is also evident, as seen with the example of the fax, that it takes time for new technology to diffuse and become widely adopted, says Coopersmith. “You will have your early adopters and your never-adopters, but for everyone else, it can depend on how much agency they have. If you work for a large corporation that mandates automation, adoption will be faster.”

The only true way of getting rid of the fax is by replacing the process with a fully digital one, says Glyn. “To achieve this, you need a viable and secure alternative, and you need ‘fax offenders’ to stop using them.”

“You can’t have that number of fax machines and still have 98% straight-through-processing rates” – Richard Clarkson

So far, the funds industry has failed on both these fronts. But, says Glyn, the transfer agency community especially has talked about banning faxes within the next two to three years. The challenge is to get the support of the asset management community and the transfer agents’ clients who have delegated operational processes to their security services providers.

“From an asset manager’s perspective, a faxed instruction could be a subscription order for a very large amount, and they’re more likely to therefore want the money to come in regardless of the operational channel,” says Glyn.

Improving the user experience is seen as a big driver for adopting automation, but some investors will be perfectly happy using a fax. After all, you only need to know your counterparty’s fax number and not the latest version of technology or the data format they currently use.

And while technological change is coming, with distributed ledger technology and the prospect of real-time data sharing, the funds industry is still reliant on many intermediaries in the chain engaged in batch operational processes.

All of this creates friction that no one has been able to eliminate. In the past, the industry has outsourced fund processing to fund supermarkets and platforms but then found they have been disintermediated.

What is really needed is a portal that connects the investor or the adviser directly to the TA through open APIs, argues Clarkson.

“A truly frictionless environment is an investor with a direct link to the fund manager using open APIs and cloud-based data flowing back and forth, not the endless reconciliation performed between a string of intermediaries,” says Clarkson.

“But the industry is still playing around,” he adds. “There are too many intermediaries and too many layers of intermediation and no open environment on modern technology. There is no easy way to connect the investor to the TA. Nor has it been coordinated, and no one wants to go first and risk losing either money or customers or both.

“It is like a house of cards. If you remove the fax, what will tumble as a result?” asks Clarkson. A house of cards? Oh no, not more paper…

© 2022 funds europe