Quarterly search activity remains as intense as ever. Sean Thompson looks at the most-sought managers in various asset classes over Q3.

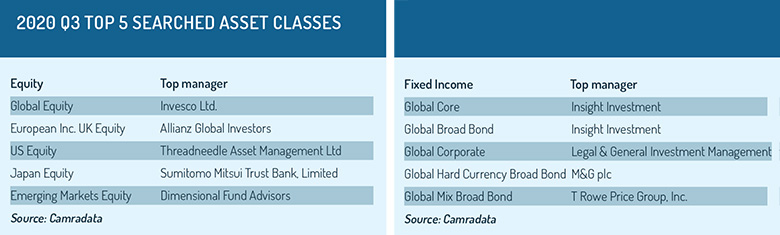

The third quarter of 2020 saw a large amount of investor search activity spanning global equities, alternatives and multi-asset as coronavirus continued to hamper economic growth.

In a world where the phenomenon of low and even negative interest rates on sovereign bonds is occurring, we are seeing a potential major shift in institutional investors’ investment positioning. This was reflected in Q3 Camradata search activity across multiple asset classes, not least global broad bonds.

The manager with the most searches in this category was Insight Investment, while in global equities, the most commonly searched manager was Invesco Ltd.

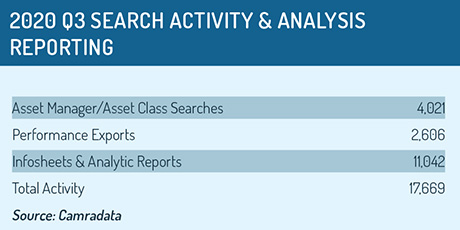

Investors would have been either seeking out new managers or monitoring their existing investments with peer group analysis reporting in order to review performance and rank asset managers.

Investors would have been either seeking out new managers or monitoring their existing investments with peer group analysis reporting in order to review performance and rank asset managers.

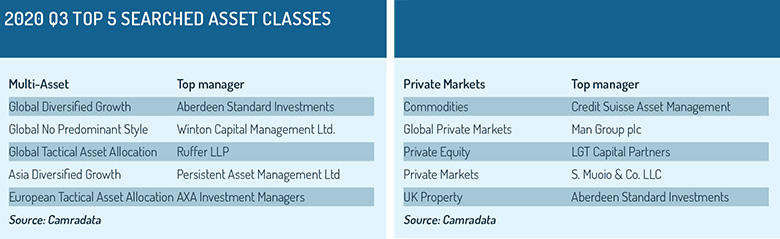

Within the multi-asset class universe, which includes strategies such as diversified growth funds, preliminary figures showed Aberdeen Standard Investments hitting the top spot for the second consecutive quarter as the most-searched manager.

There were a number of searches carried out in alternative asset classes and various asset managers came out on top, depending on asset class. These top-placed managers included Credit Suisse Asset Management, Man Group plc, LGT Capital Partners and S. Muoio & Co, LLC.

There were a number of searches carried out in alternative asset classes and various asset managers came out on top, depending on asset class. These top-placed managers included Credit Suisse Asset Management, Man Group plc, LGT Capital Partners and S. Muoio & Co, LLC.

In addition, Camradata carried out nine assisted searches during Q3 2020 on behalf of pension schemes and investment consultants. Asset classes were private markets, real estate, multi-asset, UK ethical equity, UK fixed income, multi-asset credit, absolute return, securitised/structured credit and global fixed income.

Whilst search activity continues to remain strong, the investment outlook is still highly uncertain, and the big challenge of volatility remains a central feature of the market landscape.

Sean Thompson is managing director of CAMRADATA, the owner of Funds Europe. All figures are for three months to September 30, 2020 unless otherwise stated

© 2020 funds europe