Chris Mellor, of Invesco, considers the perceived breakdown between the gold price and inflation and tries to answer if this is a permanent feature for the precious metal.

Gold had a stellar year in 2020, with investors around the world buying record amounts via physical gold ETFs and other exchange-traded products, sending the gold price to all-time highs of over US$2,000 an ounce in August. The precious metal recorded a higher annual return than any other major asset class last year.

Conditions in 2021 are different. Widespread uncertainty has been replaced by factors pointing to a strong recovery with fewer concerns on the downside. More recently, inflation has emerged as one of the most relevant downside risks facing investors.

The latest reading of inflation in the US showed prices continued to rise in May with CPI at an annualised rate of 5%, only the third time in the past 30 years it has been so elevated. So, following a brief lull, investors have returned to gold, with strong inflows since May and the gold price rallied to US$1,900 an ounce earlier this month.

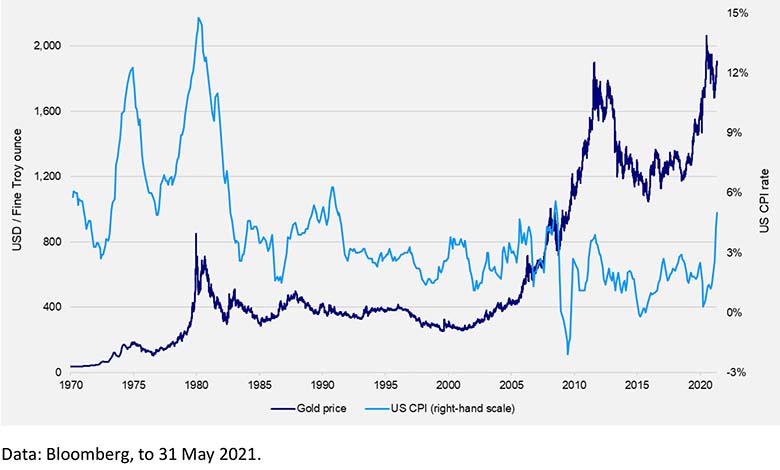

A simple study of gold’s performance over the last 50 years would tend to support the theory of gold being a hedge when inflation is notably elevated, when it is significantly higher than any target set (implicitly or explicitly) by policymakers. According to a study by the World Gold Council and using data since 1971, gold has returned 15% per annum on average when inflation has been higher than 3%, compared to just over 6% per annum when inflation has been sub-3%.

If, however, we look into the data more closely and consider not only year-on-year changes but also the direction and velocity of movements – in both directions – we can observe that, although gold appears to offer a reasonable hedge against inflation over the long term, its credentials in this aspect are less clear over shorter time periods.

Indeed, evidence suggests the interaction between the gold price and inflation is now weaker, arguably since the early ‘90s, and it’s important to understand the cause in order to determine whether it is a permanent breakdown.

What people are willing to pay

To answer that, we can look at two of the main drivers of the gold price – fear and opportunity costs. Because gold doesn’t pay an income, has no maturity date and carries a sentimental quality, it’s difficult to value using traditional financial models. Gold – probably more than any other asset – is worth what people are willing to pay for it.

This brings us to opportunity costs. Gold does not pay an income so if investors can get paid any positive income for an asset, such as Treasuries, then gold seems less attractive. Crucially, the income needs to be adjusted for inflation, i.e. positive real income.

While inflation has clearly been rising, it’s important to understand the future. According to the latest Fed survey, the average US consumer believes inflation will be 4% a year from now, up from the 3.4% they anticipated a month earlier, and could be 3.6% in three years’ time, up from 3.1% a month earlier. You could interpret that as signalling inflation is possibly at or near the peak, but equally you could read into those forecasts that inflation could remain higher than the Fed would like for the next few years. As such, real yields may remain close to zero – or even negative – in the near to medium term. That could make gold look more attractive.

If inflation were to surprise to the upside and overshoot even currently high estimates, gold may shine brighter. The turning point could be if inflation goes from a “comfortable” level to one that forces the Fed to step in with rate hikes.

There are many factors that influence not only the gold price but also its importance in investor portfolios. A key attraction is the diversification benefits that gold may provide as it tends to be lowly correlated with equities in particular. And that could be worth its weight in gold.

Chris Mellor is head of Emea ETF, equity and commodity product management at Invesco

© 2021 funds europe