How the financial services industry can help deliver a just transition to net zero was a central topic on day two of Alfi’s European Asset Management Conference in Luxembourg.

Sarah Gordon, senior advisor at the Impact Investing Institute, said during her talk ‘How and why, the financial services industry can help deliver a just transition to net zero’ that although statistics are alarming, the good news is that solutions to climate change already exist.

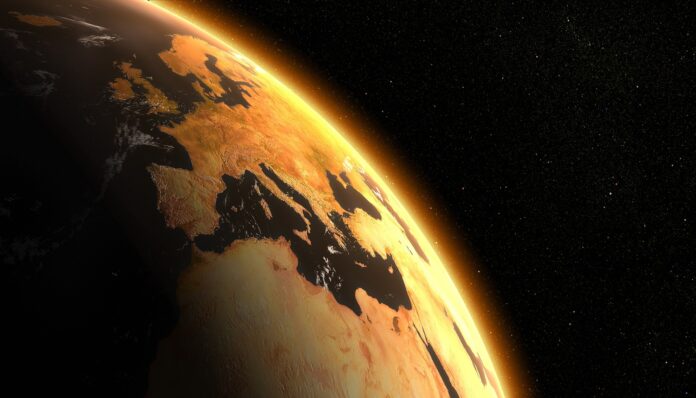

Citing a recent Intergovernmental Panel on Climate Change (IPCC) report, which is the most authoritative global body on climate change, Gordon said the world has already warmed 1.1 degrees over pre-industrial levels and will hit 1.5 degrees next decade (seven years). It will switch over 2.5 degrees in the next century, “and there will be irrevocable damage to our planet and way of life”.

For actors in financial markets, the practical challenge is how to channel the capital needed to address the climate crisis to people and places that need it the most – and then also deliver financial returns.

“I have been working to help come up with a playbook, to address those practical challenges, how to make that happen in practical ways in which we financial markets actors and government regulators can address the climate crisis in a way that delivers us financial returns and is just and socially inclusive – because if the transition to net zero is not just and socially inclusive, it is simply not going to happen,” Gordon said.

There will not be public backing for the transition and the profound changes in societies and economies that it requires if “we do not mitigate the negative social consequences of the transition”, she added.

There will not be public backing for the transition and the profound changes in societies and economies that it requires if “we do not mitigate the negative social consequences of the transition”, she added.

A just transition is not only necessary, but it also provides excellent opportunities for financial returns, Gordon said, and claimed that there were multiple examples of success at transition through investing across asset classes, sectors and geographies.

Examples of these need to be replicated on a “far greater scale than at present”, she added.

In July last year, the Impact Investing Institute launched a just transition finance challenge which is designed to mobilise more private and public capital into investments that support just transition to net zero in the UK and other developed and emerging markets, she said.

As part of the challenge, the Institute has developed a set of universally applicable criteria for financing vehicles that deliver the “three critical elements of a just transition”: climate and environmental action, socio-economic development and community voice.

The criterion is designed to help companies approach a just transition within their existing investment strategies or those yet to hit the market.

“It is very important to emphasise that just transition is not only an emerging markets challenge, as widely believed, but it is also very much a developed market challenge too,” Gordon states.

The just transition challenge brings together global financial institutions with over £4 trillion of public and private assets, including Fidelity, BNY Mellon, Schroders and HSBC.

© 2023 funds europe