Funds Europe’s annual survey of the funds administration sector shows that 2019 was a good year for the industry, but the covid crisis will make 2020 different from anything that has gone before.

Almost without exception, the nine large fund administrators that took part in our annual survey of the third-party fund administration sector saw healthy increases in their assets under administration as a decade-long bull market ran what turned out to be its final course.

With assets under custody/administration of US$37.1 trillion (€34.3 trillion) at the end of December 2019, BNY Mellon – by far the world’s largest custodian bank and asset servicing firm – remains at the head of the table in terms of the size of its assets, which rose 12.08% from $33.1 trillion at the end of 2018.

It was also a vintage year for JP Morgan, which saw its assets under administration rise 24.28% from US$9.16 trillion at the end of 2018 to US$11.39 trillion by the end of 2019.

Meanwhile, SGSS saw a small dip in its total assets under administration from US$719 billion at the end of 2018 to US$713 billion at the end of last year.

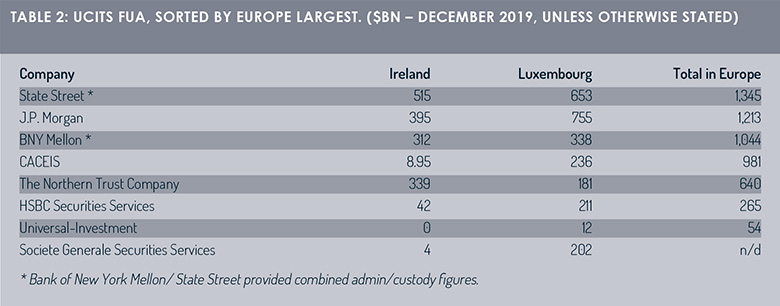

When it comes to assets under administration in Ucits funds in Europe, State Street, JP Morgan and BNY Mellon retained their top three places at the head of the table from 2018, while Caceis and Northern Trust remained in positions four and five respectively.

Since the end of 2019, the global business environment has of course changed markedly, with some economists warning that the world economy has entered its biggest slowdown since the Great Depression of the 1930s.

Creative thinking

Diane MacFarlane, head of global fund services for Emea at JP Morgan, says there has been evidence that the launch of new funds products had slowed since the Covid-19 crisis got underway.

“Asset managers are understandably focusing at the moment on their staff, running their core business, reacting as the various countries react, and of course dealing with market volatility,” she says.

“We have seen that some clients are being creative and investing in new derivatives that can take advantage of the market volatility and I think that clients are very much trying to maintain that pipeline.

“People may look to prioritise their product launches a lot more. Administrators will play a key part in this.”

MacFarlane says that market turmoil has historically seen a flight to quality and liquidity and that firms need the ability to meet potentially large redemptions as investors revisit their strategies.

“There is also an increased need to have accurate cash forecasting,” she says. “As clients try to manage their future liabilities, their abilities to adjust their cash forecasting is becoming crucial.”

Credit products could well become more appealing to investors as a result of the crisis, MacFarlane says.

“The liquidity and market challenges that this is bringing is going to have significant impacts,” she adds.

“We are going to see regulators continue to ask for increasing amounts of information on liquidity.”

MacFarlane also believes that actively managed investment products could, as a result of the investor unease that the crisis has unleashed, grow in popularity.

“Whenever there is market turbulence, people look to move to the more actively managed and risk-balanced products to try and have some certainty.

“What this crisis has proven from a fund administration perspective is that global operating models provide a lot of resiliency in times of uncertainty.

“As things move around the globe, the ability to be very flexible and have consistent operating models really does show its benefit in times like this.

“I think that the industry can pull together in times like this and in a very fast and flexible way, but also in a calm way.”

“People are planning well and executing well, but the processes need to be sustainable and that is what the industry is focusing on.”

The Brexit question

Other than the uncertainty created by the pandemic, the other big unknown facing European fund administrators – which will not become clearer until later in the year – is the post-Brexit trading arrangements between the UK and the European Union.

Talks between the two sides have been delayed by the crisis and the chances of a deal being reached by the original deadline of June look increasingly remote.

Many are expecting either a no-deal scenario of trading on World Trade Organization terms (which would bring an end to cross-border trade in financial products) or for the current transitional period to be extended beyond the end of this year.

Arnaud Claudon, head of asset owners and asset managers client lines at BNP Paribas Securities Services, says fund clients will need to carefully assess the location of their investor base and adjust their UK offering to UK-based investors.

“For EU-based asset managers with EU fund ranges, this may in some cases result in the creation of a UK-specific fund range for UK investors, and vice versa,” he says.

Neil Coxhead, Caceis’s managing director for the UK and head of regional coverage for Ireland, North America and the UK, says that the trend of UK managers setting up Luxembourg or Ireland-domiciled products for EU market distribution continues.

“Some EU clients are interested in launching UK-domiciled products for their UK investors and our UK branch can help such clients launch new products depending on the final passporting rules,” he says.

Dorothy Hamilton, global head of fund services operations at HSBC Securities Services, believes uncertainty over regulation and the potential tax implications of Brexit is leading to “constant re-evaluation” of the best approach for fund structuring solutions.

She says: “We are supporting clients through this by providing flexible, and yet consistent, solutions across different jurisdictions. This extends to the launch of double layers of tax-transparent funds across jurisdictions for taxable investors.”

Meanwhile Sarbjit Panesar, global head of business development at Societe Generale Securities Services, says the business uncertainty thrown up by Brexit remains the biggest challenge for the industry.

“We have seen UK managers who have promoted their UK-domiciled funds, cross-border transition these to Luxembourg or Dublin,” he says.

“What we have not seen is the mass launch of UK-domiciled funds by managers who currently distribute their cross-border product into the UK.”

This, Panesar believes, has been driven by the Financial Conduct Authority’s Temporary Permission Regime (TCR), which will be reopened in 2020. “The impact of the TCR has meant that managers have been able to continue to distribute cross-border funds into the UK. As discussions come to fruition on how trade will occur between the UK and the EU, we may see more transition from cross-border funds to UK-domiciled funds.”

© 2020 funds europe