Market participants are largely aligned on the need for extensive geographical reach as the ETF market aims to triple its assets, Funds Europe research, in partnership with Calastone, shows.

A significant beneficiary of the explosion of capital supply that low-interest rates spurred on in the 1980s was the private equity industry. Professional investors borrowed money for low interest rates and used this debt to take ever larger equity stakes in companies. It became known as the “leveraged buy-out”.

Not every asset manager will choose to offer ETFs – but every asset manager will surely by now have made the decision whether to. These renowned liquid investment vehicles that track indices, and hold huge appeal for investors, have become so dominant that it is hard to imagine that any firm will have ignored this strategic question. At the end of June, ETF assets under management globally stood at US$10.5 trillion (ETFGI), which compares to $70 trillion held by investment funds worldwide, according to a recent figure from trade body Efama.

BBH bank predicts that ETF assets will grow to $30 trillion in the next ten years, powered partly by the rise of active ETFs. About a quarter of a century after the first ETF was issued in the US, these passive products that trade whole indices with the liquidity of a single share are pivoting towards active management. JP Morgan Asset Management entered the European ETF market in 2017 with a strategy centred on active ETFs.

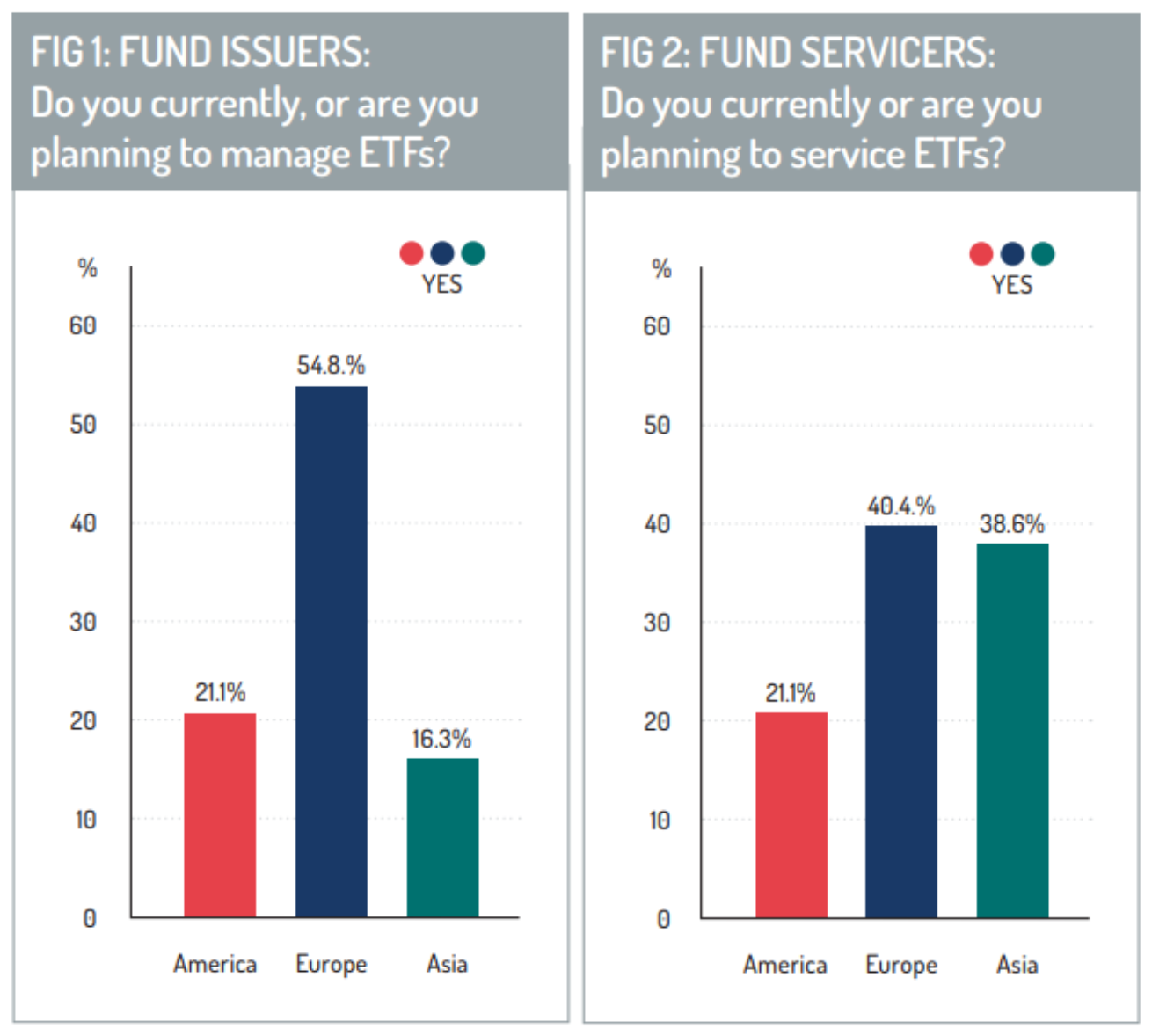

Funds Europe’s research into ETF administration, in partnership with fund transaction network firm Calastone, shows that of the 104 respondents from fund issuers that took part in our survey, all said they currently manage ETFs (fig 1). Most participants in the fund-issuer cohort were from Europe (54.8%), as fig. 1 highlights.

Along with the 104 fund issuers, 114 fund administrators also took part in the ‘ETF fund administration survey’, along with 95 authorized participants (APs) – the brokerage-like firms central to the ETF creation and redemption process. The survey spanned the US (74 respondents), the EU and UK (146 respondents), and Asia – mainly Singapore (28 respondents) and Hong Kong (27 respondents).

Market Alignment

One purpose of the survey was to understand how aligned these three market actors are in delivering ETF strategies, and so we asked the 114 fund administrators (known as ‘fund servicers’ in our survey) if they, too, currently offered ETF services, or if they planned to. All respondents answered yes, with 40% from Europe (fig 2).

Geographical Reach

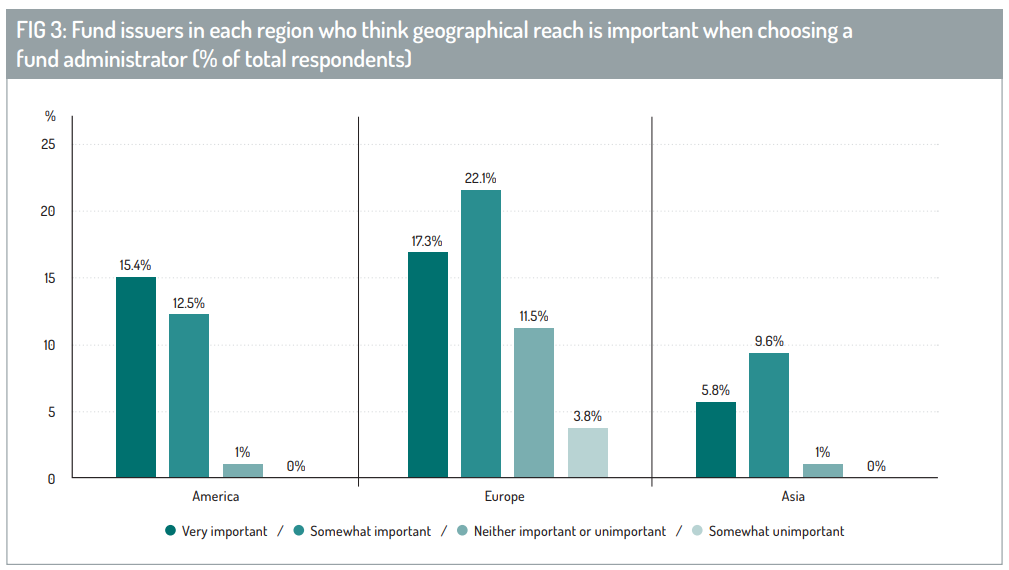

Like an ordinary investment fund, an ETF will be domiciled in a particular country. However, it lists on the stock exchange in the country where the ETF is sold. As providers seek to expand their distribution of a particular ETF, multiple listings are required internationally. Is it, therefore, important to fund issuers that their ETF administrator – typically a third-party firm – can offer the fund issuer expansive geographical coverage?

For fund issuers, this is certainly the case, with 83% overall saying it was either very important or somewhat important.

There was a big drop between the 83% who signalled that geographic reach was at least ‘somewhat important’, and the 13.5% who said it was neither important nor unimportant (fig 3).

There was a big drop between the 83% who signalled that geographic reach was at least ‘somewhat important’, and the 13.5% who said it was neither important nor unimportant (fig 3).

The importance of geographical reach is hardly surprising considering the degree to which asset managers generally seek to globalize their distribution. BlackRock, the largest ETF provider in the world, is the most well-known example of an ETF provider – under the iShares banner – internationalizing its business, but similarly, Franklin Templeton and Northern Trust join their US rival JP Morgan in launching ETF strategies in Europe in recent times.

“Sooner or later, market developments in the US inevitably find their way to Europe in some shape or form,” Tony O’Brien – the Dublin-based chief commercial officer at fund administrator US Bank – says, with reference to ETF trends.

Making sense of Europe

The data shows that geographical reach has more importance to the US issuers who responded to our survey: more of them answered ‘very important’ than ‘somewhat important’, whereas respondents who work for issuers in our European and Asian cohorts mainly selected ‘somewhat important’.

If we are to make sense of why geographical reach is relatively less important overall to European respondents, then we might assume that many brands in Europe focus mainly on their domestic and European cross-border markets. For those who are cross-border, the EU’s Ucits regulatory framework should, in theory, make European issuers’ pan-European ETF distribution simpler to execute owing to a (largely) harmonised regulatory regime under the Ucits regulations. Their regulations allow for a fund created in one EU country to be passported into others with low levels of red tape.

If American issuers prize geographical reach more than those in Europe, this could be because branching out into the UK and the EU – let alone the discrete markets of Asia – makes it imperative that any US issuer works with a geographically expansive service provider that can facilitate access to markets with contrasting regulatory regimes and disparate levels of process standardization. The same can be said of the Asia-based respondents to our survey who position themselves as pan-Asian.

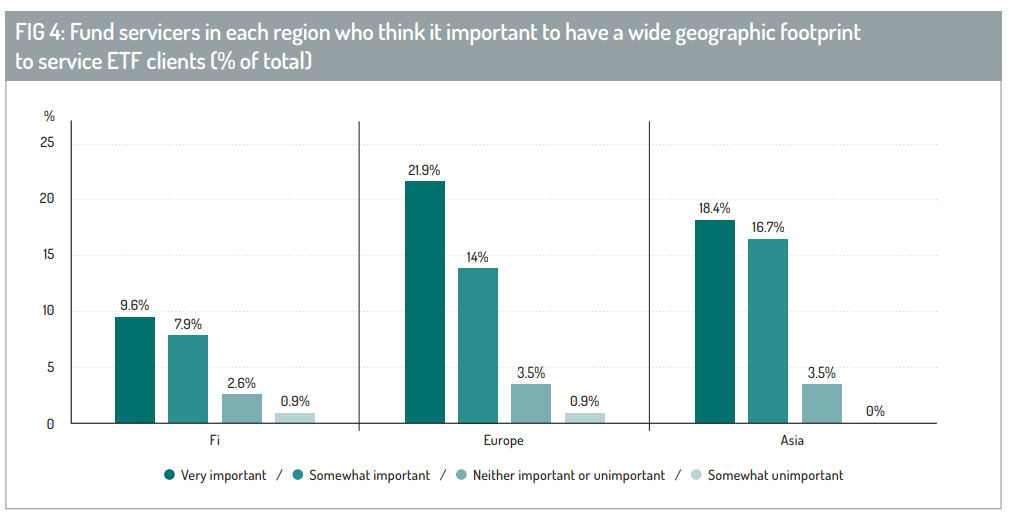

Are fund administrators aligned on the importance of geographical reach? Given the global nature of fund administration and associated custody (at least for the largest and most well-known firms) it would be hardly surprising to find that they are aligned. And, indeed, they are (fig 4).

Are fund administrators aligned on the importance of geographical reach? Given the global nature of fund administration and associated custody (at least for the largest and most well-known firms) it would be hardly surprising to find that they are aligned. And, indeed, they are (fig 4).

If anything, our data suggests that European fund administrators are even more ambitious to provide wide geographical coverage than are their European clients (the issuers). Most of the fund administrators said it was ‘very important’ to have geographical reach, while ‘somewhat important’ was a prevalent answer, too.

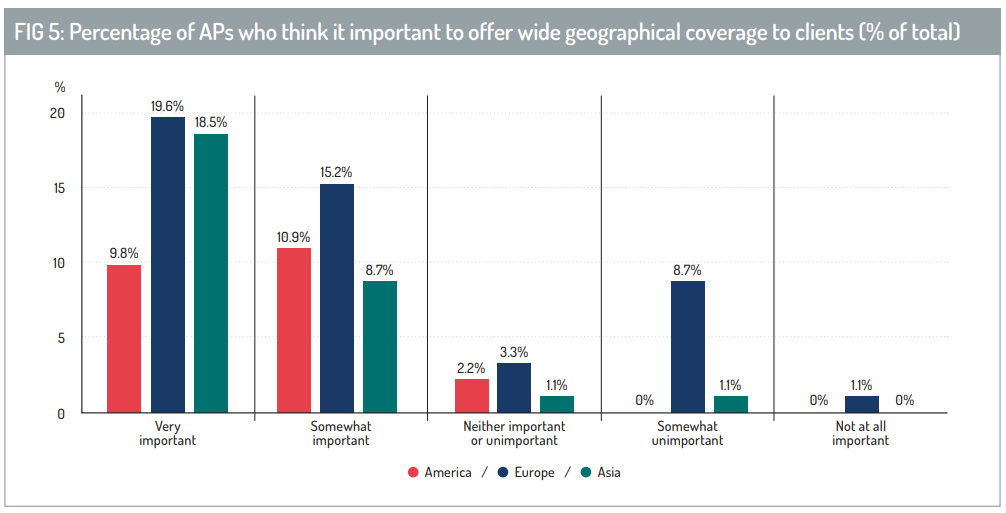

Similarly, APs consider it important to be able to offer wide geographical coverage for their clients, their clients being the issuers. Of the 95 APs that took this survey, 48% said this was very important, and 35% said it was somewhat important to them, with Europe and Asia showing a significantly heightened importance for this than in America (fig 5).

Similarly, APs consider it important to be able to offer wide geographical coverage for their clients, their clients being the issuers. Of the 95 APs that took this survey, 48% said this was very important, and 35% said it was somewhat important to them, with Europe and Asia showing a significantly heightened importance for this than in America (fig 5).

Rob Rushe, global product head for ETF servicing at HSBC’s securities servicing business, says: “Geographical coverage is key for the ETF industry as it’s important that best practice is carried across markets and regions. We see this, particularly with our Asia and European footprint, where there is more standardization and automation of the ETF primary market in Europe compared to Asia.”

‘High level’

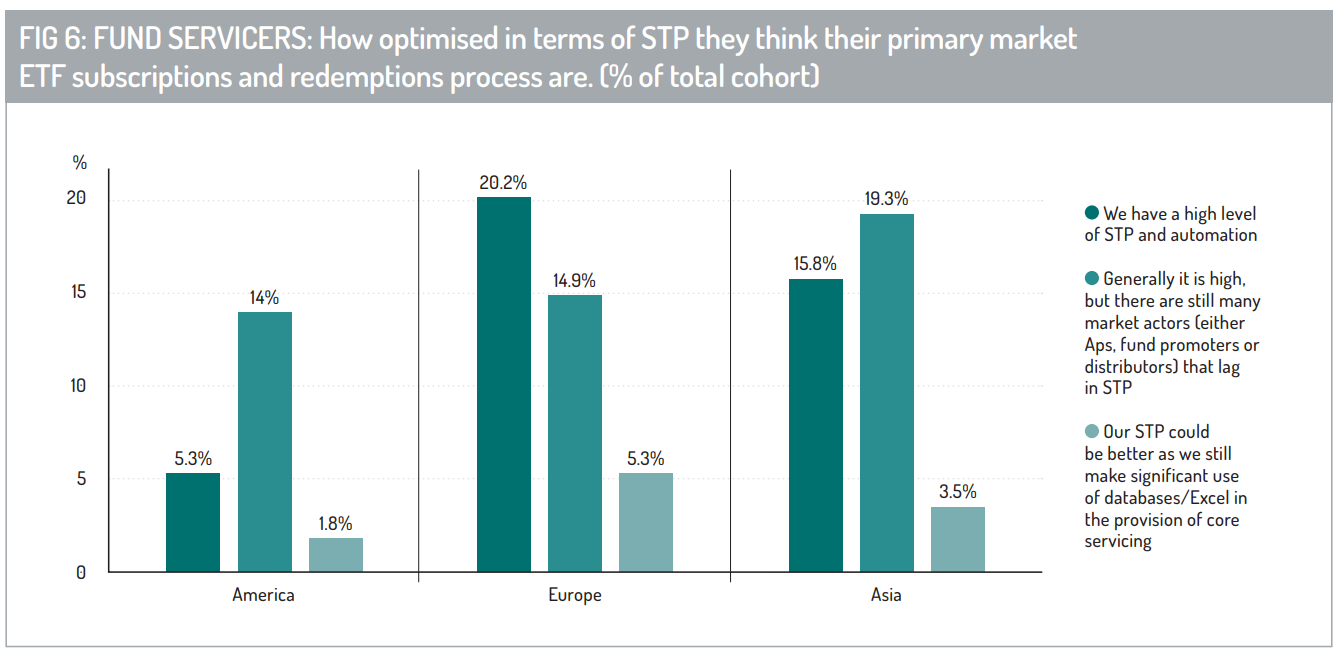

Possibly, Rushe’s observations are reflected in a question that we put to fund servicers on their experience of the ETF creation and redemption process, which is where fund servicers principally encounter the primary market and work with APs. Our question was about straight-through processing (STP) and automation. We found that fewer Asia-based respondents described their STP in this sphere as being of a high level compared to those in Europe who described STP and automation as similarly high (fig. 6).

Possibly, Rushe’s observations are reflected in a question that we put to fund servicers on their experience of the ETF creation and redemption process, which is where fund servicers principally encounter the primary market and work with APs. Our question was about straight-through processing (STP) and automation. We found that fewer Asia-based respondents described their STP in this sphere as being of a high level compared to those in Europe who described STP and automation as similarly high (fig. 6).

As fig. 6 also tells us, our Asia-based respondents did not indicate that STP and automation in Asia were poor, with just 3.5% of this cohort opting to say that STP ‘could be better’. Most of them described STP and automation as ‘generally high’. Nevertheless, more Europeans opted to describe STP and automation as high. Perhaps surprisingly, most of the US respondents to this question described STP and automation as ‘generally high’. This is significantly more than those who described STP and automation as ‘high level’, suggesting there is still work to be done on process standards and technology in what is the most advanced technological economy in the world, and where the ETF was first conceived.

Part 2 of our research – to be published in November – will explore these service and connectivity issues in more depth.

Active ETFs

Finally, we circle back to active ETFs. We know all respondents from the fund issuer cohort have or plan to offer ETFs. But what about active ETFs? Of the 104 issuers, 90% said they currently managed active ETFs, and of the 10 who said they did not, all but one said they planned to offer active ETFs in the next three years.

The active ETF may well be the next shockwave of investing, and it is likely that administration processes will face extra pressures to automate and that all market actors will need more connectivity. Part 2 of the survey will explore connectivity issues, as well as general levels of satisfaction with current service quality.