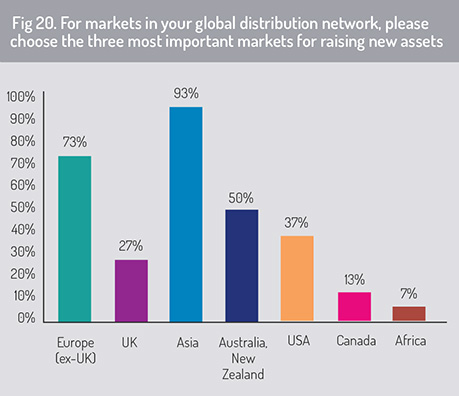

In concluding the survey, we asked participating firms to focus on their future sales opportunities and to predict which three markets or regions across their distribution networks will be most important for raising new assets (fig 20, page 22).

More than 90% of respondents said that regional investment from Asia-based investors will be the principal source of new asset flows.

Europe (ex UK) also featured highly (73%), particularly with investors wishing to build exposure to China and India. Respondents said that Australia and New Zealand (50%) and the US market (37%) also provided good opportunities for asset gathering for funds investing into Asian markets.

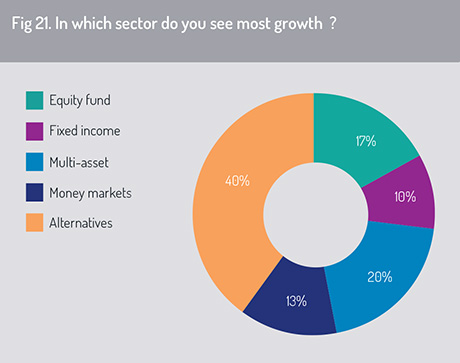

In terms of asset classes (fig 21, page 22), alternative investments were expected to provide the most important asset class to deliver growth in the region (40%). This answer scored at least twice as highly as multi-asset strategies (20%), equity funds (17%) and fixed income funds (10%).

Concluding thoughts

The survey reveals growing confidence in the ability of technology developments to deliver improvements in efficiency and cost management to Asia’s asset management industry. Distributed ledger technology is expected to have the greatest impact, along with products that capture advances in artificial intelligence and reinforcement learning, particularly based around natural language processing, robotic process automation and the application of AI to computer security and threat detection.

Respondents told us that the funds industry is getting better at implementing new technology to support business development. However, in some companies their ability to move forward is constrained by skills shortages and a failure on the part of decision-makers to understand the competitive advantage, and benefits to customers, that new technology can offer. For some firms, technology investment was also constrained by lack of budget or concerns about meeting return on investment targets.

Respondents told us that the funds industry is getting better at implementing new technology to support business development. However, in some companies their ability to move forward is constrained by skills shortages and a failure on the part of decision-makers to understand the competitive advantage, and benefits to customers, that new technology can offer. For some firms, technology investment was also constrained by lack of budget or concerns about meeting return on investment targets.

The funds industry is also getting better at making use of data around its distribution supply chain. There was a relatively even split between those firms that had the necessary skills internally to manage their data requirements and those that lacked these skills and needed to source them from external partners.

In managing their business innovation, asset management firms are likely to find advantages in partnering with fund platforms, with online retailers (such as Alibaba and Amazon) and with financial technology specialists.

Over time, however, the survey indicates that some of these partners may also become competitors and be major disruptors of the asset management industry.

For example, given the commercial penetration and wide service portfolio that Alibaba and Amazon can already offer (including supply chain management, commercial brokerage and intermediary services, cloud services and IT networking), it may be only a matter of time before these services extend more fully into the financial services arena.

Looking more closely at investment flows and distribution trends, respondents identified Hong Kong as the most popular location for targeting new investment from Asian investors. In the next five years, however, China and India are expected to deliver most growth from within the region. Bank distribution represents the most important distribution channel in Asia currently, but fund platforms will continue to extend their distribution reach and will become an increasingly important sales channel in some Asian markets by the mid-to-late 2020s.

©2019 funds europe