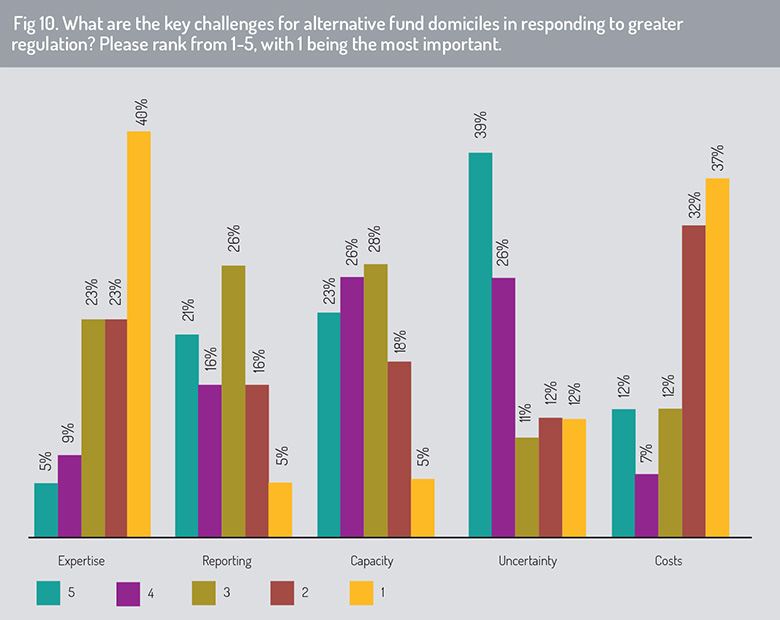

Asked about the key challenges for fund domiciles in responding to greater regulation (fig 10), expertise was again chosen as the main concern, with 40% of respondents deeming it to be of highest importance. Costs were another key concern, with 69% of respondents considering this challenge to be of highest or second highest importance.

Despite Covid-19, Brexit and the climate crisis, respondents did not emphasise uncertainty as a key challenge. This may reflect the fact that the worst has already happened. Alternatively, it could be symptomatic of a perceived flight to quality in times of uncertainty, which could be seen to benefit Jersey.

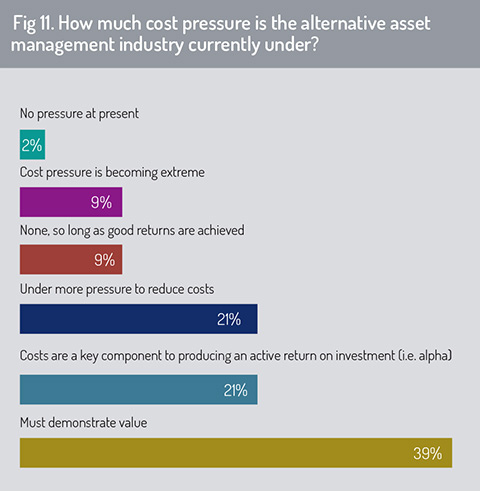

In terms of cost pressure in the alternative asset management industry (fig 11), respondents heavily favoured an interpretation that places the emphasis on value. Thirty-nine percent said managers must demonstrate value – up from 29% last year – while 9% said there was no cost pressure as long as good returns were achieved. However, 9% felt that cost pressure was extreme, up from 6% last year, and 21% said they were under pressure to reduce costs.

“In an increasingly complex alternatives environment, costs are rising as asset managers deal with greater regulatory challenges and product complexity,” says Alex Di Santo, group head of private equity at Crestbridge. “Given the increased scrutiny around costs, it is important managers demonstrate value is being generated, and this is the principal feedback from the survey. There remains some pressure to reduce costs, as shown by the survey findings, and this is resulting in asset managers re-evaluating their business models by, for example, increasing their use of technology or outsourcing.”

Finding talent

Finding talent

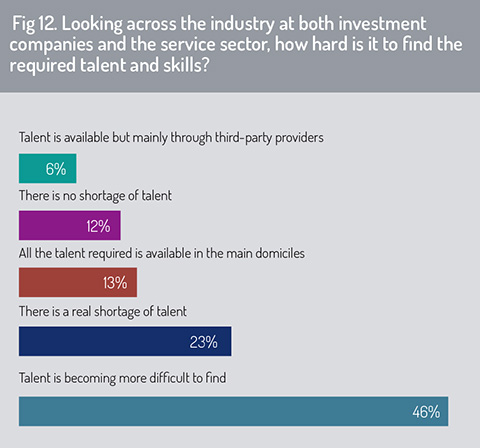

The value of expertise came up repeatedly in this year’s survey, and there is a strong sense that finding the right talent is becoming both more important and mor difficult. Asked how hard it is to find talent across both the front and back office (fig 12), 69% of respondents said it was difficult, with 23% of them identifying a real talent shortage. This is a substantial increase on last year, when only 48% thought talent was hard to find, with 19% of those describing a real shortage.

Combined with comments about domicile consolidation, this search for talent points to a potential trend for domiciles to become more specialised. Expertise in particular market segments may congregate in certain domiciles. Jersey had established itself as a domicile of choice for alternatives and Refson believes it has the potential to become a specialist centre for ESG.

“I believe that there is an opportunity for a single jurisdiction to come to the fore in the ESG space and I believe that jurisdiction will be Jersey, especially given our baseline of stability,” he told the Funds Europe webinar audience on April 20 this year.

Looking to the future

Talent was again a topic when respondents were asked what they would change about the industry if they could change one thing. Some wanted it to be made easier to use cross-border talent, while others came at the topic from the more oblique angle of diversity. This suggests an opportunity to marry the social goals that ESG investing promotes with practical solutions to the talent shortage.

Greater stress on ESG was also on the wish list, with some hoping for less of a box-ticking approach. More standardisation and greater uniformity of regulation were also on the wish list.

Greater stress on ESG was also on the wish list, with some hoping for less of a box-ticking approach. More standardisation and greater uniformity of regulation were also on the wish list.

By far the most common wish, however, was for greater transparency. Transparency was sought at the level of costs and fees, as well as at the product level, with some also pleading for the industry to become more accessible to investors. Overall, it seems the desire is for a more harmonised and more transparent industry that gives proper attention to ESG – coupled with access to right kind of talent to deal with today’s investors’ complex needs.

“We see continued regulatory and investor pressure on alternatives to build trust and transparency in all aspects of their operation,” says Refson.

© 2021 funds europe