Whatever its problems hosting the olympics, Japan has seen a significant number of investor searches this year, reports CAMRADATA.

In CAMRADATA Live, it has been interesting to note that Japanese equity has never been outside the top ten most researched asset classes by European institutional investors in each of the first five months of 2021.

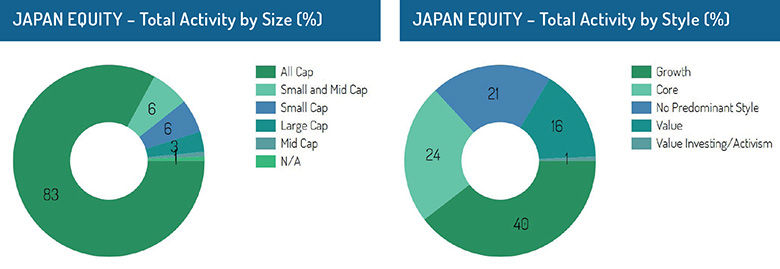

There are 126 Japanese equity vehicles within CAMRADATA Live. Predominantly, 63% of the vehicles are All Cap and the styles of these vehicles varied with Value (24%), Core (22%), Growth (31%) and No Predominant Style (22%). The total search activity carried out by investors when looking at size was led by All Cap (83%); whereas when searching on style, it was Growth at 40%.

When analysing the first quarter of 2021, we have seen an increase in the total activity in this particular asset class. This may potentially be due to the Japanese government increasing the importance of sustainability and ESG to Japanese listed companies.

Also, as investors’ preferences have shifted towards more ESG-focused portfolios lately, many firms in Japan are assigning more importance to ESG. For example, Toyota has been developing a hydrogen engine to become more environmentally friendly.

Another approach, taken by Japanese officials, is monetary and fiscal easing to boost the recovery of the economy following the Covid-19 pandemic. Perhaps these measures will give the Japanese financial markets hope.

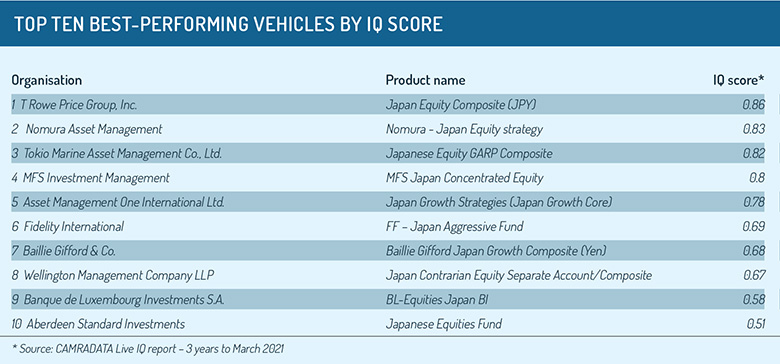

One of the ways CAMRADATA demonstrates manager ranking for institutional investors is through proprietary IQ scores, a ranking that reflects five statistical factors measured over a three-year period. The IQ universes are created from a set of criteria that vehicles must meet. The IQ report that is published highlights the best-performing vehicles from an asset manager for a particular asset class.

Over the three-year period ending March 31, 2021, there were 25 products in the Japanese Equity All Cap universe. The IQ table featured opposite shows just the top ten best-performing vehicles.

T. Rowe Price Group, Inc is the best-performing firm, with its vehicle Japan Equity Composite (JPY) achieving an IQ score of 0.86. This achieved an excess return of 7.03% over the benchmark whilst taking excess risk of 6.20%.

The scatter graph above represents these vehicles’ various excess returns produced by taking different excess risk levels across the universe for the same period.

Observers seem hopeful that the Japanese market is showing signs of recovery. However, external factors such as the pandemic may prevent this summer’s Tokyo Olympic Games going ahead, and the general election due to be held by late October 2021 may have an impact on the economy.

*All figures are for the 12 months to May 31, 2021 unless otherwise stated

© 2021 funds europe