Pioneer Investments’ target income suite offers investment opportunities aimed at generating an attractive and stable level of income with low volatility, says Hugh Prendergast, head of strategic product and marketing, Western Europe and international.

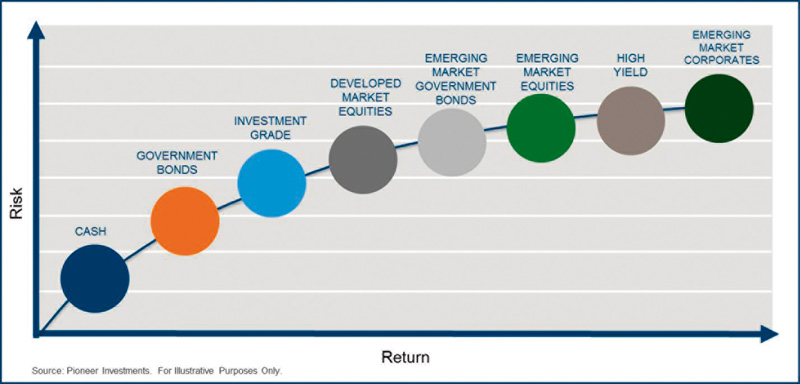

The absence of attractive yields on sovereign bonds has prompted investors to move up the risk curve in search of income. However, Pioneer Investments believes that a higher income does not necessarily have to come at the cost of significantly higher volatility.

Seeking income from sovereign bonds was the norm. Investors sought the secure and consistent income from sovereign bonds for their portfolios over the more unpredictable returns of equities. However, these safe havens have seen their yields gradually diminish over recent years. Cheap and plentiful money has compressed yields and the threat of rising interest rates after historically low levels is now forcing investors to adopt a significantly different approach to generating income.

CHANGING LANDSCAPE

Against the backdrop of artificially depressed sovereign yields and fears of the adverse impact on investor capital from possible hikes in interest rates, the search for attractive yields has turned away from traditional asset classes towards new and innovative sources of income.

Consequently, investors have begun to consider asset classes further up the risk curve to satisfy their need for consistent income, despite their higher contribution to volatility. After underperforming for almost a decade, equities appear to have become attractive, not for their prospective capital appreciation but rather their dividend potential. The dividend yield of the European equity market is approximately 3.5%, while its higher dividend component yields in excess of 5%. Alternative sources of income, such as high yield and emerging market corporate bonds, can yield in excess of 6%.

Consequently, investors have begun to consider asset classes further up the risk curve to satisfy their need for consistent income, despite their higher contribution to volatility. After underperforming for almost a decade, equities appear to have become attractive, not for their prospective capital appreciation but rather their dividend potential. The dividend yield of the European equity market is approximately 3.5%, while its higher dividend component yields in excess of 5%. Alternative sources of income, such as high yield and emerging market corporate bonds, can yield in excess of 6%.

Pioneer Investments has created tailored strategies with the primary aim of generating a target income through an active investment approach, while carefully managing portfolio volatility. An option overlay strategy is used to enhance the portfolio’s income potential while reducing overall volatility.

RISK APPETITE

A suite of products identified as the “target income” range provides a clear income target at the start of each year, allowing visibility on the level of income that investors may expect over the course of the year. There are different options in the suite which allows investors to choose between the alternatives depending on their income requirement and appetite for risk.

We initiated the suite with a product focused on European equities. Following its success, we brought a product focused on global equities to the market.

For investors who are seeking income but want to avoid concentrating risk in one asset class, we launched a low volatility, diversified* global multi-asset strategy. The most recent launch in this suite is a product focused on real assets aiming to deliver a target income, while still protecting investor capital from potential inflation.

SECURITY SELECTION

Our income strategies aim to deliver above average income while accommodating for the potential of capital appreciation over the long term. By expanding into alternative asset classes, such as MLPs, REITS, infrastructure bonds and the like, we believe that we can secure a higher income potential for our investors but also diversify* portfolio risks, thus reducing portfolio volatility.

The true value of our investment approach is in the security selection. An experienced team of portfolio managers work closely with quantitative and fundamental analysts. They screen and select securities that have delivered an attractive income stream historically and we believe we are able to sustain this.

Important Information

*Diversification does not guarantee a profit or protect against a loss.

Unless otherwise stated all information and views expressed are those of Pioneer Investments as at May 19, 2014. These views are subject to change at any time based on market and other conditions and there can be no assurances that countries, markets or sectors will perform as expected. Investments involve certain risks, including political and currency risks. Investment return and principal value may go down as well as up and could result in the loss of all capital invested. The investment schemes or strategies described herein may not be registered for sale with the relevant authority in your jurisdiction. Past performance does not guarantee and is not indicative of future results. The content of this document is approved by Pioneer Global Investments Limited. In the UK, it is approved for distribution by Pioneer Global Investments Limited (London Branch), Portland House, 8th Floor, Bressenden Place, London SW1E 5BH. Pioneer Global Investments Limited is authorised and regulated by the Central Bank of Ireland and subject to limited regulation by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority (“FCA”) are available from us on request. Pioneer Investments is a trading name of the Pioneer Global Asset Management S.p.A. group of companies.

©2014 funds europe