Nicolas Thomas, principal thematics – private equity at Pictet, delves into the essential role of technological innovation and investment in propelling the global initiative against climate change, with a focus on the expanding opportunities in private markets.

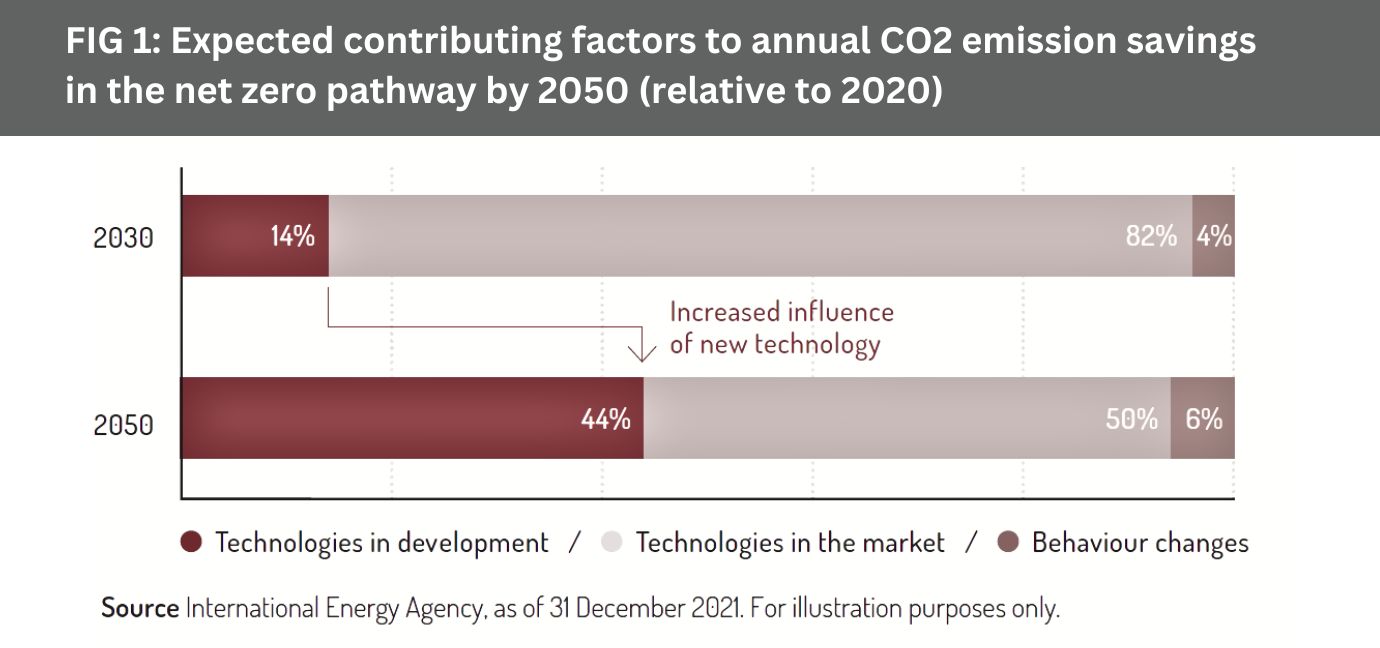

The fight against climate change is gaining momentum, with 92% of global GDP now covered by net-zero targets. Crucially, this collective will to act is matched by an accelerating ability to act. These commitments cannot be met by behavioural change alone; rather, they will need to rely on the deployment of existing technologies as well as the development of innovative new ones. Indeed, the IEA estimates that the majority of the technologies needed to achieve the world’s net-zero commitments by 2030 are already market-ready; innovation in new technologies becomes more material for the net-zero path towards 2050. The penetration rate of such environmental technologies is admittedly still low but is expected to – and needs to – grow exponentially. The market size for environmental technologies is forecast to more than double from $4.9 trillion in 2020 to $12.1 trillion by 2030.

However, these technologies require significant investment to reach their full potential. The Climate Policy Initiative calculates that, at a minimum, climate financing must increase by 590% to meet the world’s declared climate objectives by 2030. That presents a huge opportunity for investors. In our view, there are five key areas where this investment can have the greatest effect:

- Greenhouse gas reduction

- Sustainable consumption

- Pollution control

- The circular economy

- Enabling technologies

These solutions are already attracting interest from investors, and we believe the opportunity is particularly compelling in private markets, where private companies are at the cutting edge of these technologies.

Globally, the cumulative number of private environmental companies with a valuation above $1 billion, known as unicorns, has increased 14-fold since 2017. This compares with an increase of only four times in the number of total unicorns over the same period.

Such a boom in valuations is not surprising, given that private companies are leading on the innovation front. For example, a private European company set the efficiency record for converting the sun’s rays into electricity via a commercial-sized panel in May. Private companies also include some of the largest players in the electric-vehicle value chain, as well as leaders in recycling lithium-ion batteries.

History shows that we can achieve positive change. Forty years ago, one of the planet’s foremost environmental concerns was the hole growing in the ozone layer. Activism led to the 1989 Montreal Protocol on phasing out ozone-depleting substances, such as chlorofluorocarbons (CFCs), and then the wider Kyoto Protocol in 1997. Today, stratospheric ozone levels are one of the few Planetary Boundaries – a framework establishing numerical limits for the nine most damaging environmental phenomena, from climate change and freshwater use to biodiversity loss and land use – not in breach.

So when the political will exists, as it does today on a host of environmental issues, technology advances and collective action by private and public institutions can avert crisis. This is why we are confident today that the combination of political inspiration and technological innovation, supported by private finance, can help restore the planet.

For more insights on the opportunities within private assets, please scan the QR code or visit am.pictet

For more insights on the opportunities within private assets, please scan the QR code or visit am.pictet

© 2023 funds europe