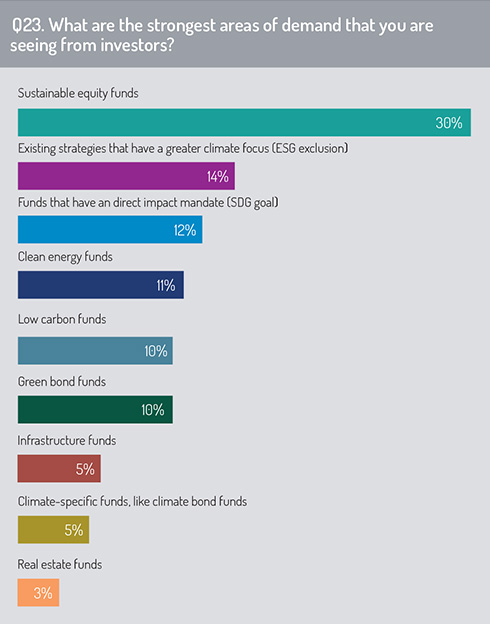

The survey asked where the strongest demand for climate-related products lies with investors (Q23). The clear answer was for sustainable equity funds (30%) which was cited by twice as many respondents as the next most popular option – existing strategies that have a greater climate focus via exclusion (14%).

While this shows that investor appetite is still for mainstream products, there is also a demand for funds with a direct impact mandate (12%) as well as more innovative asset classes such as clean energy funds (11%), low carbon funds (11%) and green bonds (10%).

While this shows that investor appetite is still for mainstream products, there is also a demand for funds with a direct impact mandate (12%) as well as more innovative asset classes such as clean energy funds (11%), low carbon funds (11%) and green bonds (10%).

The green bonds market is clearly growing. Dutch asset manager NN Investment Partners has forecast that the green social and sustainability bond market will reach €1.1 trillion worth of issuances this year. The asset manager cited investor urgency to finance the energy transition as sovereigns and corporates look for fossil fuel alternatives and other low-carbon transport opportunities.

The green bonds market is clearly growing. Dutch asset manager NN Investment Partners has forecast that the green social and sustainability bond market will reach €1.1 trillion worth of issuances this year. The asset manager cited investor urgency to finance the energy transition as sovereigns and corporates look for fossil fuel alternatives and other low-carbon transport opportunities.

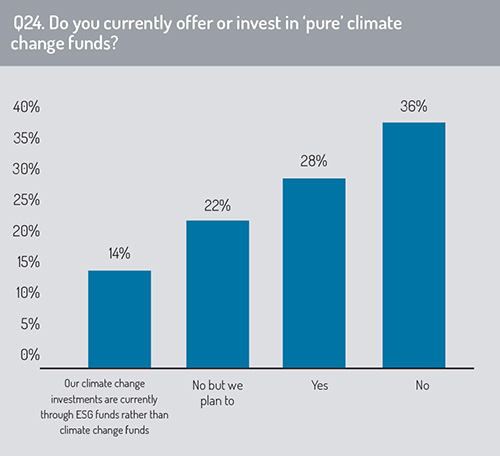

There is still a relatively small number of firms (28%) offering or investing in pure climate change funds (Q24), although 22% said they plan to do so, which accounts for a combined 50% of respondents. This means that exactly half of respondents offer no dedicated climate funds, including the 14% that offer exposure to climate factors through existing ESG products rather than on a standalone basis.

There is still a relatively small number of firms (28%) offering or investing in pure climate change funds (Q24), although 22% said they plan to do so, which accounts for a combined 50% of respondents. This means that exactly half of respondents offer no dedicated climate funds, including the 14% that offer exposure to climate factors through existing ESG products rather than on a standalone basis.

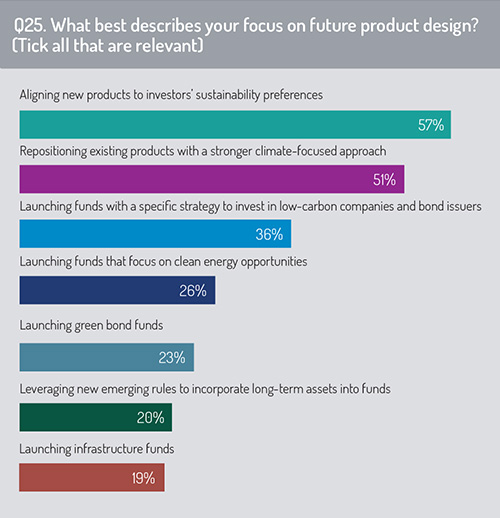

Repositioning existing products to align with a stronger climate-focused approach was mentioned by 51% of respondents as a key focus on product design (Q25). And for new products, the direction is very clear – 57% said new products would be aligned to investors’ sustainability preferences.

Specific funds that target climate impacts through low-carbon companies or bond issuers was a priority for 36% of respondents. Clean energy opportunities was a focus for 26% of respondents. These all came ahead of launching green bond funds.

Read the full report

2: Creating a climate risk framework

3: Importance of investment risk overlooked

4: Internal governance still developing

5: Education and skills are key

6: Data availability challenge misplaced

8: Product development

10: Recommendations and regulation

© 2022 funds europe