Fund accountancy and liquidity are the most important issues for ETF issuers, but transfer agency also shows strongly. But where does technology come in this?

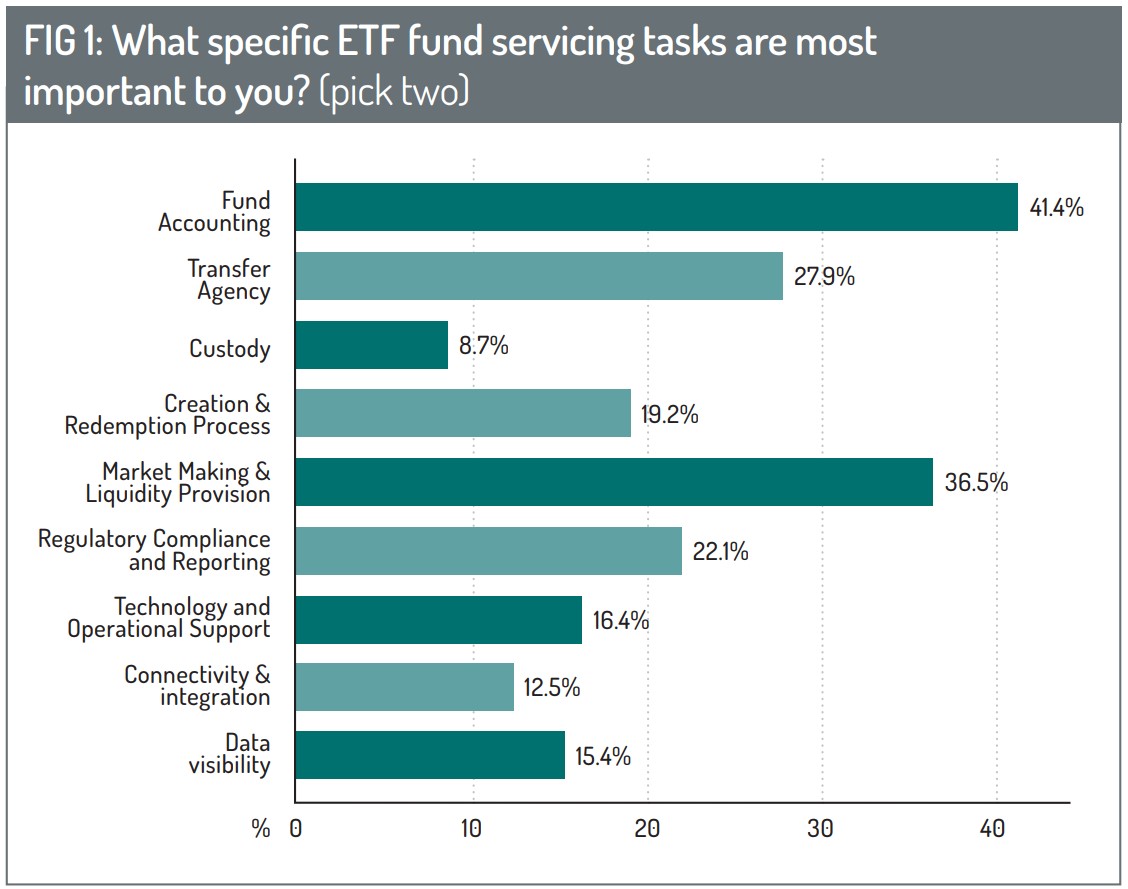

Our ETF administrator survey has plenty for fund administrators, their transfer agent colleagues, and authorised participants (APs) to take notice of when looking at how fund issuers responded. We gave fund issuers nine potential answers and asked them to say which two fund servicing tasks were most important to them (Fig 1).

‘Fund accounting’ and ‘market making & liquidity provision’ were the standout answers, with 41% choosing fund accounting and 36% choosing market making & liquidity as one of their two most important fund servicing tasks.

These two functions clearly refer to fund administrators and APs. Fund administrators are the main providers of fund accounting services, while APs play a critical role in capital markets by organising the creation and redemption of baskets of shares (or bonds) during the ETF creation and redemption process. This includes obtaining liquidity, which is vital because ETFs are designed to be bought and sold with a similar level of liquidity as the underlying shares they represent.

But the third most important service for fund issuers was ‘transfer agency’ (TA). TA is a major role in fund distribution that is centred mainly on investor record keeping and normally comes wrapped up as part of a fund administration service. Some 28% of respondents chose TA as the top two most important functions.

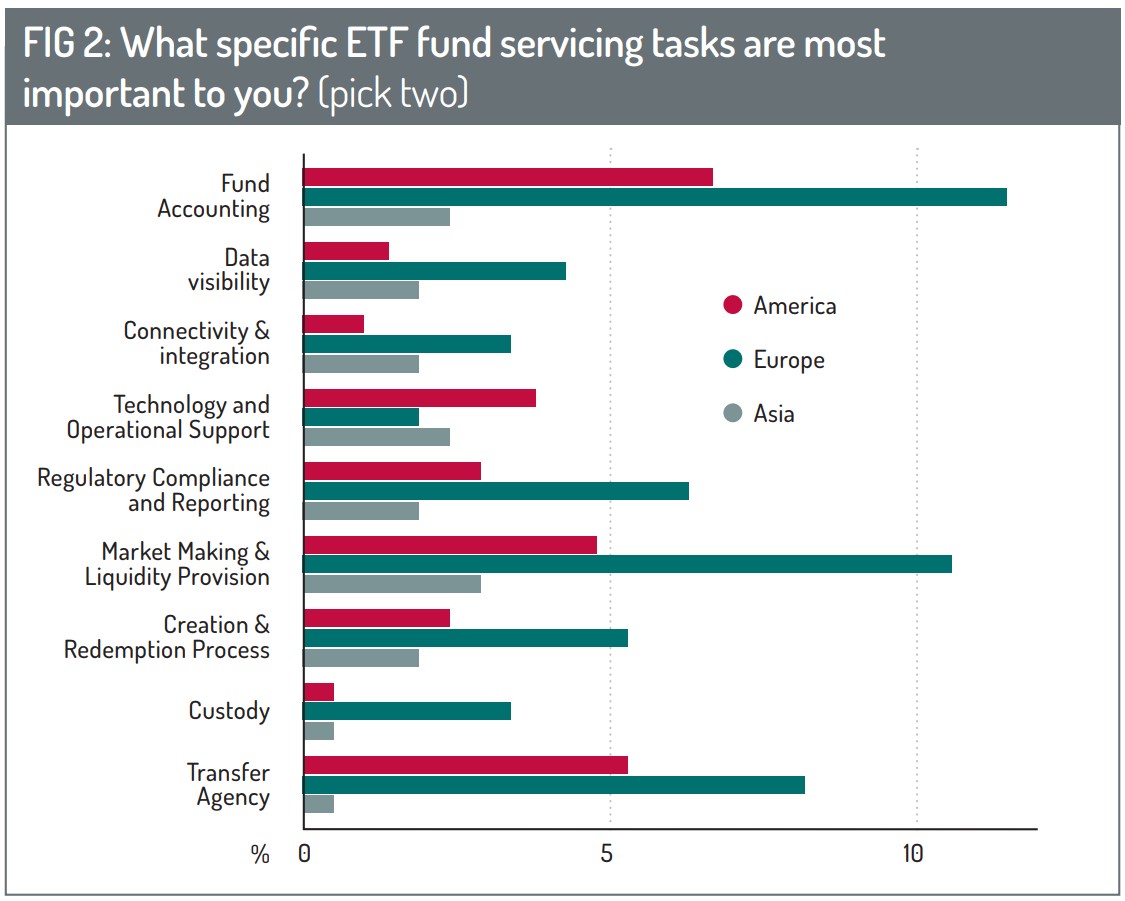

These results were reflected as much in the geographical breakdown, particularly for America and Europe (see Fig.2)

Fund accounting was the most important servicing task for respondents from Europe and America. Additionally, technology and operational support rated quite strongly in America and less so in Europe, while the need for regulatory and compliance reporting rated comparatively stronger in Europe.

Our ETF administration survey, carried out in association with global fund transaction network Calastone, surveys the three main ETF market actors – the ETF issuers, fund servicers (predominantly meaning fund administrators) and transfer agents.

The results of our survey repeatedly highlight the importance of fund accounting, capital markets activity around the AP, and the role of the TA.

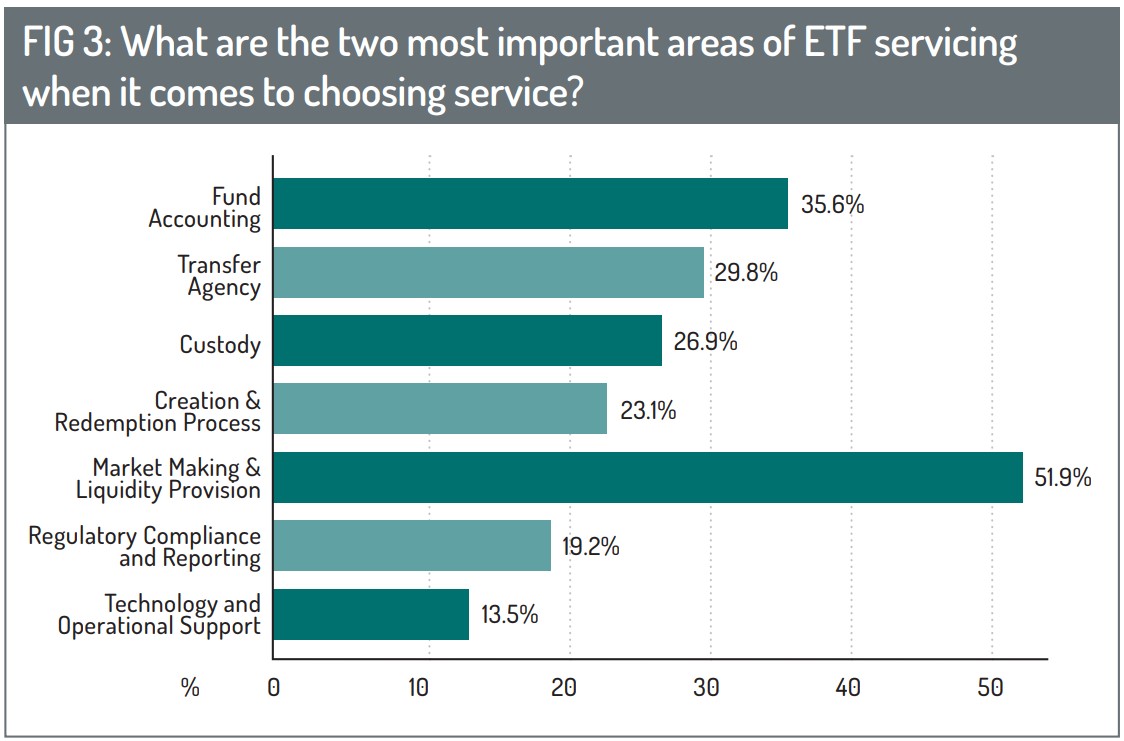

For example, when we asked fund issuers which areas of service they consider most important when choosing a fund service provider, they overwhelmingly chose ‘market making & liquidity’, while fund accounting and TA – came second and third, respectively (Fig 3).

Measures of success

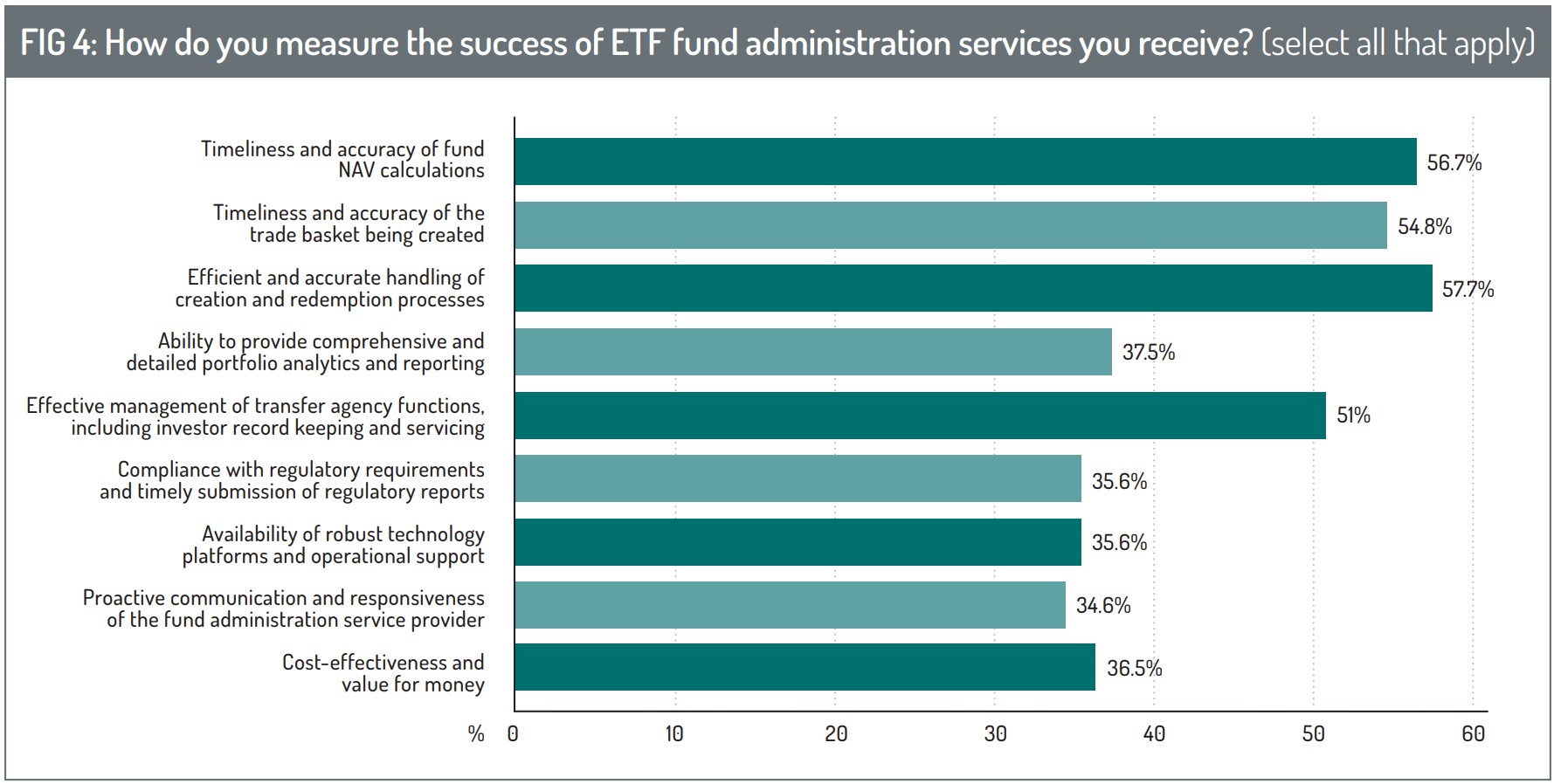

The survey asked how fund issuers measure the success of ETF fund administration services they receive. (We offered seven answers and asked respondents to select two). The data suggests conclusively that ‘efficient and accurate handling of creation and redemption processes’ is the key determiner of success (Fig 4).

It was selected by 58% of the 104 fund issuers that responded to our survey.

It’s worth pausing here to note that the creation and redemption process straddles the AP on one side (who will create and subsequently redeem a basket of shares) and the fund administrator on the other side (who will manage the issuance of the ETF’s own shares).

The two activities must remain in lockstep as much as possible to maintain ETF liquidity for the investor and to avoid situations such as ‘breaking the NAV’, whereby the value of the share basket diverges from the value of the ETF shares.

Rob Rushe, global product head, ETF servicing at HSBC’s securities services business, says: “The AP/fund administrator relationship is crucial to ensuring the ETF primary market works as efficiently as possible. The goal of the administrator is to make the creation/redemption process as streamlined as possible to remove any points of friction and ensure there are no hidden costs to the AP. This should then result in better hedging of their ETF positions and potentially improved on-exchange spreads for investors.”

His colleague Steve Palmer, global head of ETF product, within HSBC’s markets and securities services business, points out that the AP does not compete to become an AP to an ETF issuer but rather competes with other APs and market makers for client flows within ETFs.

“ETF issuers seek as many APs and market makers as possible to generate competition and better pricing for their end investors,” he says.

But only a small amount of the turnover in ETFs – the trades between market maker and end-investors – results in a primary market trade.

“This is because the ETFs already created previously and held on balance sheets across the market-maker community, tend to supply the necessary liquidity, leaving a smaller portion to be created or redeemed as a ‘top-up’ or ‘slight reduction’ to that supply of inventory,” he says. “In fact, most APs will want to avoid creating and redeeming, as this is often the most expensive way of covering a short/long position that results from a client trade, and so tends to be the last option.”

Other measures of success scored in the 50% mark, too. Trailing the creation and redemption process was ‘timeliness and accuracy of fund NAV calculations’. And third, came ‘timeliness and accuracy of the trade basket being created’.

The above three answers again reflect the importance of a fund administrator’s fund accounting ability, and of capital-market processes associated mostly with APs.

Transfer agents

But before we leave the most popular measures of success, we do see an important outlier that scores higher than 50% – and again, it is the TA function.

Some 51% of fund issuers selected ‘effective management of transfer agency functions’ as one of their top two measures of success.

The TA function, in covering tasks such as the keeping of investor records, is a high-volume activity. Not only do ETFs straddle multiple types of investors, but ETF use cases have grown beyond mere passive investing. For example, they are used in “transition management” – where investors transition their portfolios from one fund manager to another. An investor is likely to park their cash in an

emerging market ETF fund, say, while the newly appointed fund manager builds up an active emerging markets portfolio.

ETFs have also grown at a fierce rate over the past decade, and they are designed to trade quickly. In short, ETFs keep transfer agents busy. Crucial, also, for issuers is that transfer agents – whether in-house or outsourced – are often the first and main point of contact between a fund provider and the fund provider’s clients. Therefore, the quality of client experience the transfer agent can give to an investor is crucial to the fund issuer. If the transfer agent fails, the fund issuer fails.

What about tech?

The other answers to this question on measures of success drop down to the 35% mark. ‘Cost-effectiveness’ and ‘regulatory compliance’ almost inevitably make this list, although we might have expected them to rank higher. But what about technology?

Technology is explicitly referenced by the 35% of respondents in Fig. 4 who said that the ‘availability of a robust technology platform’ was a main determinant of success, and perhaps more implicitly by the 37% who measured a fund administrator’s success partly by the ability of the administrator to deliver ‘comprehensive and detailed portfolio analytics and reporting’.

Technology is seemingly a ubiquitous solution to many industry problems – so might we have expected tech to rank higher in these answers?

It could be said that technology permeates all of our suggested answers to some extent or another. The effectiveness of an administrator’s fund accounting service will be dependent to a considerable extent on tech – and no doubt many of the improvements that fund administrators say they are making to this service are tech-driven.

The same can be said for TA. Of all fund activities, the TA function is one of the most people-heavy. TAs know full well the importance of automation to their high-volume activity – not just for reducing errors and saving time, but also for gathering lucrative data about investor trends that can be sold to, or used as added value for, clients.

There’s little doubt that technology ranks highly in this survey, if implicitly by stealth rather than explicitly.

Where fund issuers want to see improvements

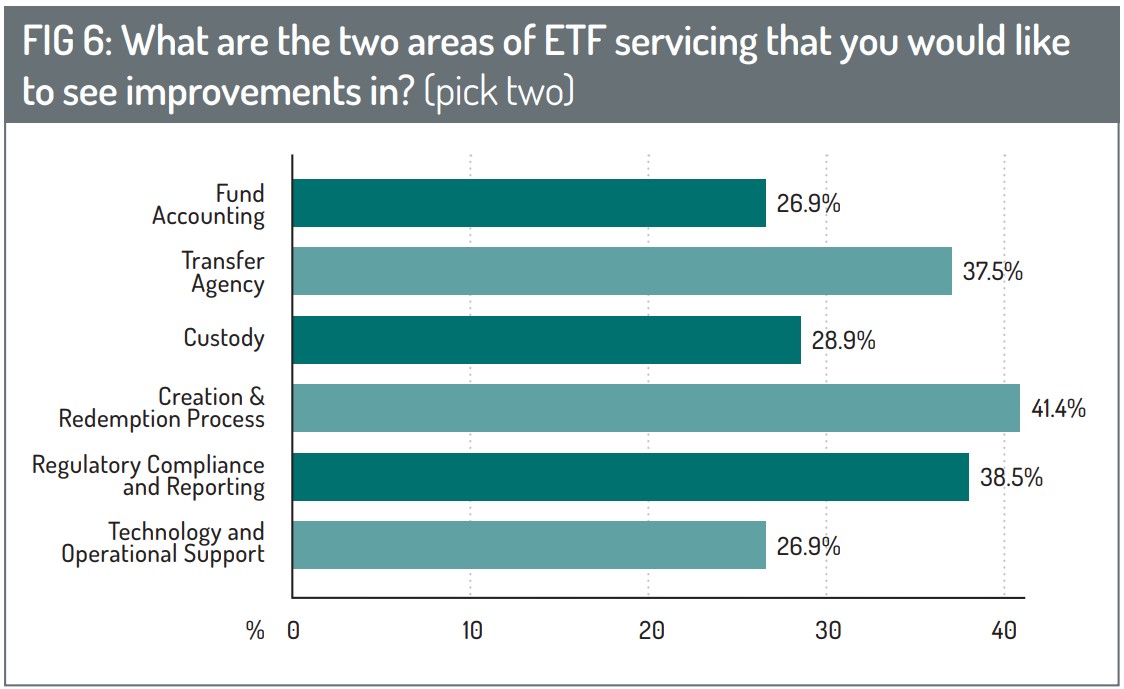

So, fund accounting is seen by fund issuers as the most important task, and, fortunately, the survey suggests fund issuers are comparatively satisfied with this service. We glean this from answers given to our question that asked which two fund administration services fund issuers would most like to see improved.

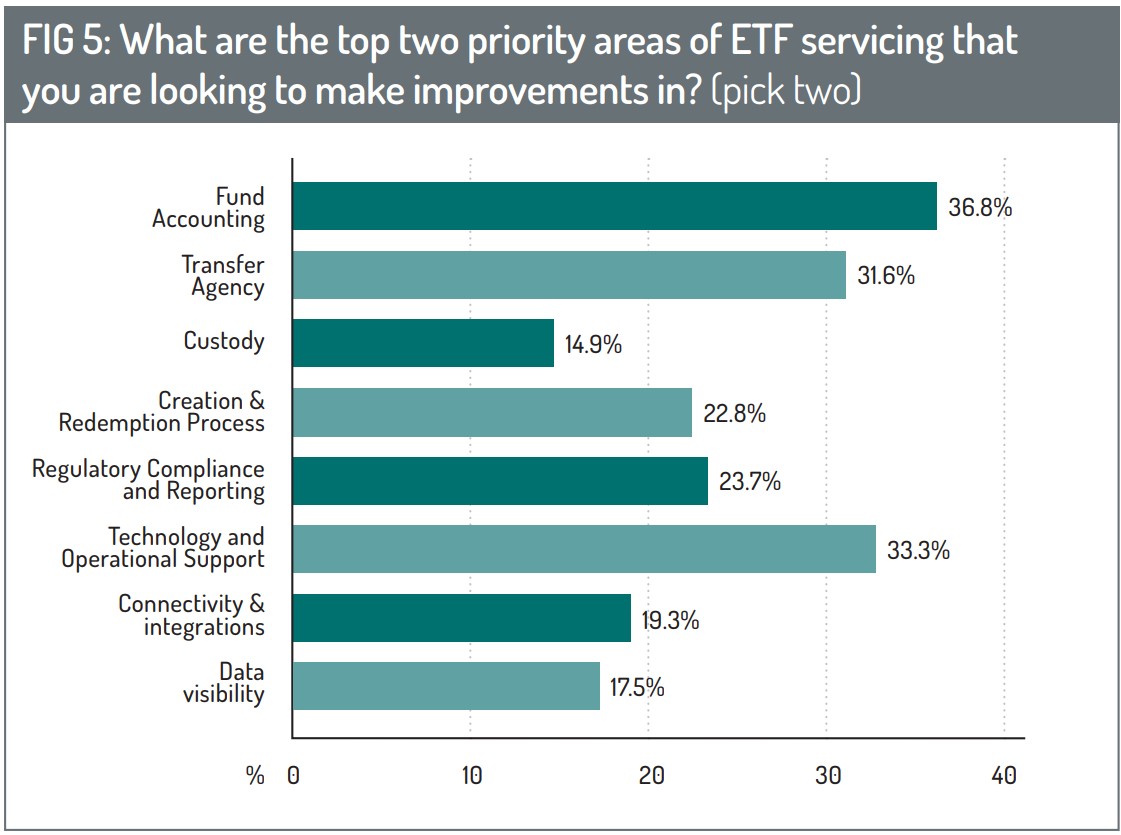

Fund accounting did not score particularly high (see Fig 5). But we see again the importance of the creation and redemption process and of the TA function – albeit regulatory reporting and compliance score significantly here as areas that fund issuers would like to see improved, too.

Let’s quickly compare the improvements the fund issuers want to see with the improvements that fund administrators are looking to make.

When we asked the fund administrators what improvements they were looking to make, TA appears to be the main commonality between what improvements the administrators are making, versus the improvements fund issuers want.

We already know the TA function is important to fund issuers. We further see that fund issuers want to see improvements in the TA function – and we see from Fig. 6 that fund service providers are working to deliver improvements. That’s a good thing, then!

We also see that it is important for fund administrators – at least, in their own view – to improve fund accounting. Nearly 37% of the administration respondents said they were looking to improve fund accounting – though let’s not forget that Fig 5 indicated that fund issuers are quite pleased with the levels of fund accounting services they receive.

Whereas fund issuers saw ‘efficient and accurate handling of creation and redemption processes’ as the key determiner of success, this only came in fifth place as an area for improvement by fund servicers. Perhaps this is an important divergence.

But there also appears to be some misalignment of priorities between fund issuers and fund servicers over technology and operational support.

Again, this function scored comparatively low for fund issuers as an area that needed improvement. Still, for fund service providers, it was the second biggest area where administration firms are looking to improve.

Does this really point to a misalignment of priorities between fund issuers and their service providers? To an extent, yes, but the issue is complicated. Again, we have to go back to the role of technology in, for example, TA, where there is a great push by transfer agents to automate their processes and – transfer agents would argue – where there is a passive resistance by fund issuers to facilitate this.

Transfer agents and the fund administrators that typically own them are greatly incentivised to automate processes to gain efficiencies. But necessary for automation is a greater level of standardisation of processes – and this can only happen if standardisation is bought into and facilitated by fund issuers. Yet the problem for fund issuers is they may still have to support a number of different messaging methods (such as fax) in order to keep wealth management clients happy – particularly where the wealth manager is less invested in technology. This is a burden for transfer agents who would prefer one standardised method of executing fund orders.

It follows that transfer agents will put greater emphasis on technology than some fund issuers might.

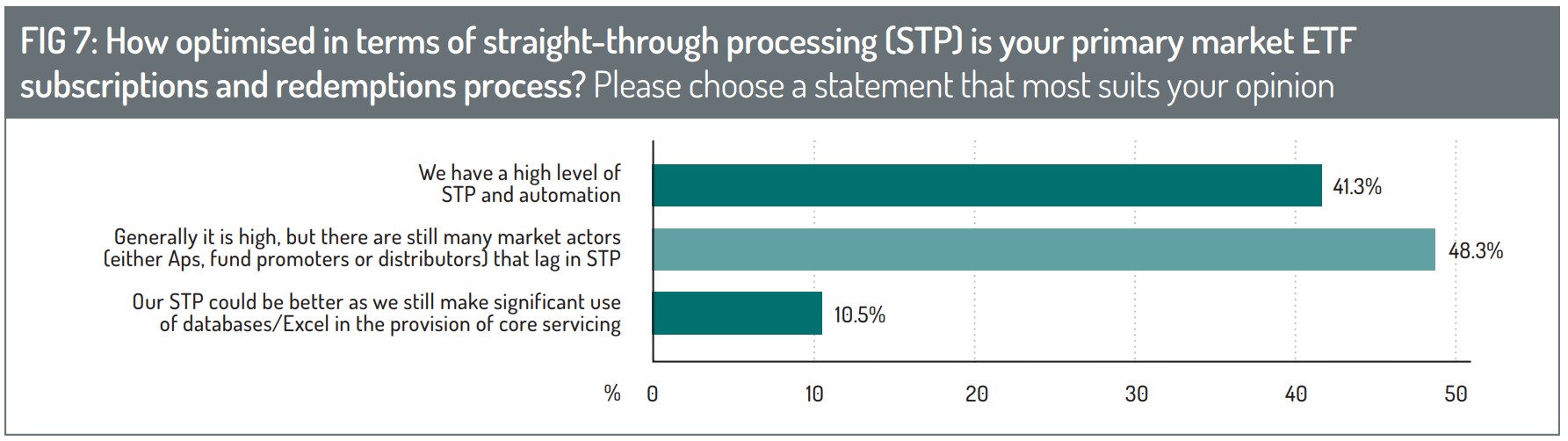

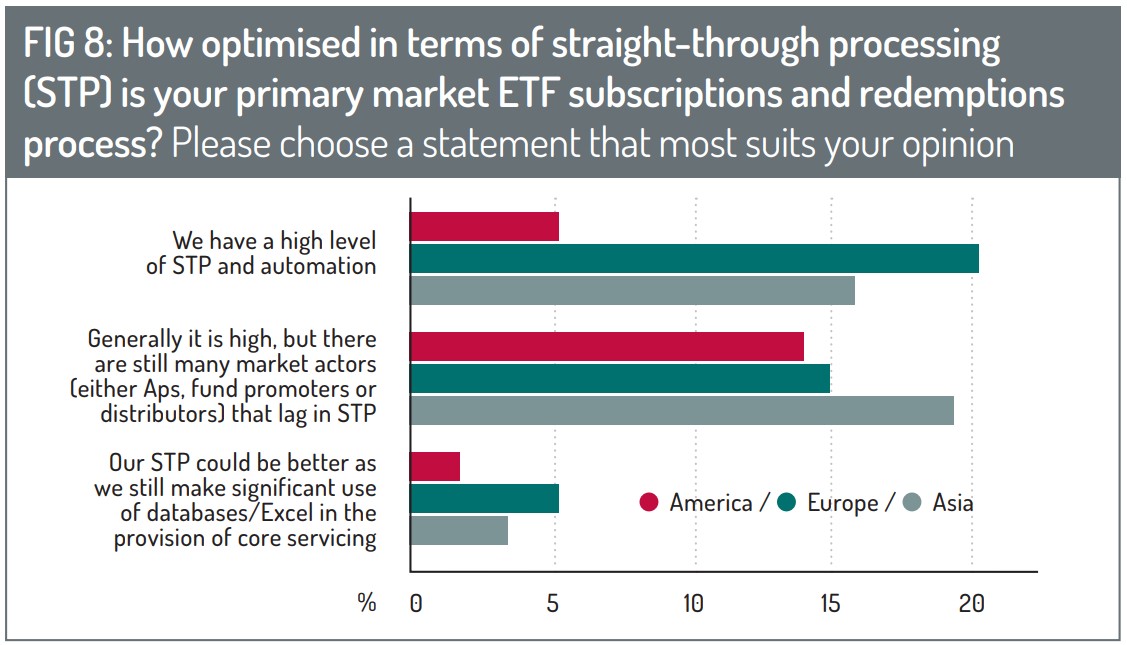

Signs of irritation from fund servicers about automation levels are seen in Fig 7, where we asked how optimised is straight-through processing (STP) in primary market subscriptions and redemptions.

It’s true that a significant percentage of respondents from fund servicers said there were high levels of automation and STP, and a low percentage said STP “could be better”. But a significant middle – the highest percentage of answers – said that although STP was generally high, many market actors (APs, fund promoters or distributors) still lagged in automation and STP levels.

Geographically speaking, it was in Asia and America where respondents most felt STP levels were generally high, albeit with some actors who were lagging. European respondents mostly voted that they had high STP standards, but a significant percentage (15% out of all respondents) said STP was only generally high and some market actors lagged.

Authorised participants

Speaking with Ciaran Fitzpatrick, head of ETF solutions, Europe, and Frank Koudelka, global ETF product specialist at State Street, we learn that a close relationship between the fund administrator and the AP community is “crucial” to the success of an issuer’s product.

“The administrator is responsible for several key elements of the ETF lifecycle, including basket production, AP confirmation, accurate NAV calculation and ETF share creation and settlement. Each of these is an important touchpoint between the fund administrator and the AP.”

So, what do APs feel about administrators?

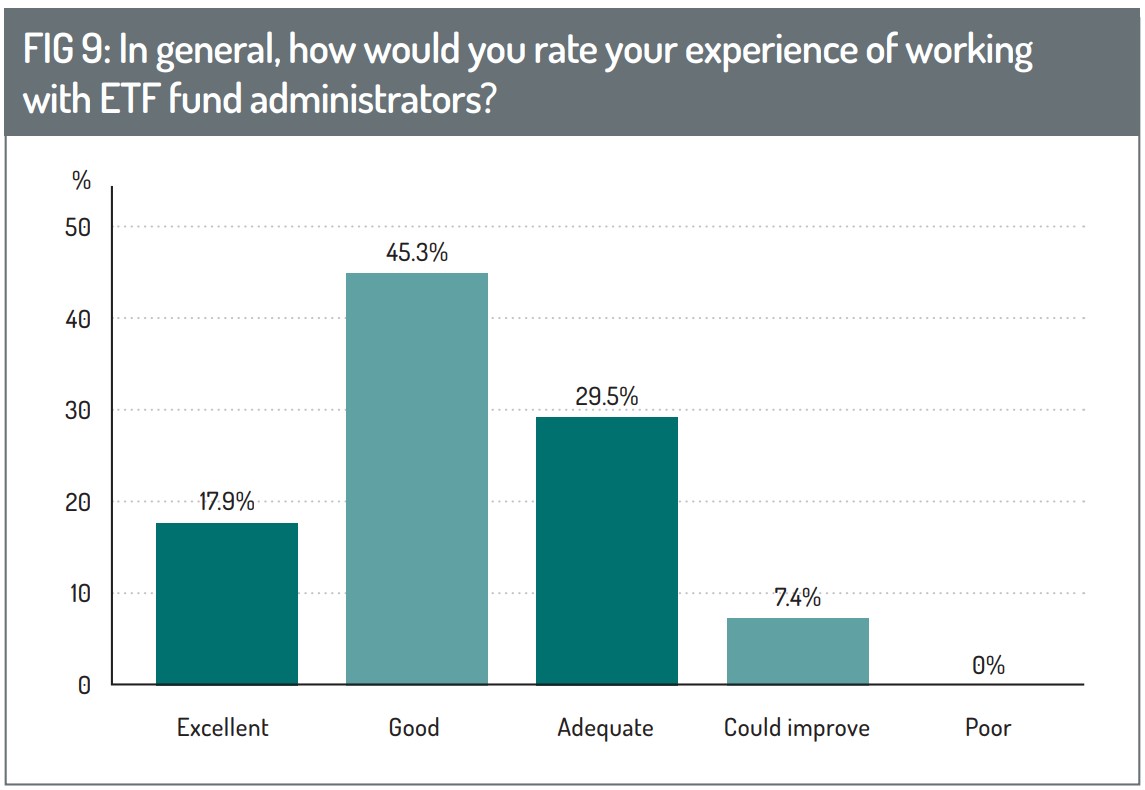

Overall, they have a positive experience working with ETF fund administrators (Fig 9). Most said their experience was good; many said it was adequate; some even thought it excellent. No one said it was poor.

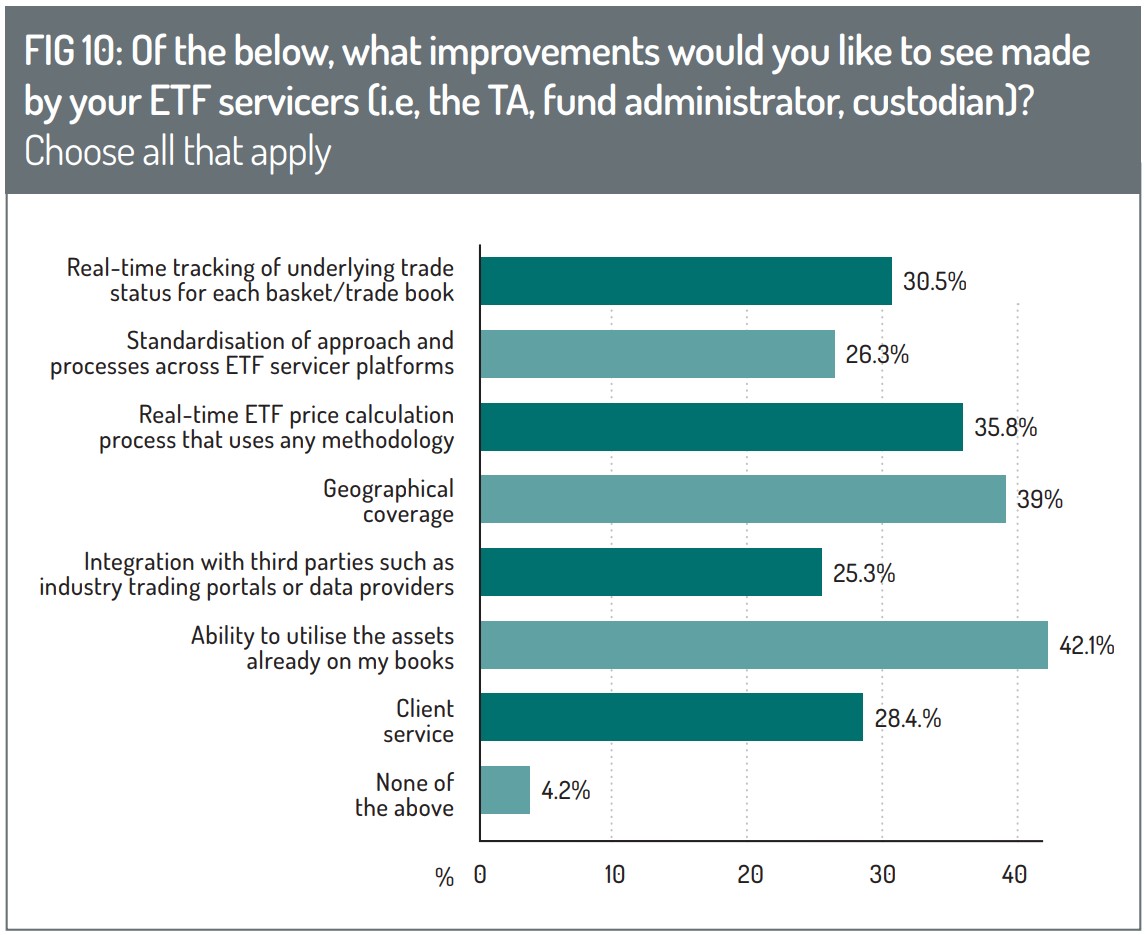

Apart from wanting geographical coverage to be wider, there are strong technology, connectivity and data elements to the improvements APs would like to see in the fund administrators they interact with, including TAs and custodians (Fig 10).

‘Integration with third parties such as industry trading portals or data providers’ was the chief improvement APs would like to see.

“Certainly, one of the challenges currently seen in the European market is the fragmentation of the order placement model. This is because there are multiple portals offered by either the ETF issuer or the service provider, resulting in APs having to log into several different applications daily,” say State Street’s Fitzpatrick and Koudelka.

They say State Street is implementing application programming interfaces (APIs) in Europe. APIs enable APs to enter primary market orders directly in their own system and for that to be sent to the system at the fund administrator. This has “simplified the process significantly”, they say.

Rushe, at HSBC, adds: “We recognise that as the ETF market has grown, APs are looking for simple, consistent and centralised utilities. Not 20 different versions of a dealing portal or contract note. That was one of the drivers for our recently announced ETF Platform Solutions to provide full integration with AP systems and connect with all third parties directly.”

‘Real-time price calculation processes using any methodology’ is another improvement that APs would like to see in the fund administration community they work with. ‘Real-time tracking of trade status’ is also important. (And through in these answers). We’d perhaps be mistaken to think the above improvements are urgently needed, however. As we have seen, APs broadly like the service they get from fund service providers.

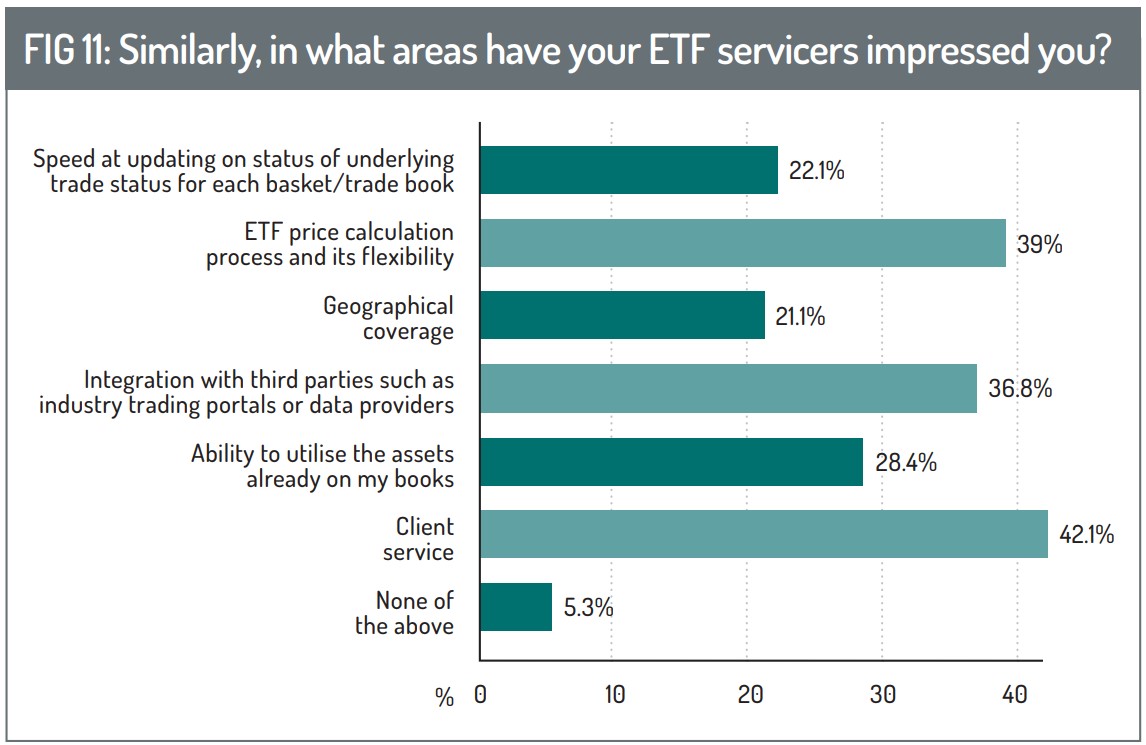

Fig. 11 shows they have been impressed by some services, including the integration issue with trading portals or data providers.

Conclusion

ETFs have revolutionised the investment funds industry, and active fund managers that have diversified into ETFs have seen these index-tracking products grow as a percentage of their assets under management.

This survey has shown how important fund accounting, creation and redemption processes, and TA functions are to ETF offerings, and we have seen a generally good level of alignment of interests.

However, the survey also points to issues around technology, such as automation and STP, which have been recognised as major asset management challenges for over a decade.

Therefore, the extent to which an asset manager might rate a fund administrator’s service on its ability to offer support for ETFs (as opposed to the wider ability to support active mutual funds) may be debatable. But as active ETFs take a greater portion of market share in the coming years, the importance of fund administration capabilities to ETF issuers could rise – especially if active ETFs prove more complex to manage.

*104 fund issuers, 114 fund administrators and 95 authorised participants participated in this survey. The survey spanned the US (74 respondents), the EU and UK (146 respondents) and Asia – mainly Singapore (28 respondents) and Hong Kong (27 respondents).

© 2024 funds europe