While Investment Grade (IG) credit fundamentals continue to look robust, central banks are wary of higher inflationary pressure. Within this environment, investors should seek an active and flexible approach.

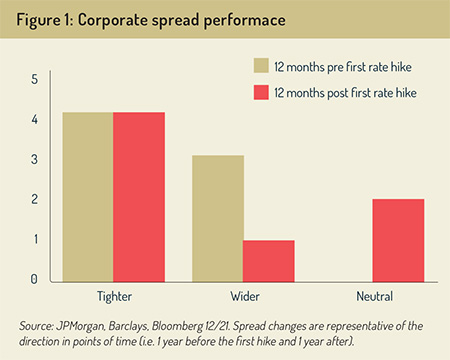

Central banks have found themselves flat-footed by surging inflation and the rhetoric from most major policymakers has taken a hawkish turn. For IG credit investors, the past seven rate hiking cycles between 1980 and 2016 suggest that credit spreads have tended to perform relatively well in the 12 months pre and post the first rate hike (see Figure 1). However, higher levels of inflation in both emerging and developed markets means that investors are faced with coordinated tightening in monetary policy across the central banks. Such a synchronised shift in policy has induced higher levels of volatility across fixed income markets and poses a challenge to IG investors.

The US Federal Reserve has strongly hinted that it is preparing to tighten monetary policy and this is a similar theme across major central banks. The Bank of England (BoE) struck a hawkish tone by following up on its initial rate hike in December with a further 25 basis point hike in its latest meeting.

The US Federal Reserve has strongly hinted that it is preparing to tighten monetary policy and this is a similar theme across major central banks. The Bank of England (BoE) struck a hawkish tone by following up on its initial rate hike in December with a further 25 basis point hike in its latest meeting.

This is the first time the BoE has conducted back-to-back interest rate hikes since 2004. Most notably for IG credit investors, the Monetary Policy Committee also took the unexpected step of announcing the sales of its entire, though relatively small, corporate bond holdings, amounting to £20 billion.

The European Central Bank (ECB) has had a much larger impact on the European IG market, purchasing over €300 billion in corporate bonds via its Corporate Sector Purchase Programme (CSPP) since its launch in mid-2016. Further corporate purchases under its Pandemic Emergency Purchase Programme (PEPP) now mean that the ECB owns approximately 11% of the euro IG market.

Investors were already bracing themselves for a blockbuster year with net issuance expected to be €180 billion as regional corporations adopt more sustainable financing practices and look to fund further M&A activity. The possibility that elevated supply might coincide with the ECB tapering its corporate purchases in the middle of the year could further challenge euro IG markets.

Investors were already bracing themselves for a blockbuster year with net issuance expected to be €180 billion as regional corporations adopt more sustainable financing practices and look to fund further M&A activity. The possibility that elevated supply might coincide with the ECB tapering its corporate purchases in the middle of the year could further challenge euro IG markets.

How should IG investors respond using ETFs?

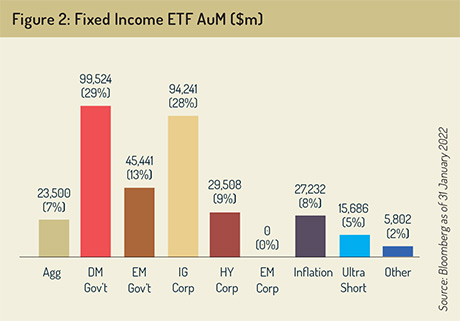

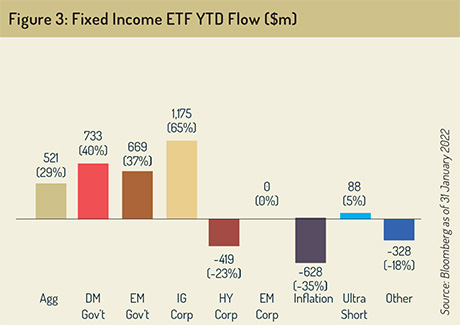

Investment Grade Bonds are a significant part of the UCITS ETF fixed income universe: they make up around 28% of the $341 billion assets under management (see Figure 2). Since the start of the year, IG has taken the lion’s share of fixed income inflows (see Figure 3).

The improving economic backdrop means that corporate balance sheets remain in good health, however, the coordinated withdrawal of liquidity by the major central banks has triggered higher levels of volatility across fixed income markets, including IG credit.

With volatility increasing, we think investors should look beyond pure indexed exposures and consider a more active and flexible approach when managing their IG allocation. Our Corporate Bond Research Enhanced Index (ESG) UCITS ETF* provide investors with index-like risk in a cost-effective ETF wrapper, but with targeted active exposure.

With volatility increasing, we think investors should look beyond pure indexed exposures and consider a more active and flexible approach when managing their IG allocation. Our Corporate Bond Research Enhanced Index (ESG) UCITS ETF* provide investors with index-like risk in a cost-effective ETF wrapper, but with targeted active exposure.

This range of funds leverage the depth of our expertise in credit portfolio management, security selection and fundamental research, to provide investors with an attractive active alternative to passive funds. We offer a Credit Research Enhanced Index ETF* strategy for USD Corporate Bonds, EUR Corporate Bonds and EUR Corporate Bonds 1-5 years.

These ETFs incorporate environmental, social and governance (ESG) factors by using exclusions and are categorised as SFDR article 8 funds. They can therefore help investors achieve an ESG tilt to their core fixed income allocations.

Find out more about our Credit Research Enhanced Index (ESG) ETFs at:

Disclaimer:

This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. Your capital may be at risk.

For France: Investors should note that, relative to the expectations of the Autorité des Marchés Financiers, these ETFs presents disproportionate communication on the consideration of non-financial criteria in its investment policy.

*For Belgium only: Please note that ETF marked with (*) not registered in Belgium and can only be accessible for professional clients. Please contact your J.P. Morgan Asset Management representative for further information. The offering of Shares has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority. The Shares may be offered in Belgium only to a maximum of 149 investors or to investors investing a minimum of EUR 250,000 or to professional or institutional investors, in reliance on Article 5 of the Law of August 3, 2012. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of Shares. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.

09li221602124514

© 2022 funds europe