Change is inevitable, whether it’s through gradual evolution or an earth-shaking ‘big bang’. Rob Langston delves further into our ‘Future of Distribution’ research among fund managers.

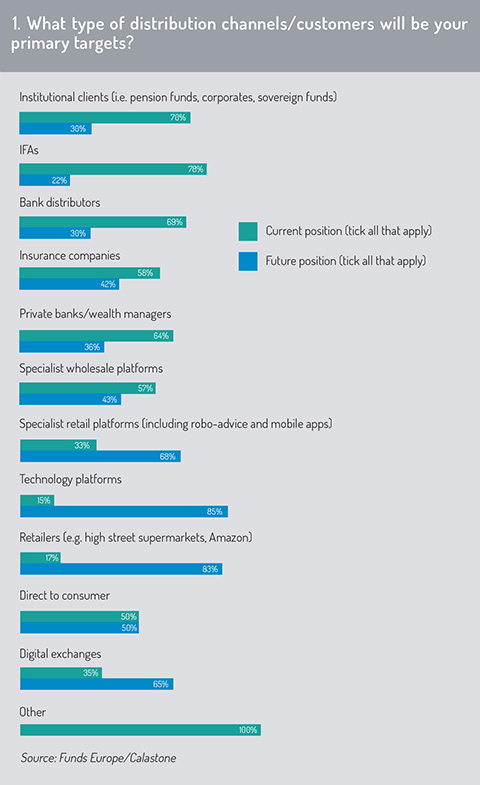

The notion that tech giants like Google, perhaps Uber, and especially Amazon, will impact the world of fund distribution will not go away. In a recent Funds Europe/Calastone survey, we see that of the asset management professionals that selected retail channels as a distribution channel now or in the future, 83% said retail channels such as Amazon (and high street supermarkets) would be key distribution targets in future.

With digital technology and greater pressure on fees and margins likely to impact fund distribution significantly, there is a growing realisation among European asset managers that embracing technology will be crucial for their businesses’ success in fund distribution.

“We’ve been saying for years as an industry that change is coming,” says Simon Keefe, head of global product at technology firm Calastone. “But it’s here and has already happened. Asset managers have to get on board with being able to look at new distribution models and not expect that new world to come to them.”

With the gradual abandonment of paper-based processes involved in fund distribution – see the increased acceptance of digital signatures in functions such as investor onboarding and transfer agency, for example – it’s likely that efficiencies for many asset management distribution operations will improve.

‘Amazonification’

It’s not just about how new technologies will be implemented in fund management, however. Internet giants like Amazon and Facebook could emerge as more important distribution channels for fund managers as they target new investors on the platforms they use.

Calastone’s Keefe says: “There have been years of talks about the ‘Amazonification’ of funds. Everyone’s been saying ‘it’s five years down the track’, but asset managers are starting to wake up to the fact now that they have to get onboard with new players and look into servicing that market at the same time as servicing existing distribution channels, platforms and intermediaries.”

Referring to the Singapore-based taxi app Grab, he says one model for asset managers to observe is in Asia, where savings and investments products are already offered on ‘one-stop shop’ apps.

“Grab Invest, for example, is basically a kind of Uber for South-East Asia, and as part of their service, they offer the ability to top up your investment portfolio by adding X amount of cents to the ride. That’s been really successful, and they have partnerships with asset managers.

“Grab Invest, for example, is basically a kind of Uber for South-East Asia, and as part of their service, they offer the ability to top up your investment portfolio by adding X amount of cents to the ride. That’s been really successful, and they have partnerships with asset managers.

“So, it’s already happening in Asia, and the last five to ten years have been a breeding ground for new innovations such as this because they haven’t got the legacy [problem of] trying to satisfy both worlds.”

Omnipresent technology

Steven de Vries, head of retail distribution for Emea at Legal & General Investment Management (LGIM), doubts we’ll see “one big and sudden change or disruption” to fund distribution in Europe. He says change is more likely to be incremental as pressure on fees and distribution costs push asset managers to become more efficient and embrace technology.

Yet he acknowledges that “technology is omnipresent in asset management and is reshaping the way we manage funds, data and clients”.

It is not just potentially disruptive technologies like blockchain and artificial intelligence (AI) that will significantly impact distribution, he says. Better collection and analysis of data will also generate better investment outcomes for the end-investor.

“Investors nowadays and going forward expect more transparency from asset managers and faster, ideally real-time information,” de Vries says. “Technology and secure data management can help asset managers be more successful,” he notes, adding that regtech and cyber security are overarching tech themes that will become an integral part of asset management.

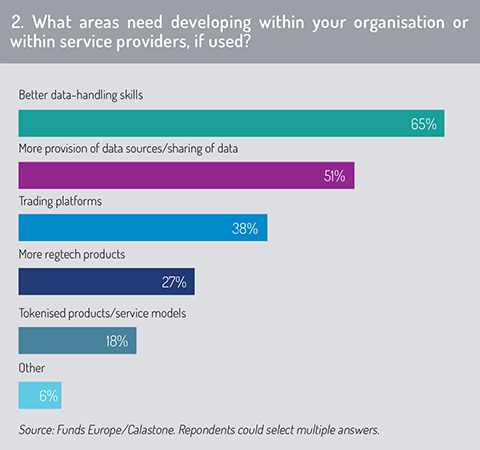

Our survey reflects the demand for better data-handling skills among industry actors (see fig 2).

Paul Ronan, chief technology officer at FE fundinfo, says automation techniques geared towards bringing better Big Data-driven advice to fund supermarkets’ or fund wrapper services’ customers are becoming increasingly important.

Paul Ronan, chief technology officer at FE fundinfo, says automation techniques geared towards bringing better Big Data-driven advice to fund supermarkets’ or fund wrapper services’ customers are becoming increasingly important.

“These range from robo-advisory services to social/crowd portfolio-following techniques, and they are perceived as cutting through the standard analysis lifecycle,” he notes.

“They tend to shorten the cycle by digitising the investment process for Generation X and millennials.”

Meanwhile, data transparency will enable asset managers to profile investors better and help them meet goal-based objectives, says Ronan, particularly as asset managers respond to investor appetite for ESG-friendly strategies. To win in this space, participants require access to Big Data in the traditional and non-traditional sense, he says. Meanwhile, this transparency of data becomes more achievable with the shift to API technologies.

“The next innovation will be the standardisation of processing flows to allow blockchain mechanisms to enter the picture,” Ronan adds.

Crypto and digital

Data is a must-have, but within the digital sphere fund manages will look at digital assets to facilitate distribution. Note that 18% of respondents in our survey cited tokenisation a development area. But what of the likes of bitcoin and ethereum?

Ulrik Lykke, executive director at alternative investment fund manager ARK36, which runs a digital asset fund, says awareness of cryptocurrencies is building among European investors, despite some lingering reservations.

As investors become more confident with the broader universe of digital assets, they are likely to become more mainstream, says Lykke, which could see new products launched and fund managers enter the space.

“Since it is a new market and virtually still a blue ocean, it almost goes without saying that more actors and bigger players will enter this market in years to come,” says Lykke. “Additionally, there is still a lot of demand from professional and semi-professional investors who are actively seeking exposure to digital assets.”

He believes more traditional institutional investors will soon begin to enter the digital asset market. “We are seeing this already in the case of institutions such as Goldman Sachs, where demand from existing clients is pushing the management to expand their offer to include digital assets.”

In a survey earlier this year, Nickel Asset Management found 82% of 100 institutions and wealth managers would increase crypto holdings.

Ultimately new technologies are likely to lead to more innovation in the industry and could make it easier to launch new products in response to client demand. Access to assets through tokens is one. However, there are others. LGIM’s de Vries says: “New technologies such as blockchain, AI and big data will allow asset managers to be more nimble and creative when launching new products.

“This means there will be more innovation, more opportunities to manage bespoke products efficiently and a much faster process of launching new and exciting products.”

The survey found many different opinions about how fund distribution can be improved, and asset managers recognise the potential of embracing technology. Many of the comments received highlighted the frustrations that many asset managers face on an everyday basis – such as onboarding, staffing issues, language obstacles – which could be solved by better technology or existing tools.

However, in an industry that has yet to replace the fax machine fully, asset managers still have some way to go.

“We need to make sure that the available technologies lead to a better outcome for clients,” says de Vries. “That means all parts of the value chain need to integrate technology to create solutions for our clients. Having said that, it is also very important there continues to be human oversight and interaction.

“Ultimately, asset management is a people business, so a healthy combination of humans and technology is crucial.”

© 2021 funds europe