The role of fixed income in multi-asset portfolios is evolving with the unprecedented levels of market volatility we have seen this year, and it is hard to think of a better time to rethink fixed income.

In today’s fixed income markets, investors face increasing pressure to deliver returns, generate yield and maintain diversification. To do so, we believe there is a need to move beyond the outdated ‘active first and only’ fixed income approach and consider indexing and fixed income ETFs.

Global fixed income ETF assets accounted for US$1.3 trillion at the end of June 2020 after growing 30% in just 12 months; still, ETFs represent only about 1.3% of the US$100 trillion global fixed income securities market.1

Bolstered by recent adoption patterns, BlackRock believes that institutional investor adoption of ETFs will be one of the key growth drivers that will help expand global fixed income ETF assets to US$2 trillion by 2024.2 So far in 2020, BlackRock counted over 60 asset owners and asset managers that were first-time buyers of iShares FI ETFs in the first half of 2020. We estimate this group collectively added about $10 billion in assets. (All amounts given in USD) 3

The best way to understand just why fixed income ETFs are suitable is to consider how they can help address the main challenges in today’s bond markets. We see four big challenges.

The best way to understand just why fixed income ETFs are suitable is to consider how they can help address the main challenges in today’s bond markets. We see four big challenges.

Risk: Two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to repay the principal and make interest payments.

1. Resilience through diversification

Firstly, the endless search for yield has reduced resilience.

As yield becomes increasingly scarce, investors are allocating to riskier asset classes. Corporates and emerging market debt – a sizeable amount rated high yield – make up 40% of fixed income allocations in multi-asset portfolios.4

This increase in exposures exacerbates credit spread risk. Such allocations also reduce the diversification benefits of bond portfolios by giving them higher correlation to equity markets – in particular during market downturns.

Indexing and ETFs offer investors transparency and clarity on portfolio exposures and risks in fixed income because of their rules-based approach. Moreover, they serve as efficient building blocks that may bring resilience to investors’ fixed income allocation through diversification, in a cost-effective way that also saves time. After all, indexing can offer access to as many as 25,000 bonds with just one trade.5

These building blocks can be far-reaching, allowing investors to buy broad diversification through a single ETF. However, they can also be offering exposure to more targeted slices of the market, enabling investors to diversify in a very precise way – perhaps to fill a gap in their existing portfolio. All in all, fixed income ETFs reach almost every part of fixed income markets.

Risk: Diversification and asset allocation may not fully protect you from market risk.

2. Help to protect portfolio from currency fluctuations

Another challenge is the impact of currency fluctuations on overall performance. Foreign exchange is the largest risk in multi-asset portfolios, after equity risk. Investors need efficient building blocks which also feature the flexibility to hedge currency risks. iShares fixed income ETFs may help with this, offering various currency hedged share classes across exposures including Sterling, dollar, euro, krona and Swiss francs.

Risk: The return of your investment may increase or decrease as a result of currency fluctuations.

3. Flexibility

The third challenge is investors’ discovery that their portfolios lack flexibility.

2020 was a stress test for all portfolios. As market volatility soared in March 2020, many investors discovered their fixed income allocations lacked the liquidity, price discovery and flexibility they needed to de-risk as markets sold off. Investors need nimble, liquid fixed income exposures that remain liquid and continue to track their indices tightly even during volatility.

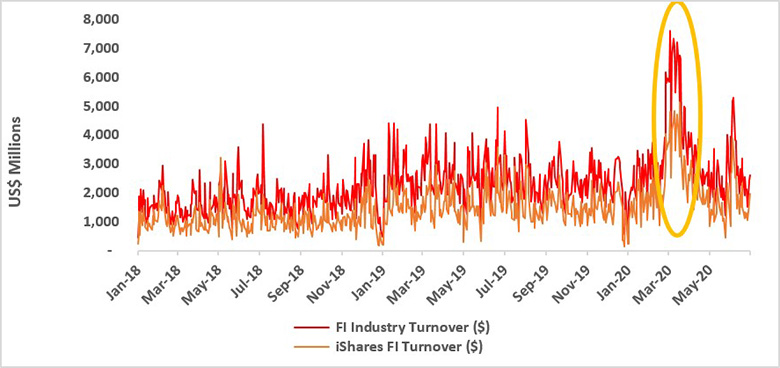

Investors have always tended to use fixed income ETFs even more during times of uncertainty because they are efficient and effective tools for rebalancing holdings, hedging portfolios and managing risk, and this was the case again in Q1 2020. Trading in U.S. FI ETFs surged to $1.3 trillion (All amounts given in USD) in the first quarter of 2020, half of the $2.6 trillion for all of 20196, while between 21-27 February, average trading volumes in UCITS domiciled fixed income ETFs increased by nearly 200% versus 2019 weekly average of US$7.8bn.7

High trading volumes support the notion that fixed income ETFs provide actionable prices for investors at a time when the underlying bond markets are challenged. The on-exchange market prices for fixed income ETFs during the recent volatility reflected both absolute and relative values and helped enable investors to understand rapidly changing market conditions. For example, on 12 March, shares in a single USD investment grade 40Act and UCITS ETFs traded over 100,000 and 1,000 times respectively, while their top five underlying holdings traded an average of only 37 times each, and during March more than half the bonds in the index the ETF follows traded between zero and five time per day on average.8

Risk: There can be no guarantee that the investment strategy can be successful and the value of investments may go down as well as up.

4. Sustainability

The final challenge is sustainability. Interest has been on the rise in recent years and 2019 saw a 13% increase in allocations to sustainable fixed income, as more investors seek ways to navigate the bond market with a sustainable lens.9 Investors also want a transparent and scalable implementation approach.

An indexed approach to sustainable fixed income allows for full attribution and transparency through a rules-based methodology. With a range of building blocks, investors may use iShares sustainable fixed income ETFs to achieve similar risk-return characteristics to traditional exposures while improving their sustainability profile.

Risk: This information should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This is for illustrative and informational purposes and is subject to change. It has not been approved by any regulatory authority or securities regulator. The environmental, social and governance (“ESG”) considerations discussed herein may affect an investment team’s decision to invest in certain companies or industries from time to time. Results may differ from portfolios that do not apply similar ESG considerations to their investment process.

Fixed income ETFs: A greater role in today’s portfolios

To conclude, investors in fixed income today face several challenges and fixed income ETFs may help investors address these. As the pace of growth to date has been even faster than expected and as multi-asset investors rethink the role of fixed income in their portfolios and address today’s portfolio construction challenges, we see an even greater role for fixed income ETFs.

By Henry Odogwu, Head of UK iShares Institutional Sales

1 – BlackRock, Bloomberg (as of 26 June 2020). Global fixed income assets were $1.322trn as of 26 June 2020; they surpassed $1trn for the first time in June 2019

2 – BlackRock, ‘Primed for Growth: Bond ETFs and the Path to US$2 Trillion’, June 2019

3 – BlackRock as of 30 June 2020

4 – BlackRock Portfolio Analysis & Solutions (BPAS) Portfolio insights 2020 edition as at January 2020.

5 – BlackRock, Bloomberg as at 30 September 2020.

6 – BlackRock, Bloomberg as of 31 May 2020

7 – Bloomberg (as of 20 March 2020). $17.5bn on average uses period from 21 February–20 March 2020

8 – BlackRock, TRACE as of 24 March 2020

9 – Portfolio Insights (2020 Edition), BlackRock – January 2020

Risk Warnings: Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The data displayed provides summary information. Investment should be made on the basis of the relevant Prospectus which is available from the manager.

Regulatory Information: This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

Until 31 December 2020, issued by BlackRock Advisors (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: +44 (0)20 7743 3000. Registered in England and Wales No. 00796793. For your protection, telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock.

From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: (i) BlackRock Advisors (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area.

BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

For investors in Switzerland: This document is marketing material. This document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2020 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK and SO WHAT DO I DO WITH MY MONEY are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. MKTGH1120E/S-1419316

© 2020 funds europe