The next section has been included in the survey for the past three years. This evaluates which companies will be the most valuable partners to asset management firms in managing business innovation and which will be the primary point of disruption to the investment funds industry.

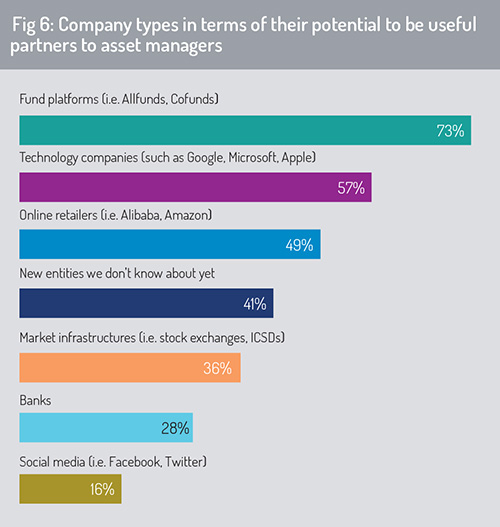

Respondents were asked to select the three most important answers from this list. This year, fund platforms (such as Allfunds, Cofunds and FundsNetwork, 73%) appeared at the top of the rankings (73%), with technology companies (e.g. Microsoft, Google, Apple, 57%), and online retailers (such as Alibaba and Amazon, 49%) also recognised as important service partners to asset management companies (fig 6). These three leading choices mirror the findings of last year’s survey.

Over two decades, fund platforms such as Allfunds, Cofunds and FundsNetwork have established a comprehensive fund distribution network and have extended access to a wide universe of collective investment funds and ETFs.

Wider research conducted by Funds Europe suggests that asset management firms are seeking partnership with fund platforms that extends well beyond a global sales function. The investment platform provides a transactional service linking product manufacturer, distributor and investor, supporting execution of subscription and redemption orders, provision of basic safekeeping services and access to tax-efficient wrappers in some locations.

Alongside this sales component, parties to the fund transaction may require a wider range of services – including support with compliance reporting, managing distributor agreements, transmission of data on distributor sales, portfolio monitoring tools, along with access to product information and fund documentation.

Online retailers such as Alibaba are establishing high-profile alliances with financial services companies, including asset managers. For example, Atlanta-based asset manager Invesco reported a significant growth in assets under management (AuM) following an alliance with Alibaba, signed in 2018, through which the Invesco Great Wall Jingyi Money Market Fund became one of a limited number of money market funds to be hosted on Ant Financial’s wealth management platform.

More generally, Alibaba and Ant Financial have established strategic alliances with partners across the financial services sector – including fund management, banking, insurance and fintech – some of which have been in place for many years. In December 2019, for example, Alibaba and Ant Financial entered into a strategic partnership with the Industrial and Commercial Bank of China (ICBC) to enhance cooperation in fintech and financial services. This aims to use their joint expertise to apply smart technologies and product innovation, particularly relating to electronic payment settlement, cross-border financing and scenario-based financial services. However, there has been active project collaboration between these two companies since 2005, when ICBC and Alipay first announced a partnership to deliver online payments in the Chinese market.

Partnerships between asset management firms and technology companies are taking a range of forms. Technological partnerships with BigTech firms can allow financial services companies to streamline their infrastructure, thereby reducing costs and increasing speed of service. Use of cloud-based data management is an obvious example. Partnership with BigTech firms may also offer access to new developments in data analytics, artificial intelligence or computer security that it may be impractical for an asset manager to develop entirely in-house.

Collaboration with online retailers and technology firms may also open up new distribution opportunities to asset management companies, particularly in emerging and frontier markets – including potential to extend access to collective investments for communities that were previously weakly served by financial product coverage.

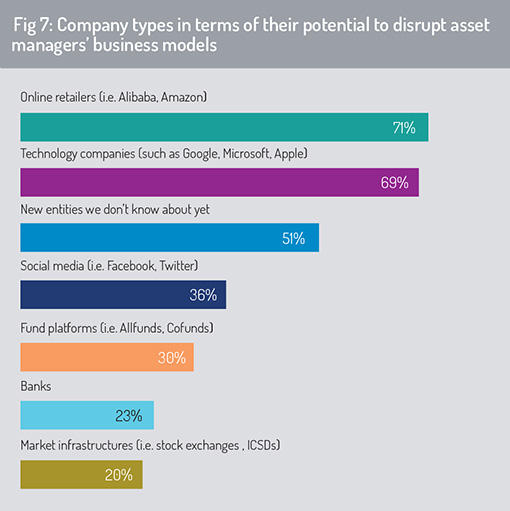

When we asked survey respondents which types of company provide the greatest threat to asset managers for their existing business, they told us that the primary threat would come from online retailers (Alibaba, Amazon) and technology companies (Google, Microsoft, Apple). It is noteworthy that technology companies and online retailers are viewed both as an important service partner to asset management firms and as a primary source of disruption to the asset management industry (fig 7).

At least two conclusions are significant here. There is a potential threat presented to asset management companies through competition, resulting in the loss of sales opportunities and revenue to competitor organisations. Second, there is a threat through stability and resilience concerns – particularly relating to the systemic importance of BigTech companies in providing essential services such as cloud-based data management and “-as-a-service” type delivery options (e.g. infrastructure-as-a-service, platform-as-a-service).

At least two conclusions are significant here. There is a potential threat presented to asset management companies through competition, resulting in the loss of sales opportunities and revenue to competitor organisations. Second, there is a threat through stability and resilience concerns – particularly relating to the systemic importance of BigTech companies in providing essential services such as cloud-based data management and “-as-a-service” type delivery options (e.g. infrastructure-as-a-service, platform-as-a-service).

The Financial Stability Board published a paper in December 2019 focusing on the role of large technology in financial services (FSB, ‘BigTech in finance: market developments and potential financial stability implications’, December 9, 2019). This highlighted its growing concerns around systemic risk and a “too big to fail” problem – the risk that certain BigTech firms (and potentially online retailers such as Alibaba, which offer both financial and technology services) are so large and integral to the secure functioning of the financial infrastructure that their failure would be a major threat to financial continuity. Having tightened oversight of global systemically important financial institutions (G-SIFIs) in the wake of the global financial crisis, regulators are now focusing their attention on what might be regarded as global systemically important technology organisations (although the FSB does not use that terminology).

A point of concern for financial authorities is that a small number of technology firms (and/or online retailers) may come to dominate, rather than to diversify, financial services provision in some jurisdictions. The widespread access that these firms have to customers’ purchasing histories and lifestyle data is likely to reinforce this trend. In this situation, the failure of one of these firms could lead to major disruption in the financial services industry.

Equally important, this raises fundamental questions around regulatory equivalence. Financial supervisors must ensure that the licensing, risk management and control procedures applied to technology firms and online retailers must be of an equivalent standard to those required of regulated financial institutions when they are delivering similar financial products and services.

© 2020 funds europe