Diversified growth funds continued to experience outflows in Q2, despite an improvement in returns, writes Sean Thompson.

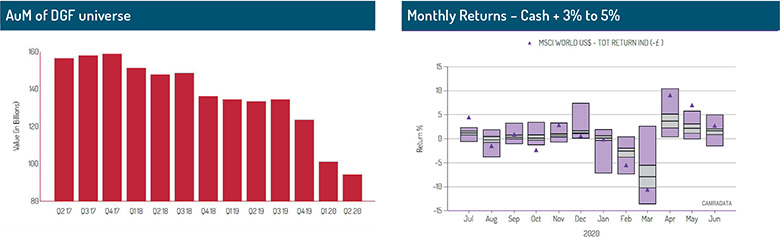

The DGF sector saw its 12th consecutive quarter of outflows in Q2 2020, despite achieving one of the best quarterly returns since Q1 2019, according to the Camradata investment research report for the period.

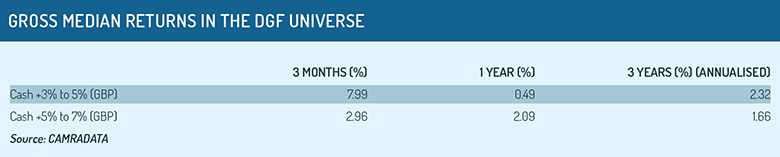

To put that into perspective, though, it came straight after the sector’s worst quarterly performance to date, following the outbreak of Covid-19. The turnaround helped claw back some of the losses experienced in Q1 2020, with the cash +3% to 5% median performance producing a positive return of 7.99% in Q2. However, the one-year and three-year medians return to June 30 are still way below its cash +3% to 5% pa target, having only produced 0.49% and 2.32% pa respectively.

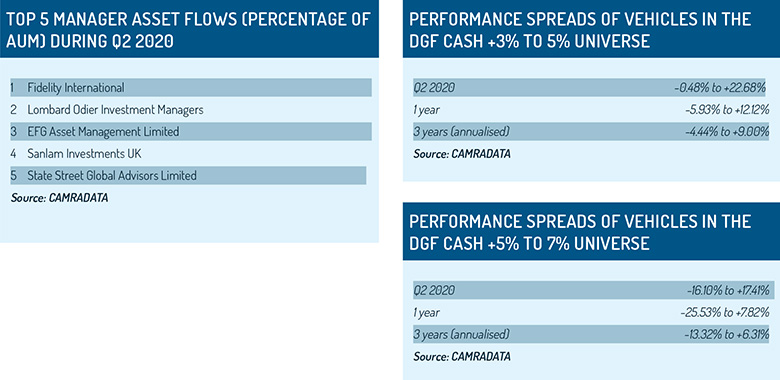

That said, a number of asset managers have managed to achieve their target returns whilst keeping within their risk parameters, highlighting the importance of manager research in the selection process and the continuous monitoring of asset managers in this sector.

Sean Thompson is managing director of CAMRADATA, the owner of Funds Europe. All figures are for three months to June 30, 2020 unless otherwise stated

© 2020 funds europe