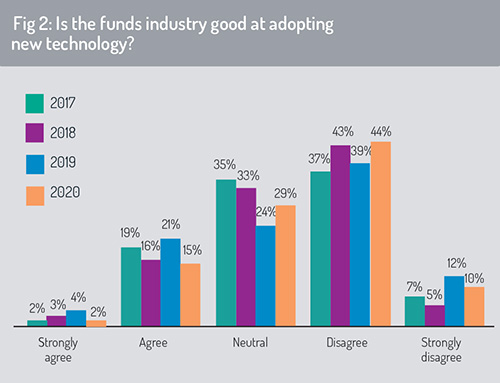

In keeping with previous surveys, we asked whether the asset management industry is good at adopting new technology (fig 2). The answer, for a fourth consecutive year, is a resounding “no”. Actually, in the eyes of our Europe and UK respondents, it is getting slightly worse.

This year, just 17% agreed that the industry is good at adopting new technology (down from 25% in 2019). In contrast, 54% of respondents disagreed with this statement (of which 10% disagreed strongly).

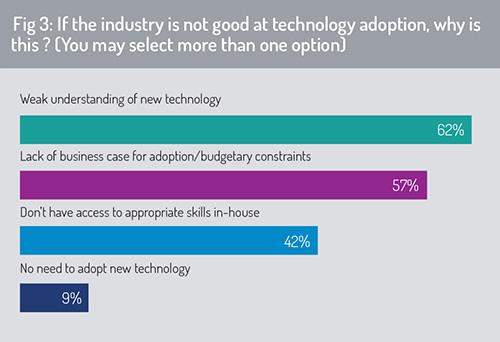

For those that disagreed, we asked for more details about why this is the case. Like last year, weak understanding of new technology was the most common reason advanced, with lack of a compelling business case for adoption also a significant constraint (fig 3).

More than two-fifths of respondents indicated that they do not have the appropriate skills in house to support their technology strategies, although this perceived skills gap has contracted slightly over the past 12 months.

More than two-fifths of respondents indicated that they do not have the appropriate skills in house to support their technology strategies, although this perceived skills gap has contracted slightly over the past 12 months.

Significantly, fewer than 10% of respondents said they have no need to adopt new technology. The need for technology updates and enhancement to their digital strategies is clearly pressing – and respondents identified a compelling need to sharpen their skills base to fulfil this requirement.

Distributed ledger technology

Distributed ledger technology

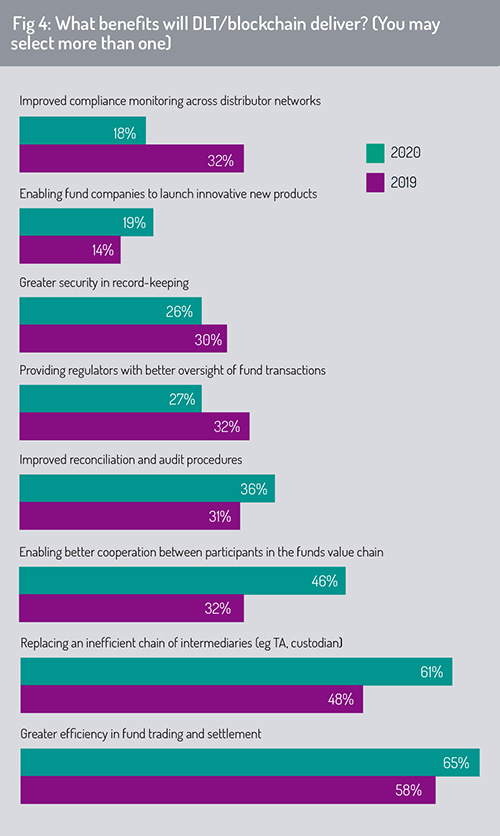

When asked to identify which benefits of DLT will be most important for the asset management industry, respondents indicated that “greater efficiency in fund trading and settlement” will be the dominant benefit (fig 4).

The survey also finds that DLT application will lead to a reconfiguration of activities along the transaction value chain, resulting in the potential disintermediation of some service intermediaries as asset management companies redesign their service models and vendor relationships. The percentage of respondents predicting this disintermediation within the intermediary chain has risen from 48% in 2019 to 61% in 2020.

Respondents predict that DLT will facilitate stronger cooperation between participants in the fund value chain, enabling participants to share access to a common book of record which is updated in near-to-real time. This can streamline reconciliation procedures and strip out costs incurred in ensuring that data records align across transaction participants.

When auditors and regulators are extended access to this blockchain-based shared ledger, this can provide regulators with better oversight of fund transactions and dramatically raise the speed and efficiency of audit procedures.

When auditors and regulators are extended access to this blockchain-based shared ledger, this can provide regulators with better oversight of fund transactions and dramatically raise the speed and efficiency of audit procedures.

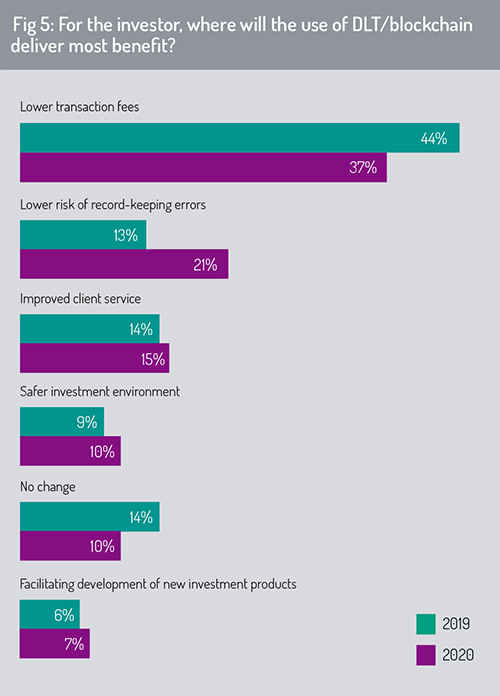

Transferring our focus to where DLT will deliver most benefits for the investor, the survey finds that the primary gain will be through delivering lower transaction fees (37%), a finding consistent with results of both the 2018 and 2019 Europe and UK surveys (fig 5). In common with the 2019 survey, respondents rank the cost-efficiency benefits of blockchain above the risk management benefits (through providing a safer investment environment, lower risk of record-keeping errors) or potential improvements in client service that DLT may offer.

© 2020 funds europe