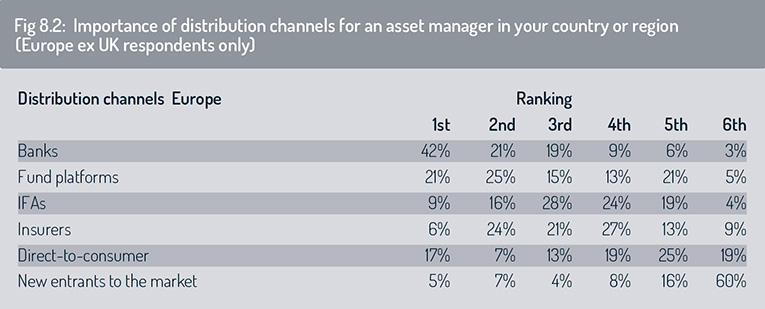

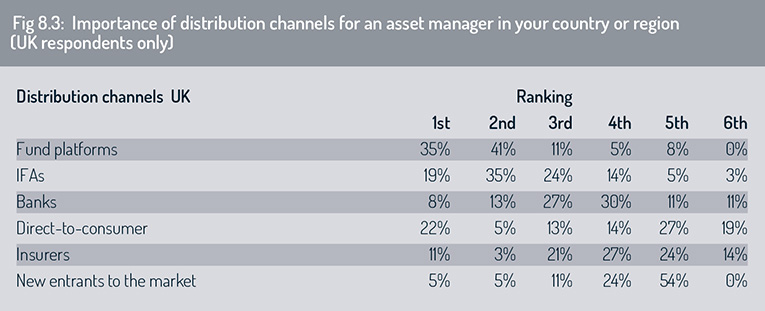

In this section, the survey evaluates how the distribution channels that asset managers are using to sell their fund products are evolving over time. We asked respondents to rank the importance of key distribution channels in their country or region (from 1, least important, to 6, most important). These responses were then ranked in order on the basis of weighted mean score, with the highest-ranked at the top.

Bank distribution and fund platforms were ranked as most important on the basis of weighted mean, with little difference between their weighted mean score (4.31 to 4.29 respectively).

For Europe (ex UK) respondents only, bank distribution is the dominant distribution channel, carrying substantially greater weight than distribution via fund platforms (fig 8.2). The IFA channel and insurer distribution recorded an almost equal weighted-mean score in third place.

Looking only at data from UK-based respondents (fig 8.3), fund platforms were identified as the dominant distribution channel, with the IFA channel in second place (with a weighted mean of 4.75 and 3.97 respectively). On the basis of weighted mean score, these two distribution channels are substantially more important currently to asset managers’ distribution strategies than bank distribution or direct-to-consumer channels in third and fourth place (with weighted means of 3.60 and 3.56 respectively).

Focusing on which distribution channels will be most important for asset management companies in five years’ time, respondents predict that online distribution via fund platforms will become the dominant channel for fund sales by the mid-2020s (fig 9).

Direct-to-consumer sales will rise as a percentage of aggregate fund sales, particularly in the UK market. Again, this aligns with findings from the 2019 survey, where more than half of UK-based respondents told us that D2C sales will provide the dominant channel for UK fund sales within five years.

Bank distribution will remain a primary channel for collective investment fund and ETF sales in a number of European markets (e.g. Germany, Switzerland).

The survey again highlights the weakening role that independent financial advisers (in the UK and some other European markets) and insurers will play in European fund distribution in 2025 when compared with 2020. This aligns with comparable findings published in last year’s Europe and UK survey.

Margin pressure

Market compression continues to exert pressure across the asset management industry, with fund promoters, distributors, asset servicing partners and financial infrastructure entities all forced to reassess their service models in the face of these cost pressures.

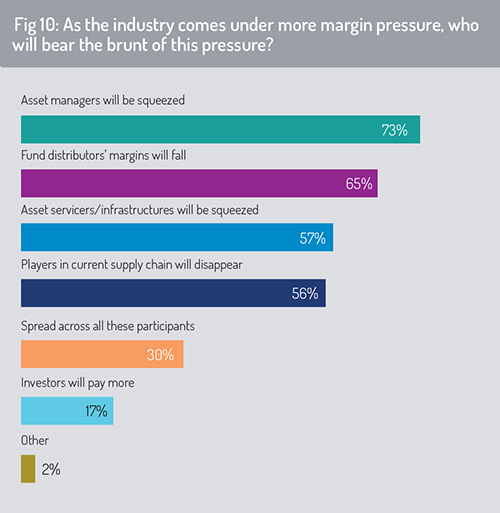

The 2020 survey reveals that the pain of margin pressure is being felt across the funds value chain, with asset management companies currently bearing the heaviest burden (73%). Fund distributors (65%) and asset servicing companies (57%) will also experience negative impact through a contraction in their margins (fig 10).

These economic pressures are likely to trigger consolidation across these market segments, with some providers disappearing from the existing supply chain.

These economic pressures are likely to trigger consolidation across these market segments, with some providers disappearing from the existing supply chain.

As one senior asset servicing executive said to Fund Europe, “we are under pressure from our asset management clients and also from competitors. Some competitor organisations are forcing prices downwards, effectively ‘buying assets’ by delivering services at such low pricing levels. A major challenge for the industry is to provide the right level of service at the right price. Digitalisation is enabling us to become more efficient, but at the same time, we need to remain client-centred and responsive to clients’ needs.”

Fewer than 20% of respondents anticipate that these margin pressures will result in investors needing to pay more for their investment products. The flexibility that investors have in their choice of investment products (including ETFs and low-cost passive products) is offering some protection against a significant rise in the cost of investment products feeding through to the end investor.

© 2020 funds europe