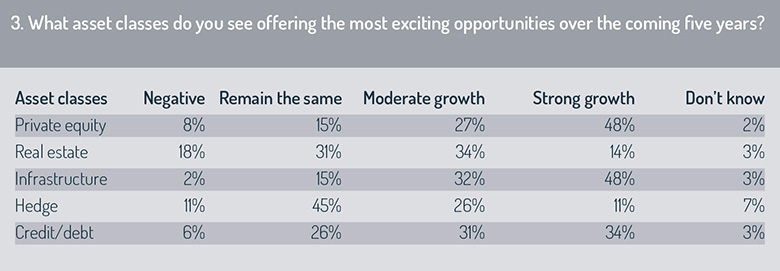

When respondents were asked which asset classes offered the most exciting opportunities over the next five years (fig 3), private equity and infrastructure emerged as clear favourites. In each instance, 48% marked them out for strong growth; by contrast, only 14% felt the same way about real estate.

In a webinar broadcast with Funds Europe, Mike Byrne, asset and wealth management leader and a partner at PwC Channel Islands, cautioned that neither private equity nor real estate is likely to escape the pandemic unscathed.

“We’re seeing big changes in behaviours and that will have a short-term impact on the asset classes,” he said.

“In the longer-term, though, the view remains optimistic – alternatives are still a massive focus for institutional investors. The question will be how quality managers perform over time, and that’s where having a solid base will really come into play.”

To varying degrees, opportunities within the alternative asset classes also elicited negative responses. Real estate fared worst in this respect (18%), followed by hedge (11%), private equity (8%), credit/debt (6%) and infrastructure (2%).

This negative perception of real estate’s prospects in the next five years is noteworthy, bearing in mind the rapid rise that real estate business fund domiciles have seen in recent times. Jersey, for instance, has seen has the value of its real estate business grow by 31% in the past five years.

ESG

ESG [environmental, social and governance] funds have seen a sharp increase in recent years, driven primarily by the climate crisis. The Covid-19 pandemic has accelerated conversations around corporate behaviour, as well as the ‘S’, to the here and now. Sustainable funds outperformed their equivalent non-ESG counterparts over the past decade, according to Morningstar, and questions over returns using the risk-mitigation factors have fast dissipated during the global health emergency of 2020.

Strong governance is vital to effective risk mitigation and both governance and substance are seen as central priorities for alternative managers.

“The governance model we’ve seen in Jersey for some time, together with the commitment the jurisdiction has long had to substance, has really come into its own in recent times, given the disruption we’ve seen globally,” said PwC’s Byrne.

“The governance model we’ve seen in Jersey for some time, together with the commitment the jurisdiction has long had to substance, has really come into its own in recent times, given the disruption we’ve seen globally,” said PwC’s Byrne.

“The availability of on-island expert directors, for instance, has meant that there has been little to no disruption to boards whilst travel restrictions have been in place. We fully expect excellence in governance to be front of mind in the coming months.”

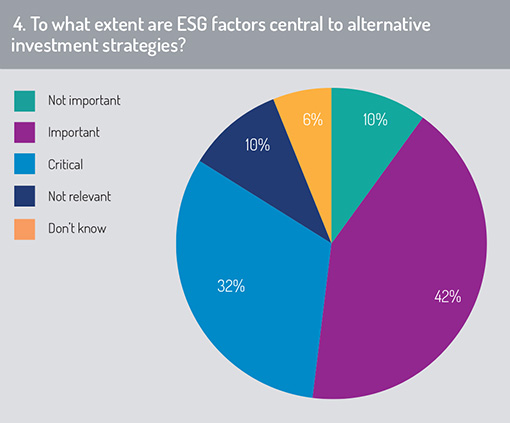

The survey asked to what extent ESG factors are central to alternative investment strategies (fig 4). Overall, 32% said ESG factors were critical, while 42% considered them important. The results for “not important” and “not relevant” were the same (10%) and 6% told us they didn’t know.

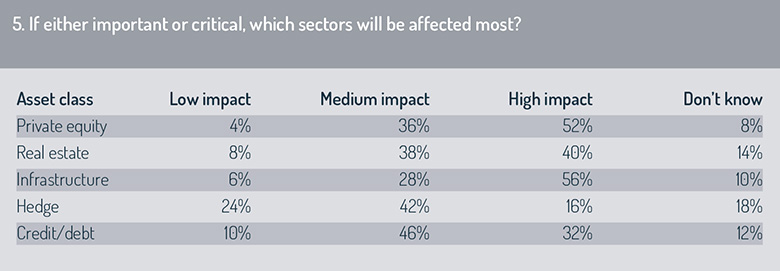

Of the 74% who identified ESG as either critical or important, respondents were asked to denote the impact on the various asset classes in the alternatives space (fig 5). More than half said that ESG will have the highest impact on infrastructure (56%) and private equity (52%). Real estate achieved a score of 40%, credit/debt 32% and hedge 16%.

This presents the financial sector with an opportunity to finance a transition to net-zero emissions by 2050 – and alternative fund domiciles can play a role in establishing funds to scale up towards this goal in a limited timeframe.

In 2018, for example, Low Carbon and Vitol launched a Jersey-based fund known as VLC Renewables with an initial €200m allocation to invest in European renewable energy generation projects.

By July 2019, VLC Renewables made its first investment in the Zaporizhia wind farm in south-eastern Ukraine. Once constructed, the 500-megawatt facility is expected to be among the top five operating onshore wind generators in Europe, according to the fund.

It is also worth noting that nearly a quarter of respondents (24%) said ESG factors will have a low impact on hedge, while 42% said it will have a medium impact on the sector.

Continue reading the report: Drivers of demand »

© 2020 funds europe