Fund search activity suggests investors in Q3 2019 were looking further afield, with manager of emerging market debt the major beneficiaries, writes Tom Ashford.

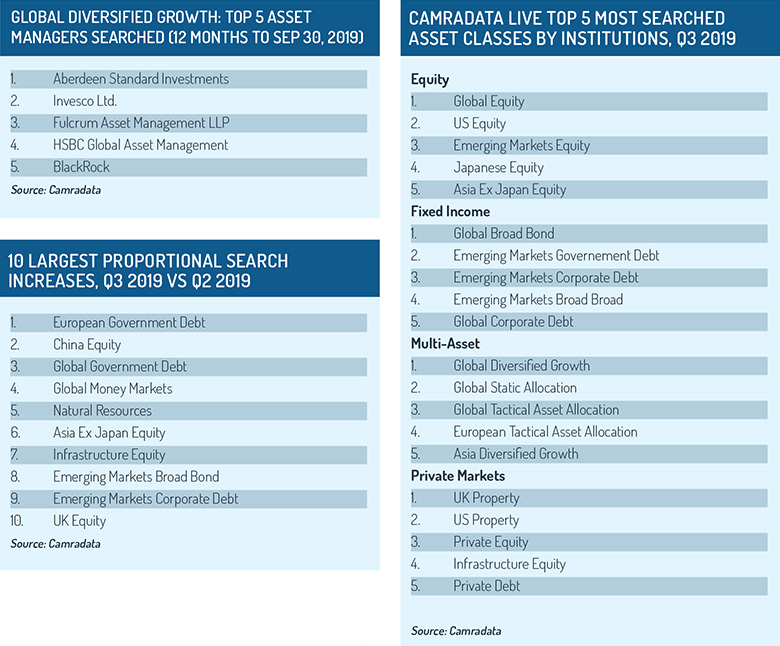

Compared with previous quarters, the most searched asset classes on CAMRADATA Live produced a few significant changes in Q3 2019. In the first half of this year, investors’ search activity was very much dominated by global, US and European-focused asset classes. However, attention in the third quarter travelled further afield, with emerging market and Asian-focused asset classes piquing investors’ interest.

Despite continued US-China trade tensions, among equity asset classes, investors focused increasingly on the Far East, with Japanese equity and Asia Ex. Japan equity seeing a marked increase in search activity. Meanwhile, European equity fell out of the top-five most searched on equity asset classes for the first time this year.

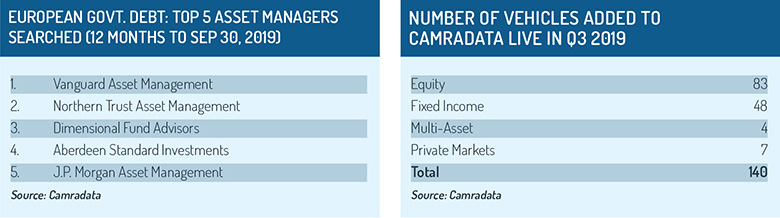

Among fixed income asset classes, emerging market debt dominated the top-five most searched on asset classes, while government debt saw the largest proportional increase in activity. Within European Government Debt, Vanguard Asset Management was the most searched on asset manager, while PineBridge Investments were the recipients of the most activity within the Emerging Markets Corporate Debt universe. Despite the increased focus on government debt and emerging market debt, Global Broad Bond continues to be the most searched on fixed income asset class on CAMRADATA Live.

Much like Global Broad Bond dominates the search activity among fixed income asset classes, Global DGFs continue to dominate the search activity among multi-asset funds. However, there has been a steady increase in search activity on Global Static Allocation and Global Tactical Asset Allocation vehicles as the year has progressed. Among Global DGFs, Aberdeen Standard Investments was the most searched on manager over 12 months to the end of Q3 2019.

US property rose to the second-most searched on asset class among private market strategies, while natural resources and infrastructure equity saw the largest proportional increases in search activity.

Tom Ashford is database support and investment research associate at CAMRADATA, the owner of Funds Europe. All figures are for the three months to September 30, 2019 unless otherwise stated.

©2019 funds europe