Fidelity International has unveiled details of its variable management fee that the firm hopes will help to bring back a competitive edge to its actively-managed funds.

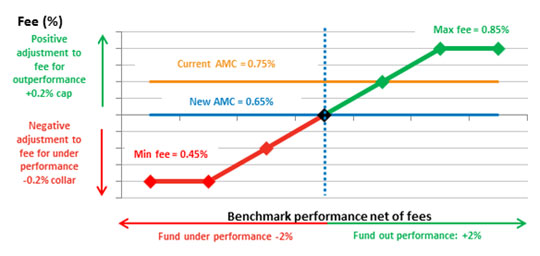

The €264 billion asset manager’s new fee will see its annual management charge being cut by 0.1% below present rates.

Thereafter, if a fund outperforms its benchmark by 2%, up to 0.2% will be added to the charge.

Correspondingly, the fee can be reduced by up to 0.2%, in the event that a fund underperformed by 2% on an annualised basis calculated over a three-year rolling period.

Fidelity said it was introducing the sliding scale pricing model, first announced in October, in response to “the challenge around the value of active fund management, the industry’s alignment with client interests and the need for innovation on fees”.

In a statement the firm said that the new fee structure would act as a “two-way sharing of risk and return”.

The fee will only start to increase from the base level once the fund has beaten the market index after all fees and charges.

The fee will only start to increase from the base level once the fund has beaten the market index after all fees and charges.

The variable management fee will be launched in March 2018, initially across ten of Fidelity’s active equity funds.

Clients with segregated portfolios including institutions and investment trusts will have access to an individually adapted version of the fee model.

Paras Anand, chief investment office for equities, Europe, said: “We believe that this new fee model allows us to demonstrate our value proposition whilst sharing in the cost during periods of underperformance which all active managers, even the best, experience from time to time.

“We hope, therefore, that this goes some way to incentivising clients to consider the value of active investing over the long term.”

©2017 funds europe