The UK arm of the CFA Institute has warned that a brain drain of talent from the UK’s investment sector is likely to accelerate as Brexit approaches.

A survey of 1,109 CFA members in the UK concluded that many European nationals who work as investment professionals in the UK could decide to leave as the likelihood of a so-called “hard” Brexit increases.

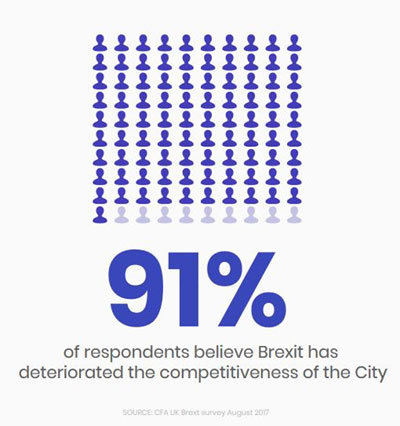

The survey found that 91% of EU respondents, compared with 71% of British respondents, believe that Brexit has deteriorated the competitiveness of the City of London.

It also found that just 42% of EU nationals are confident they will continue working in the UK investment management industry post-Brexit with 16% planning to leave and the remainder so far undecided.

Brexit is further dissuading EU nationals from encouraging others to accept positions in Britain with just 15% said that they would encourage non-UK citizens to come and work in the UK now.

Brexit is further dissuading EU nationals from encouraging others to accept positions in Britain with just 15% said that they would encourage non-UK citizens to come and work in the UK now.

By contrast, a high proportion of investment professionals from non-EU countries still envisage a future working in the UK.

Eighty-one percent of British investment management professionals indicated in the survey that they plan to continue working in the country following Britain’s departure from the EU in March 2019 and 69% of those holding non-EU international passports indicated the same.

Will Goodhart, chief executive of CFA Society UK, said: “The resulting fall in the representation of EU nationals will be a huge loss for the UK market and it is crucial to minimise this as much as possible.

“If the City doesn’t attract and retain the best talent from all regions, its ability to serve clients and the end investor will be weakened.”

©2017 funds europe