ETFs have multiple uses. Nick Fitzpatrick looks at some of these and finds out how ETF usage is developing as the market matures.

ETFs are often promoted on the basis that investors can trade them as easily as shares at any point in the day, rather than just once a day, which is the case with a traditional mutual fund.

But how many ETFs are actually used for trading in financial markets – that is, short-term, speculative day trading? Not many, it seems. The European market in exchange-traded funds is very much an asset managers’ market, which means it is long-term in nature.

“Trading in ETFs is improving because there are more and more investors who are interested in ETFs, but in Europe, ETFs are still mainly for buy-and-hold strategies and for market timing around tactical positions,” says Julien Scatena, client solutions and platform specialist at TrackInsight, an ETF data provider. He explains that asset managers will sometimes hold ETFs in the shorter term but rather use them as longer term portfolio building blocs.

Adriano Pace, managing director for equity derivatives at Tradeweb, agrees. Tradeweb is a European ETF trading platform launched in 2012. “We see very few examples of intra-day trading,” he says. “Investors tend to be long-only, long-term and buy-and-hold. They use ETFs to build up positions.”

Whereas real, speculative trading would likely take place intra-day, most ETF subscriptions and redemptions on the Tradeweb platform are ‘at NAV’, meaning they are dealt once a day for the ‘strike’ price. This suggests many ETF users are requiring ETFs to perform no more spectacularly than a normal investment fund – that is, trading once a day at the set price.

Aside from market makers who will trade ETFs sometimes heavily in order to maintain a tight bid-offer spread, the typical ETF user is an asset manager often acting on behalf of institutions or pooled investors.

“Everyone thinks ETF growth comes from individuals who put them in their private portfolio, but in many cases the growth is driven by active fund managers who use ETFs as part of their portfolio allocation,” says Tilman Fechter, a global sales and relationship management head at Clearstream (see pages 30-31).

Bryon Lake, head of international ETF at JP Morgan Asset Management (JPMAM), says asset managers typically hold an ETF for between one and six months when using them tactically to build up a position within a portfolio.

Lake was appointed at JPMAM this year, having been head of European, Middle East and Africa at Invesco PowerShares, a smart beta ETF provider.

One position to another

Using ETFs for portfolio positioning will normally reflect a shift from one long-term position to another. But the shift itself implies a trade of a shorter-term nature. “We see investors increasing rotations within their portfolios and this means ETF dealing is becoming more tactical and more news-driven,” says Lake.

Being more reactive to news is suggestive of a market gathering speed. Nuclear tensions and other major global events have impacted ETF flows in the past year, and this would appear to be something that is quite new.

“Historically, there hasn’t been significant movements due to political or other events,” says Scatena.

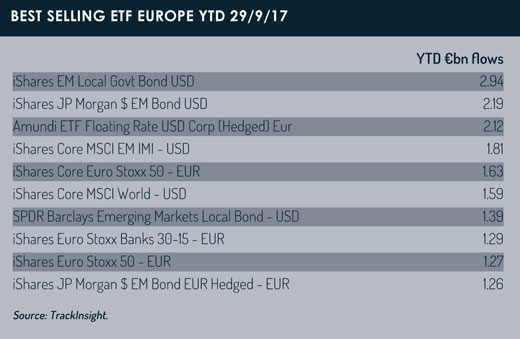

ETF flows are still far more influenced by deeper, macro decisions. In the year to date ending September 29, for example, at the global level TrackInsight registered large inflows into ETFs tracking the S&P 500 and MSCI EAFE, while in Europe there were strong flows into emerging markets (see table). TrackInsight said these flows reflected the ongoing hunt for yield.

Even in the US, where there is a much more developed equities culture among individual investors, ETFs are mainly owned by buy-and-hold investors.

Teddy Fusaro, senior portfolio manager and head of capital markets at IndexIQ, which is owned by New York Life, sums up their usage.

“One of the things that makes ETFs unique and useful is they have so many use cases and applications. Portfolio managers use them for portfolio transitions, to equitise cash, or to express long-term fundamental views in a tax-efficient manner before making more nuanced decisions.”

He points out that in the past, asset managers would have equitised cash using derivatives, such as futures.

Just like in portfolio transition management, ETFs have competed strongly with derivatives to become the main tool. But whereas derivatives are also exemplary trading tools, sometimes winning or losing speculators fortunes, ETFs are still not seen in the same way.

So why is it that the true trading qualities of ETFs have not been taken up so much by speculators?

Some of the reasons are perhaps structural.

“The European market is fragmented and it is sometimes hard for institutional investors to find liquidity and trade. This is the reason they prefer to buy and hold,” says Scatena.

He may be ambivalent about whether ETFs are used by day traders, but he does hope the revised Markets in Financial Instruments Directive (MiFID II) will help cast greater light on liquidity.

“We hope MiFID II will help us to better see where liquidity is. Around 70%-80% of trading is OTC [over-the-counter], meaning there is no transparency and it is hard to see where money flows are going to.”

Price volatility

The difference under MiFID II, when it comes into force next year, is that OTC players will have to report their deals.

This should also help track price volatility. At the moment, the exchange of so many ETF shares between parties OTC, rather than on an exchange, where the price would be sensitive to movements and displayed, means there is no real way to detect price volatility.

It is commonly expected that MiFID II will also create more interest in ETFs among the retail public. Implicit in MiFID II is an attack on fund commissions paid to distributors, so the playing field between funds and ETFs (which do not pay commissions) is supposedly levelled, meaning advisers would be more inclined to sell them.

It is commonly expected that MiFID II will also create more interest in ETFs among the retail public. Implicit in MiFID II is an attack on fund commissions paid to distributors, so the playing field between funds and ETFs (which do not pay commissions) is supposedly levelled, meaning advisers would be more inclined to sell them.

Were European distributors to offer ETFs wholeheartedly, this would reflect a trend in the US for greater retail usage.

Sam Masucci, founder and CEO of ETF Managers Group in the US, says: “In 2004, 60%-70% of the market was institutions who used ETFs as easy ways to get in and out of exposures – but it started to gather retail interest over the last ten years. A lot of slow-moving retail interest was driven by wire houses, who had to think about whether they wanted to embrace it.”

Certain products, namely levered and inverse ETFs, are designed more for the trader, says Masucci. “If you’re not a day trader, you should not be here,” he says.

At the same time, ETFs are used in Europe for more than just long-term buy-and-hold positions.

JPMAM’s Lake says asset managers use ETFs to park money from their clients in order to manage inflows into other funds. Also, investors themselves might put money in an ETF to tilt an exposure they already have to an asset class through another asset manager.

These developments show that the ETF market is not just gathering more money, but maturing in other ways and will attract more and more users.

©2017 funds europe