Two French banks saw their global assets under custody shrink during our survey period, while Citi, formerly the largest custodian of European assets, was overtaken by an American rival, finds Nick Fitzpatric.

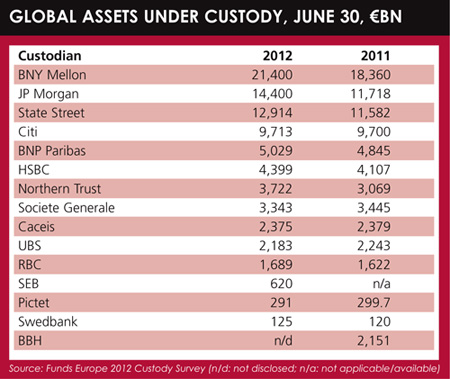

Northern Trust overtook Societe Generale Securities Services to become the seventh largest global custodian in what was a volatile twelve months in the safekeeping business.

Illinois-based Northern Trust moved up one place to rank as the seventh-largest custodian by total assets at June 30, while Societe Generale slipped down a place to eighth.

The twelve months up to June 30 provided a testing time for custodians with asset levels tugging the banks in both directions – upwards and downwards.

The twelve months up to June 30 provided a testing time for custodians with asset levels tugging the banks in both directions – upwards and downwards.

Notable for also being French, Societe Generale’s compatriot Caceis also saw a decrease in assets under custody, though held on to its ninth ranking.

The drop in assets for Societe Generale and Caceis were quite mild for their size – €2 billion and €4 billion respectively – and almost certainly reflect the strain in the eurozone over the period.

Downgradings

Swiss banks UBS and Pictet also saw asset values fall over the twelve months to June 30.

Standard & Poor’s, a credit rating agency, cut the credit ratings of Societe Generale and Credit Agricole, which owns Caceis, from “A+ with a stable outlook” to A back in January.

This closely followed a downgrade of France’s AAA-rated sovereign debt.

In June, Moody’s also cut its credit rating for Societe Generale from A1 to A2. The agency also downgraded UBS.

Elsewhere in the custody business, assets increased at the global level. Northern Trust showed which direction the Americans were travelling in, while BNY Mellon Asset Servicing retained the global lead. It saw the largest increase, from €18.36 trillion of global assets under custody last year to €21.4 trillion this year.

Global asset loss

Global asset loss

JP Morgan Worldwide Securities Services, with an increase of €2.68 billion since last year to €14.4 trillion, retained second place. There was no change in the order for the largest US custodians that occupied the top four positions globally – the other two being State Street and Citi.

Equally, BNP Paribas Securities Services retained its fifth position and, unlike its two main French rivals, did not lose assets at the global level.

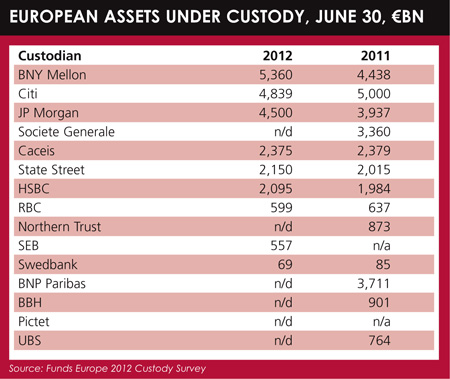

But in Europe, Citi fell from the top spot for European assets under custody according to figures the bank supplied.

Falling asset values

Citi stated that its European assets under custody were $6.09 trillion at June 30. A conversion at Oanda.com for June 30 gives a figure of €4.84 trillion. Last year Citi reported its figure in euros to us. That figure was €5 trillion, indicating a fall in European assets of around €160 billion.

C iti said it had seen a drop of 3% against a market drop of 7%.

iti said it had seen a drop of 3% against a market drop of 7%.

The change saw Citi overtaken by BNY Mellon, which increased its European assets under custody to €5.36 trillion from just under €4.5 trillion last year.

In the European ranking, French banks Societe Generale and BNP Paribas did not give figures for their European assets under custody this year.

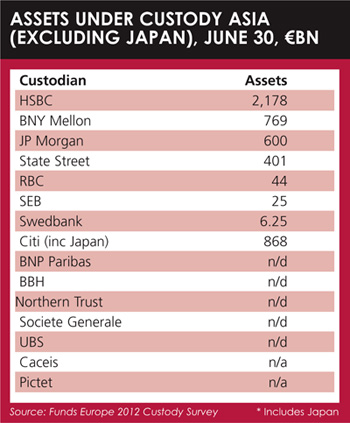

This year for the first time we also asked custodians for their assets under custody in Asia ex-Japan. HSBC tops this ranking with €2.18 trillion.

BNY Mellon came second with €769 billion and JP Morgan came third with €600 billion.

Overall, 14 banks responded out of the 15 surveyed. Brown Brothers Harriman did not provide data this year.

©2012 funds europe