Piyasi Mitra unravels the critical role of authorised participants in the ETF world and examines the debates surrounding their influence.

In 1993, the SPDR S&P 500 ETF revolutionised the investment world as the first US-listed exchange-traded fund to mirror the S&P 500 Index. As the variety and sophistication of ETFs grew, the pivotal role of the frequently overlooked authorised participants (APs) became apparent. So, who are these APs, why are they so significant in Europe, and what sort of controversies do they attract?

The role of APs

A significant financial institution, such as Bank of America or Goldman Sachs, typically acts as an AP. In other words, it enters into agreements with ETF distributors to create and redeem fund shares.

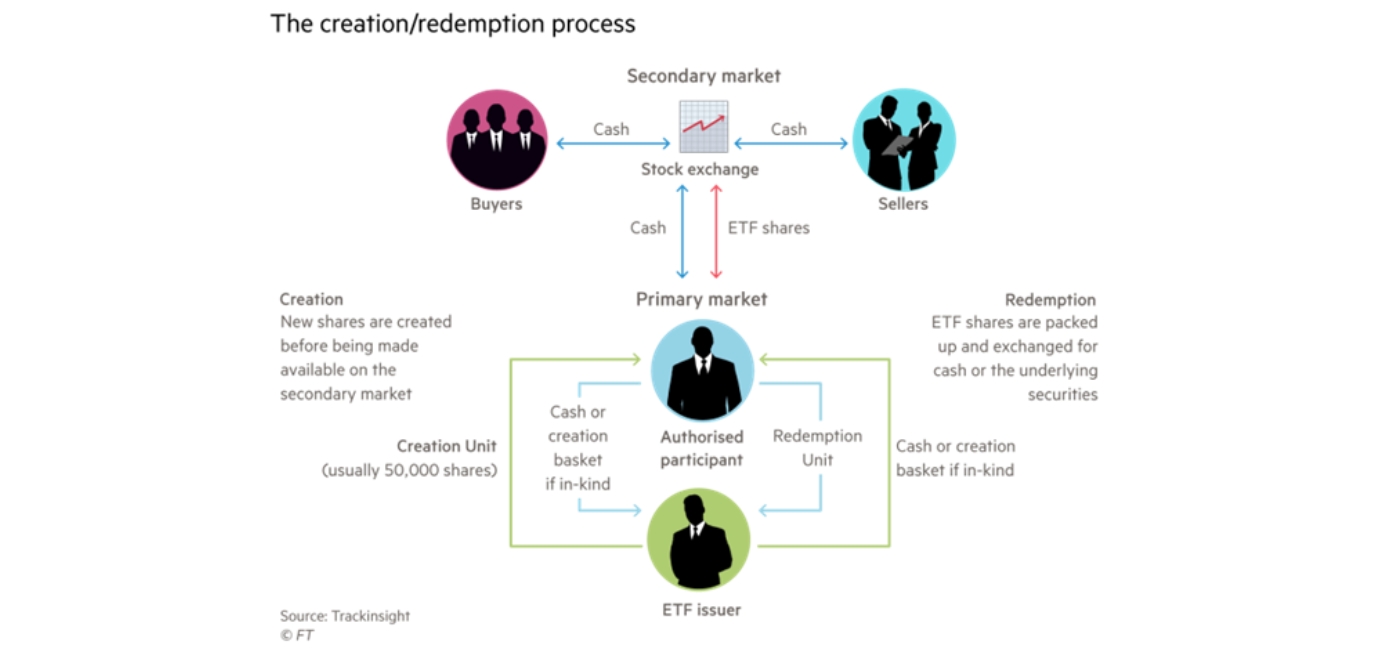

APs acquire the stocks necessary for bundling into an ETF that tracks a particular index. These shares go to a fund sponsor. In return, the fund sponsor provides shares in the ETF itself at the same value as the index shares. These ETF shares are known as a ‘creation unit’. The AP then sells these shares (for profit) in the secondary market to investors.

The AP, therefore, is the gateway for an investor into an ETF, not the fund sponsor.

“ETF investors typically trade existing ETF shares during market hours, on an exchange, just like trading stocks. This is the ‘secondary’ market, or on-exchange, where investors buy and sell existing ETF shares.”

When investors later sell their ETF shares, the AP buys the ETF shares and returns them to the issuer and gets back the index shares to sell in the stock market. This is the redemption unit.

By carefully managing this creation and redemption mechanism, APs attempt to maintain an ETF share price that is the same as the underlying net asset value of the shares tracked by the ETF. Failing to do this leads to a ‘tracking error’ between the ETF and the index that it tracks.

When introducing a new ETF, the issuer works with selected APs to produce an initial share block – the creation unit. Depending on the specific ETF, this block might range from 25,000 to 200,000 shares.

Ensuring the ETF market price aligns closely with its underlying net asset value is a key duty of the AP. APs can adjust the discrepancy through arbitrage if any deviation occurs, ensuring the ETF price accurately represents its actual assets.

By acting as buyers when there is a surge in selling pressure or as sellers when there is a surge in buying demand, APs create a stabilising effect, reducing the risk of panic selling or buying and contributing to a more stable and orderly market.

According to Deborah Fuhr, the managing partner and founder of ETFGI, which provides data on the ETF market, the fact that ETF investors do not directly engage with the fund provider while purchasing or selling shares sets ETFs apart from traditional mutual funds. “ETF investors typically trade existing ETF shares during market hours, on an exchange, just like trading stocks. This is the ‘secondary’ market, or on-exchange, where investors buy and sell existing ETF shares.”

“In Europe, year-to-date through to the end of June, ETFs gathered net inflows of $72.15 billion – all done via authorised participants.”

Uniquely, ETFs operate in two markets involving different market participants. The ‘primary’ market is where APs engage with ETF issuers to generate or redeem ETF shares in response to market demand.

Fuhr highlights that ETF trading in the primary market is usually less than in the secondary market. “In Europe, year-to-date through to the end of June, ETFs gathered net inflows of $72.15 billion – all done via authorised participants.” She adds that assets invested in the ETFs industry in Europe reached a record $1.63 trillion (€1.5 trillion) at the end of June 2023.

APs in Europe

Jim Goldie, head of Emea ETF capital markets at Invesco, predicts market structure changes will create challenges for APs. Last year, the introduction of the Central Securities Depositary Regime (CSDR) – a common set of standards to improve settlement efficiency across the European market – and rising interest rates globally both increased trading costs. However, this has yet to result in meaningful increases in spreads for investors, and authorised participants have identified ways to improve their efficiency to reduce any impact, says Goldie.

The misalignment of settlement cycles between the US and Europe – in the US, it’s T+1, meaning settlement occurs a day after the trade – may create operational friction. However, the industry has managed such changes in the past, and Goldie doesn’t expect any meaningful impact on investors this time either.

Why the controversy?

The dominance of a few APs in the ETF creation and redemption process poses a concern. Such concentration might jeopardise diversity and efficiency, especially if a critical player encounters challenges. Furthermore, these APs could access exclusive information, risking conflicts of interest and undermining a level playing field.

Last year, the International Monetary Fund (IMF) warned the Central Bank of Ireland to encourage ETF issuers to use a broader range of liquidity providers to help them weather market stress and deal with concentration risks.

The suggestions are part of a broader evaluation of Ireland’s funds industry, which, according to ETFbook data, represents roughly 67% of all European-domiciled ETFs. About 90% of activity for certain BlackRock ETFs – the dominant player in the European ETF market – was being handled by just two APs: Jane Street and Flow Traders. The way APs behave during periods of market stress “requires close monitoring”, the IMF warned.

“Last year, the International Monetary Fund (IMF) warned the Central Bank of Ireland to encourage ETF issuers to use a broader range of liquidity providers to help them weather market stress and deal with concentration risks.”

Addressing the concern, the Central Bank of Ireland stated its commitment to maintaining robust interactions with ETF providers: “The Central Bank of Ireland engages with ETF providers on an ongoing basis to ensure that their authorised participant and market maker arrangements are robust and promote the proper functioning of the sector.”

Additionally, it ensures the efficacy of arrangements with APs and market makers. A comprehensive review of the Irish ETF landscape is underway, particularly concerning the role and impact of APs and market makers. This review is expected to wrap up by the end of the year.

In light of the challenges and concerns surrounding ETFs, the International Organization of Securities Commissions (Iosco) took a decisive step by unveiling its ETF Good Practices. Iosco emphasises a proactive and systematic approach to upholding best practices in the ETF domain. A central tenet is a cautious approach towards exclusive partnerships with APs and market makers, especially when they could disrupt the arbitrage mechanism’s efficiency.

Iosco’s guidance underscores the imperative of meticulous vetting and sustained supervision of APs and market makers. As the ETF landscape evolves, such guidelines pave the way for a transparent and resilient market ecosystem.

© 2023 funds europe