While some investors may find the rise of crypto assets utterly baffling, one thing is not in doubt. Adding either bitcoin or ethereum in small amounts to a balanced and diversified portfolio has historically produced outsized returns, says Tom Rodgers, ETC Group’s head of research.

BlackRock’s recent entry into the American crypto investment space is a landmark development that is expected to have wide implications for investors’ ease of access to crypto, and not just because the company has $10 trillion of assets under management (AUM).

The move by the world’s largest money manager to file for a spot bitcoin ETF is an indication of growing institutional interest in bitcoin.

It is also a validation of the European crypto asset investment products that have attracted more than $6 billion in AUM since 2020.

But while US investors may have to wait until February 2024 to find out whether they can access spot bitcoin without having to buy crypto on an unregulated digital asset exchange — nor go through the hassle of having to custody their own crypto — European investors can do so safely and securely today using crypto exchange-traded products, or ETPs.

Hard to ignore

Institutions from family offices to private banks are enquiring in ever greater numbers about crypto ETPs. The annual Trackinsight Global ETF Survey — supported by JP Morgan and State Street — surveyed 549 professional investors that allocate roughly $900 billion across exchange-traded fund (ETF) strategies and found that 48% were considering single asset crypto ETPs.

This may not be surprising, given bitcoin has achieved annualised 78.1% returns over the last seven years at the cost of similar annualised volatility.

This may not be surprising, given bitcoin has achieved annualised 78.1% returns over the last seven years at the cost of similar annualised volatility.

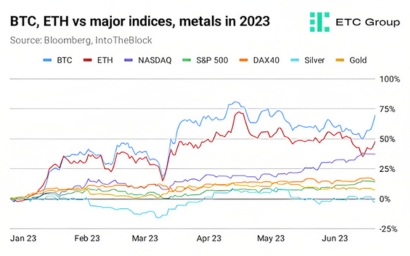

In the year to date, bitcoin’s price has climbed 69.9% at a 30-day rolling annualised volatility of 0.32. Ethereum appreciated by 47.1% with a volatility of 0.31.

For comparison, the S&P 500 has returned 14.1% at a volatility of 0.12, while gold has increased by 7.4% at a volatility of 0.11. So it is clear that the cost of such outperformance comes in the form of higher annualised volatility and larger intraday price swings.

Whether allocation to crypto assets comes in the form of the common 1-2% threshold, or up to 5% for the more adventurous buyer, not earmarking an appropriate position has, in an era of wildly shifting preferences, become a business risk that many are being forced to reassess.

What’s Europe’s problem with bitcoin ETFs?

It is a quirk peculiar to European markets that their regulatory frameworks do not allow the launch of a Ucits fund with only one constituent, for example in bitcoin or ethereum. These are the two largest and best known digital assets, with market caps of $500 billion and $200 billion, respectively.

The inability to launch a Ucits-compliant single asset crypto ETF in Europe gave rise to ETPs. These funds use a structure invented a decade ago, created for commodity assets such as precious metals, which are ineligible under Ucits rules. The largest of these is the iShares Physical Gold ETC, which has $15.3 billion of AUM, suggesting a strong degree of institutional acceptance.

ETPs are physically-backed bonds, 100% secured by the underlying asset – whether that is gold, silver, bitcoin or ethereum.

More than 80 crypto ETPs — which range from bitcoin and ethereum to lesser-known digital assets — now trade on regulated stock exchanges in Europe.

Better than a crypto exchange

The most stringent criticisms levelled at crypto-native exchanges are around their business practices: the worst are accused of co-mingling customer funds with company revenue, and holding assets in hot (online) wallets where they are more easily targeted by hackers.

By direct contrast, physically-backed bitcoin and ethereum ETPs hold coins in cold storage (offline) with a regulated third-party custodian, mitigating the risk of cybersecurity incidents.

The collapse of crypto-native FTX in November 2022 is still fresh in many minds, and the commensurate negative headlines are one of the more obvious reasons why larger players may have avoided the space to date.

Recent high-profile lawsuits against the best-known among them, Coinbase and Binance, have also left investors seeking providers known for their transparency and professionalism.

The institutional 180 on bitcoin

We may all remember JP Morgan CEO Jamie Dimon telling a conference in 2017 that bitcoin was “a fraud worse than tulip bulbs”, and that people who owned it were “stupid”.

It was quite the surprise to find the bank’s strategists in May 2023 suggesting that bitcoin should be trading at $45,000, 70% above its market price, given the price of gold, and bitcoin’s scarcity and store of value qualities.

Lloyd Blankfein, CEO of Goldman Sachs between 2006 anertfd 2018, warned towards the end of his term that bitcoin was nothing more than “a vehicle for fraudsters”. The bank’s analysts also crossed the Rubicon, in 2022, to say that bitcoin would compete with gold for the store of value market.

BlackRock CEO Larry Fink seems to have taken a remarkably similar journey. In October 2017 Fink said that BlackRock was not setting up a crypto unit and that none of his clients had ever asked for bitcoin exposure. By 2022 the company’s first bitcoin product was seeing “substantial interest” from clients.

Attitudes towards crypto are changing fast in the face of outperformance, adoption and ever greater understanding of the asset class. This makes professionally-managed crypto ETPs in Europe one of the best vehicles to access these alternative assets.

*Tom Rodgers is head or research at ETC Group.

&© 2023 funds europe