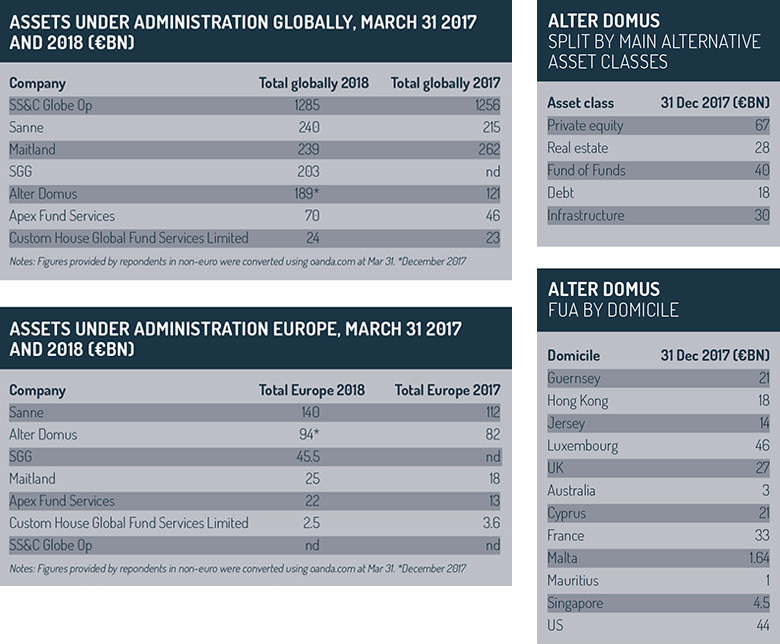

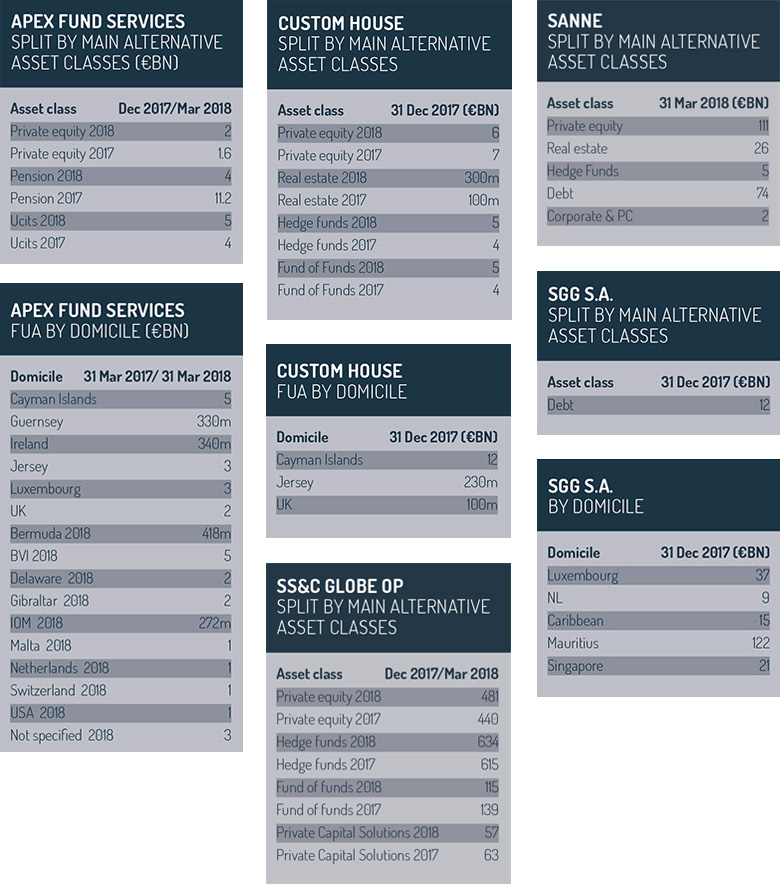

Third-party specialist providers’ assets under administration.

In the world of asset servicing and fund administration, many of the names in the specialist third-party fund administration sector were unheard of just a few years ago.

If you thought of a fund administrator, you’d normally envisage firms that carried the brands of large custody banks or even retail banks.

But since then, specialist third-party administrators have risen and this has been driven mainly by their private equity fund manager clients, together with managers of certain other less liquid asset classes, such as real estate and infrastructure.

Our survey is aimed at these generally smaller – or simply ‘specialist’ – administrators to whom mass market retail investment funds that invest in liquid stock and bond markets are not normally a core business.

Although we try to reach a wide range of European players, we do not claim a comprehensive list here, but we try to reflect the size and reach (in terms of domiciles) of some of the main market players.

©2018 funds europe