What are the top priorities in a world recovering from Covid-19, and how will the funds industry meet them?

The Covid-19 pandemic has fuelled a period of economic and financial uncertainty rarely witnessed outside of wartime. The global economy contracted by close to 3.5% during 2020, according to IMF research, with only China among the G20 economies returning positive economic growth over this period.

This severe economic collapse has, in the IMF’s words, “had acute adverse impacts on women, youth, the poor, the informally employed, and those who work in contact-intensive sectors”. (IMF World Economic Update, January 2021, page 1)1

Although the pandemic sent global equities markets into sharp decline during March 2020, a feature of this crisis has been the resilience of the financial services industry in maintaining business operations during this period and the positivity of investor sentiment in powering a rebound in global equity markets from Q2 onwards.

Indeed, the S&P 500 lost more than 30% of its value in the initial weeks of the crisis, sliding from close to 3,400 in February to below 2,300 on March 23. The UK FTSE 100 plummeted from 7,600 in January to below 5,000 in late March. Meanwhile, on March 12, the FTSE All Share Index dropped more than 10%, its largest single-day fall since 1987.

Central banks and governments have stepped in with massive and timely policy interventions to counter a precipitous slide in consumer spending – which plummeted with lockdown – and to protect jobs and livelihoods for those unable to continue work. Asset purchases by central banks mollified pressures in bond markets, with the US Federal Reserve launching a comprehensive lending programme to support households, employers, state and local government, and financial markets.

With these interventions, the Federal Reserve’s total assets have surged from US$4.1 trillion on February 1, 2020 to US$7.6 trillion in March 2021, dwarfing their levels prior to the global financial crisis when total assets on the Fed’s balance sheet stood at below US$900 billion (source: US Federal Reserve).2

Multilateral agencies have also extended support to emerging markets (EM). For example, the IMF announced a new US$500 billion allocation of special drawing rights to its members in March 2021, equivalent to 3.5% of global reserves and 0.5% of world GDP. These reserve assets, which are backed by a mechanism ensuring convertibility to currencies, are targeted to help countries withstand external pressures in case of a potential tightening of EM financing conditions.

This abundant liquidity has driven a strong rebound in global equity markets, with the MSCI World climbing 15.90% during 2020 and the MSCI Emerging Markets growing by 18.31%. For the year to March 23, 2021, the S&P 500 was up more than 60%.

Despite this huge volatility in global financial markets, particularly during the first half of 2020, the European Fund and Asset Management Association (Efama) reports that investors’ confidence has strengthened significantly during the second half of the year. With positive vaccine news driving a surge in net sales in Ucits and alternative investment funds (AIFs), this has driven European investment fund assets to an all-time high during Q4 2020.

“Despite the impact of the pandemic on financial markets in March, net sales promptly returned to positive territory, reflecting the attractiveness of Ucits and AIFs as investment vehicles,” says Bernard Delbecque, Efama senior director for economics and research.

During 2020, total net assets in Ucits and AIFs grew by 5.7% to €18.8 trillion. An 11.1% decline in net assets under management (AuM) for the European investment funds industry during Q1 2020 was cancelled out by strong inflows during Q2 and Q4. Net sales for Ucits reached €466 billion over the year, up from €392 billion in 2019. Alternative investment funds also experienced net inflows during 2020, with net sales rising to €180 billion from €156 billion during 2019.

During 2020, total net assets in Ucits and AIFs grew by 5.7% to €18.8 trillion. An 11.1% decline in net assets under management (AuM) for the European investment funds industry during Q1 2020 was cancelled out by strong inflows during Q2 and Q4. Net sales for Ucits reached €466 billion over the year, up from €392 billion in 2019. Alternative investment funds also experienced net inflows during 2020, with net sales rising to €180 billion from €156 billion during 2019.

Equity funds were the primary beneficiary, fuelled by attractive entry points as valuations dipped in February and March 2020, before the major developed market indices recovered much of their lost ground by Q3. In contrast, low yields and high levels of stress in fixed income markets triggered net redemptions of €82 billion in Q1 2020 and total net outflows of €105 billion over the year.

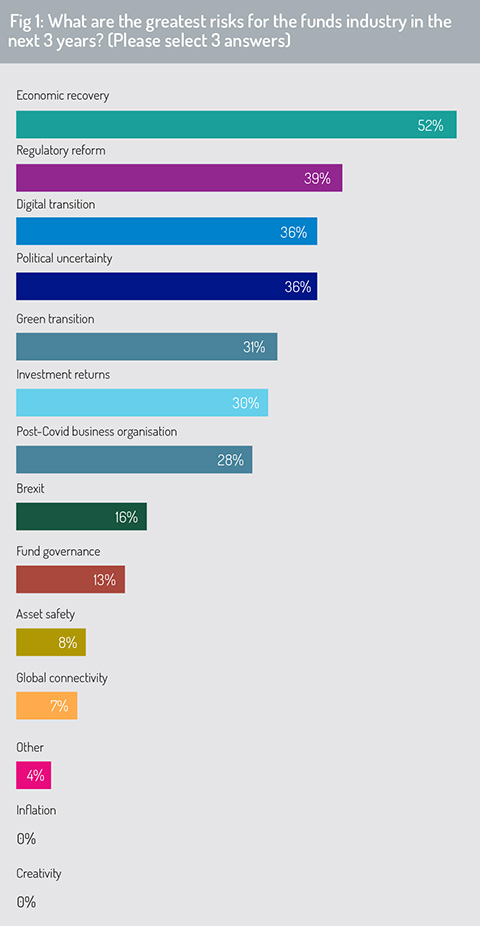

Against this background, the survey asked respondents to nominate the three greatest risks that the asset management industry must confront as it rebuilds after Covid-19 (fig 1). Uncertainties around the pace and sustainability of economic recovery sit at the top of the list, nominated by more than half of survey respondents. Pressures to implement, and to adapt to, new regulations appear second – an issue discussed later in this report. We also focus on the challenges and opportunities presented by digital transition in the asset management industry in a later section.

Scale and specialisation

Consolidation has been a constant feature in the funds industry as investment houses have used mergers and acquisitions to build market share, to expand into new asset classes and to extend distribution reach into new locations and investor segments. Firms may also consider this strategy as they seek to manage digital transition and adapt to the investment preferences of younger generations.

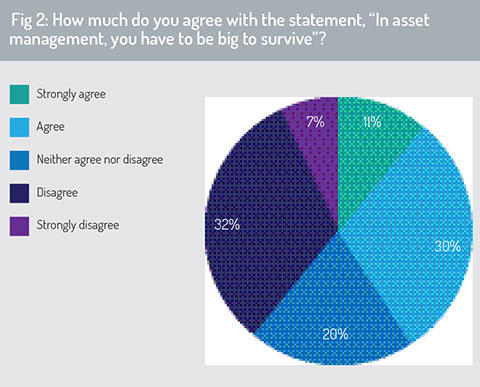

With this in mind, the survey asked whether, in asset management, firms need to be big to survive (fig 2).

This question divided opinion across the respondent group, with 41% agreeing that size is important to an investment firm’s survival. In contrast, 39% said they disagreed with this statement and 20% were agnostic, stating that they neither agreed nor disagreed.

This question divided opinion across the respondent group, with 41% agreeing that size is important to an investment firm’s survival. In contrast, 39% said they disagreed with this statement and 20% were agnostic, stating that they neither agreed nor disagreed.

A report from Willis Towers Watson (WTW), published in October 2020, indicates that assets under management for the world’s 20 largest asset managers represent just 43% of industry assets. In total, the industry’s assets exceed US$100 trillion.3

However, direction of travel suggests that the industry is consolidating over time, with market share for the largest 20 firms rising from 38% in 2000 and 29% in 1995. This report indicates that 232 asset manager names have dropped out of its ranking over the past ten years.4

Roger Urwin, co-founder of WTW’s Thinking Ahead Institute, comments: “The investment industry has always been dynamic, but the pace of change is speeding up, notably through consolidation. Rapidly advancing technology is also changing the shape of mandates and producing products that require less governance and are more streamlined. This has led to the growth of passive and index tracking [along with factor-based solutions].” The report points out that passively managed assets globally have grown from US$4.9 trillion in 2015 to US$7.9 trillion in 2019.

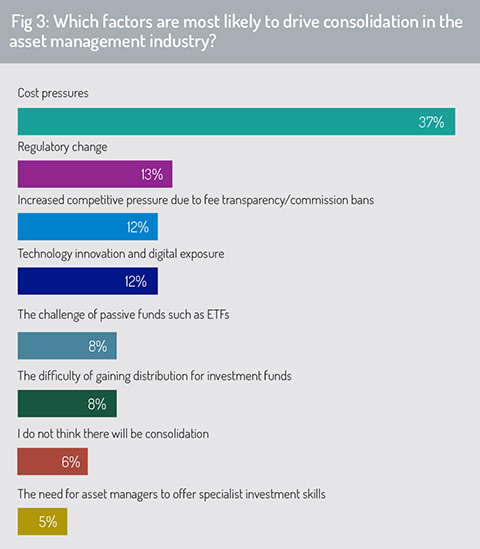

Looking at the factors most likely to drive consolidation in the funds industry (fig 3), the survey highlights the dominance of cost pressures, which attracted nearly three times as many responses as any other single factor (37%).

Beyond this, respondents indicated that companies may consolidate to make them better positioned to manage regulatory change and to manage the resource cost of technology upgrades and innovation.

Beyond this, respondents indicated that companies may consolidate to make them better positioned to manage regulatory change and to manage the resource cost of technology upgrades and innovation.

Regulatory changes (such as MiFID II – the second Markets in Financial Instruments Directive – in the EU, for example, or the Financial Conduct Authority’s Assessment of Value regime in the UK) are driving greater cost transparency across the fund transaction lifecycle and forcing the industry to review its charging structures and procedures for cost disclosure. The ongoing transition to fee-based advisory models (driven by the Retail Distribution Review in the UK and its equivalent in some other EU markets) has prompted a tighter focus on the costs of investment and a review of how investment products and investment advice are provided to, and paid for by, retail customers. Among other factors, this has driven an advance in the market for clean share classes.

1 – https://www.imf.org/en/Publications/WEO/Issues/2021/01/26/2021-world-economic-outlook-update

2 – https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

3 – https://www.thinkingaheadinstitute.org/research-papers/the-worlds-largest-asset-managers-2020/

4 – https://www.thinkingaheadinstitute.org/news/article/global-asset-manager-aum-tops-us100-trillion-for-the-first-time/

© 2021 funds europe