To coincide with Funds Europe’s emerging markets report, CAMRADATA looks at search activity in this asset class.

With high inflationary pressures across the globe, emerging market countries are angling for a recovery by keeping inflation under control at the risk of slowing down growth. Emerging markets are in a moderately solid position overall. As commodity prices are higher, this has improved the terms of trade for countries that export commodities. This is reflected in CAMRADATA Live. Our Emerging Market Equity universe was the third-most researched asset class by investors in August 2022.

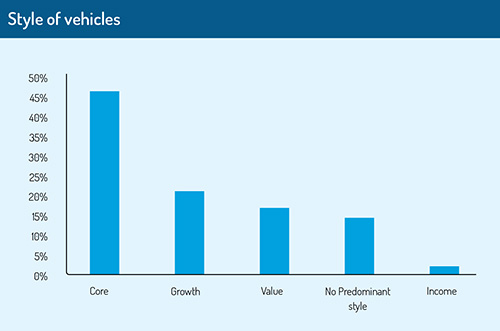

There are over 360 Emerging Market Equity vehicles in CAMRADATA Live. The base currencies of these vehicles are USD (72%), GBP (18%) and EUR (10%). The style of these vehicles varies from Core, Growth, Value, No Predominant Style and Income.

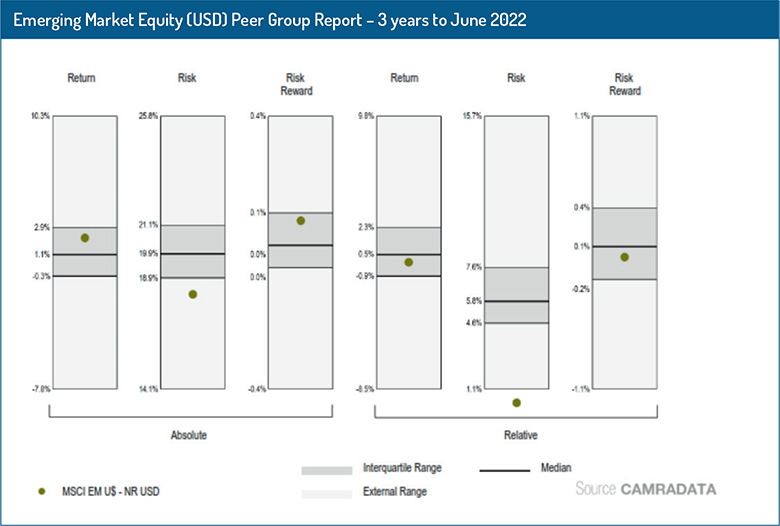

A peer group analysis of 176 funds with a base currency of USD demonstrates in relative terms, for the three-year period to June 30, 2022, that 103 vehicles performed above their benchmark return whilst taking more risk to achieve this, in comparison to the benchmark.

CAMRADATA’S proprietary IQ scores show that the best-performing manager in the Emerging Market Equity (USD) universe for the three years to June 30, 2022, was Invesco with its Invesco Emerging Markets Equity Fund. This capability produced an excess return of 5.86% over the benchmark whilst taking excess risk of 5.85% to achieve it. In comparison, the best-performing manager for one year to March 31, 2022, was Mackenzie Investments with its Emerging Markets Low Volatility USD. This vehicle achieved an excess return of 16.10% over the benchmark, whilst taking excess risk of 5.21%.

Being in the second half of the year of 2022, tighter monetary conditions have been introduced in the UK, with higher interest rates being put in place. There is uncertainty in the market since there are doubts about whether the tighter monetary policy can tackle the higher inflation rate or whether it will lead to an economic recession.

Copyright MSCI 2022. All Rights Reserved. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an ‘as is’ basis, and the user of this information assumes the entire risk of any use made of this information. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any use of this information.

*All figures are as of June 30, 2022, unless otherwise stated.

© 2022 funds europe