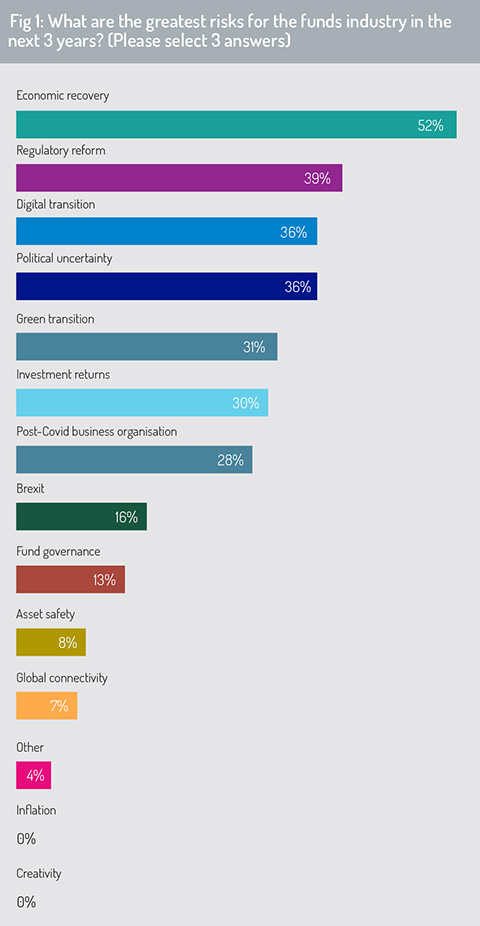

Uncertainty about the speed and sustainability of the economic recovery are at the forefront of industry concerns, Funds Europe research shows.

The finding comes at a time when firms are designing strategies for growth and innovation after the Covid-19 pandemic.

The research, conducted in association with Caceis, ranges cross many themes in asset management.

We found that decision makers also feel challenged by the continuing pressure of adapting to regulations, for example rules to do with ESG.

Technology is also a pain point, with managers feeling a need to redesign technology ‘stacks’ and communication interfaces because they want to fulfil the digital needs of the funds industry for current and future generations (Fig 1).

The survey had a total of 172 responses from investment fund professionals and was conducted online during February 2021.

The report confirms that ESG and climate change is moving to the forefront of the regulatory and policy agenda in Europe.

The report confirms that ESG and climate change is moving to the forefront of the regulatory and policy agenda in Europe.

As a component of the European Commission’s Sustainable Finance Action Plan, the Sustainable Finance Disclosure Regulation (SFDR) requires fund managers, financial advisers, and some other categories of regulated firms with activities in the EU, to disclose information on ESG implications of their investment strategies to investors.

When asked how their business will be affected as policymakers extend legislation around ESG, almost 70% of respondents said that they have started the process of integrating ESG standards into their investment strategies. A further 12% said that they have already implemented changes required under this regulatory and legislative agenda.

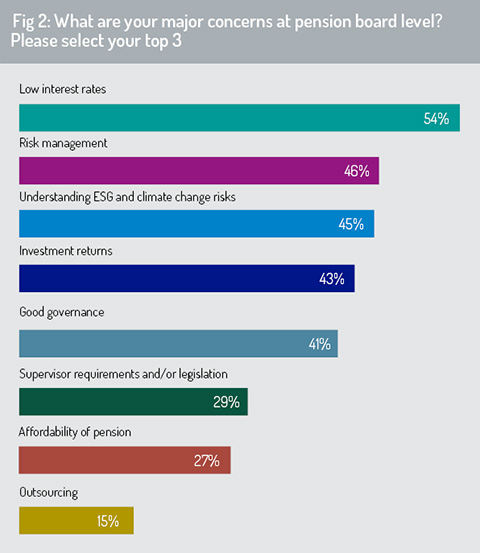

Reflecting on the challenges confronting pension scheme boards in the current investment climate, 54% of survey respondents pointed to the current low interest rate environment as their top priority (fig. 2). More generally, almost 50% highlighted a broad focus on risk management, including investment risk management, regulatory risk and asset servicing risk, while 45% of respondents listed ESG and climate change risk among their top 3 priorities.

Diversity, inclusion and equality are the foundation stones of an environment where individual differences and the contributions of all participants are recognised and valued. In the workplace, these principles help to ensure each employee can apply their experience, knowledge and skills for benefit of the organisation and its customers, staff and wider community.

Diversity, inclusion and equality are the foundation stones of an environment where individual differences and the contributions of all participants are recognised and valued. In the workplace, these principles help to ensure each employee can apply their experience, knowledge and skills for benefit of the organisation and its customers, staff and wider community.

To gauge where the asset management industry will focus efforts to promote diversity and inclusion, we asked respondents to rank six categories in order of importance (from 6, most important, to 1, least important). We then compared their relative importance on the basis of their weighted mean.

Respondents told us that measures to address age discrimination will be most prominent in the coming 24 months.

Policies to improve cognitive diversity across the organisation were ranked in second place¬ representing steps to include employees with diverse perspectives and methods of problem solving and processing information.

Measures to address lack of opportunity linked to social background or education background featured in third and fourth positions respectively in the ranking order.

Read the full report here: Product Distribution and Governance Survey

© 2021 funds europe