Gender is likely the over-riding ‘diversity’ issue in asset management – but how do other diversity elements such as race fare?

The UK’s Investment Association (IA) has found that less than 1% of asset management staff are black and so a number of firms working through the Diversity Project are now trying to address the issue.

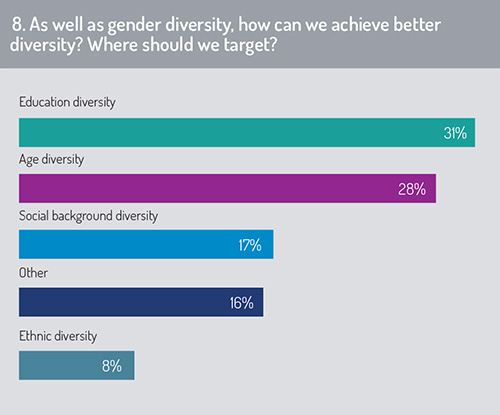

Yet, in a just-published Funds Europe/Caceis report on governance we found that just 8% of respondents considered ‘ethnic’ diversity to be an important area for the industry to target.

>Perhaps the reason for the low score was that our survey only allowed respondents to select one area of diversity to target and so it could be that respondents felt that their preferred area of diversity – which was educational diversity – best captured a number of other diversity fields.

>Perhaps the reason for the low score was that our survey only allowed respondents to select one area of diversity to target and so it could be that respondents felt that their preferred area of diversity – which was educational diversity – best captured a number of other diversity fields.

In our webinar that runs concurrently with the report, one audience member suggested CVs viewed by interviewers should be submitted without applicants’ names or other clues about race that might cause unconscious bias against candidates.

Educational diversity, being considered the most important for the asset management industry to target (at least after gender) – scored 31% of the vote. Again, the IA has brought attention to education and the related topic of social background. Chris Cummings – IA chief (pictured below, left) – has said class is arguably “one of the last taboos” to be discussed in the City.

Feedback to our report’s question on diversity strongly suggested that disability is another important diversity issue. This chimes with a comment from Yves Perrier, chief executive of Amundi, who last year told Funds Europe that disabled people faced tremendous barriers to finding jobs.

Feedback to our report’s question on diversity strongly suggested that disability is another important diversity issue. This chimes with a comment from Yves Perrier, chief executive of Amundi, who last year told Funds Europe that disabled people faced tremendous barriers to finding jobs.

In fact many respondents said they would have selected multiple areas of diversity, had they been able to.

© 2020 funds europe