Market compression continues to exert pressure across the asset management industry, with fund promoters, distributors, asset servicing partners and financial infrastructure entities all forced to reassess their service models in the face of these cost pressures.

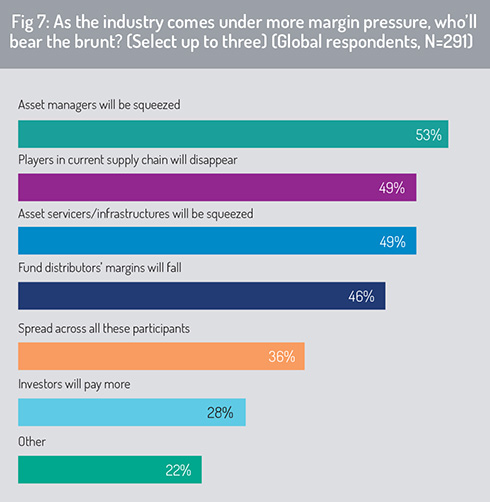

The 2020 global survey reveals that the pain of margin pressure is being felt across the funds value chain (fig 7), with asset management companies currently bearing the heaviest burden (53%). Asset servicing companies (49%) and fund distributors (46%) will also experience negative impact through a contraction in their margins.

Australia-based respondents believe strongly that asset managers will bear the burden of these margin pressures (64%). However, margin compression will also bear on the fund distributor (39%) and asset servicing (29%) communities. Almost a third of respondents to the Australia survey say that these pressures will force existing players to exit the investment funds value chain.

Australia-based respondents believe strongly that asset managers will bear the burden of these margin pressures (64%). However, margin compression will also bear on the fund distributor (39%) and asset servicing (29%) communities. Almost a third of respondents to the Australia survey say that these pressures will force existing players to exit the investment funds value chain.

A strong message to emerge from the Australia survey, however, is that little of this cost pressure will be passed through to the end investor: only 7% of respondents believe that investors will pay more. Respondents expect, inter alia, that asset managers will introduce a wider range of ETFs and other low-cost products and take further steps to reduce operating and service costs in efforts to prevent cost pressures feeding through into higher fees for the end investor. This percentage is substantially lower than for the global survey, where 28% of respondents said that investors will pay more as a result of these downward pressures on margin.

Attracting new investors

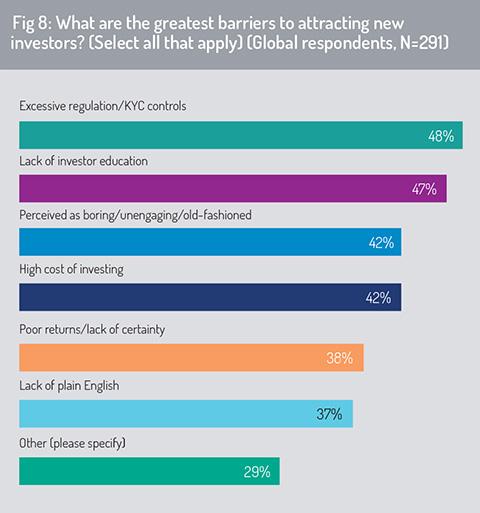

The largest challenge asset management companies face in attracting new investors derives from excessive regulation, according to respondents to the global survey (48%). Lack of investor education comes a close second (47%, fig 8).

Given the major impact that the Covid-19 pandemic has had on the global economic outlook and the expected performance of investment markets during 2020, it is noteworthy that global respondents prioritise regulatory and educational factors well above uncertainties in global investment markets, and lack of certainty around investment returns, as a potential barrier to new investors.

Asia-based respondents are an exception to this general trend: 74% identify uncertainty over investment returns as a primary barrier to attracting new investors, with “excessive regulation” ranked a close second (71%).

Asia-based respondents are an exception to this general trend: 74% identify uncertainty over investment returns as a primary barrier to attracting new investors, with “excessive regulation” ranked a close second (71%).

One Asia-based respondent commented: “The coronavirus encourages people to be cautious and to build cash for a rainy day.”

For Australia-based respondents, lack of investor education is ranked as the dominant constraint to attracting new investment (54%), with excessive regulation (46%) and “lack of plain English” in investor documentation and marketing materials (36%) also featuring high on the list.

Significantly, lack of certainty around investment returns was ranked as having low importance by Australian respondents – only 7% said this presented a significant barrier to new investment.

Adapting business models

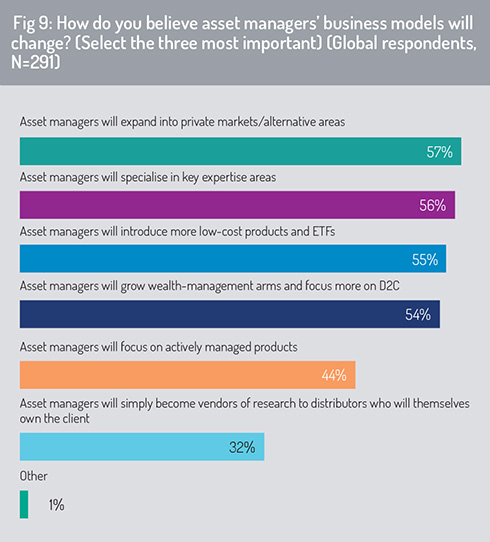

When asked how asset managers will adapt their business models to meet the needs of investors in the 2020s, respondents to the global survey predict further specialisation from asset management companies, many of whom are expected to focus their product range and concentrate product innovation in targeted areas of investment expertise (fig 9).

One widely held belief is that some asset management houses will extend their footprint in specialist private market strategies. Others will continue to promote actively managed products, but will become increasingly selective in supporting fund products only where they identify comparative advantage and strong demand for investment solutions from the customer.

Respondents also anticipate that asset managers will extend their range of ETFs and low-cost products. This was the dominant answer from respondents based in Europe and the UK, where 72% said that asset management firms would reinforce their ETF and passive investment product suite.

Respondents also anticipate that asset managers will extend their range of ETFs and low-cost products. This was the dominant answer from respondents based in Europe and the UK, where 72% said that asset management firms would reinforce their ETF and passive investment product suite.

More broadly, some asset management groups will extend their wealth management arms and will improve their ability to distribute directly to the investor via D2C channels. As one respondent noted, “active management may need to be repackaged by the asset manager to bring themselves closer to the investor – a form of ‘advisory sales’.”

Australia-based respondents also indicate that asset management groups will increasingly specialise in key areas of expertise. The dominant trends will be to extend their capability in alternative investments (61%) and introduce more low-cost products and ETFs (61%). Some 54% said that asset managers will also expand their wealth management divisions and strengthen their D2C sales capability, thereby internalising some of the distribution responsibilities that they previously sourced through partnerships with third-party distributors.

Access to investment advice

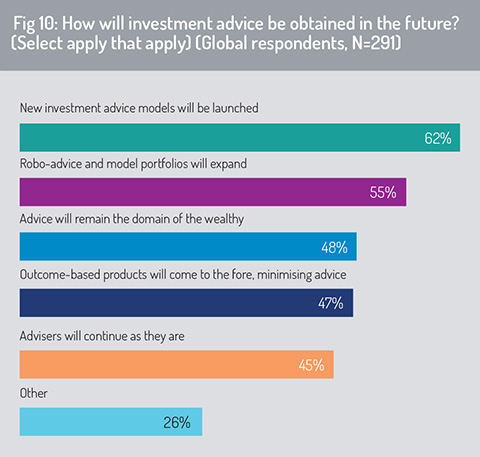

Building on this assessment, almost two-thirds of respondents to the global survey said that they expect new models of investment advice to be launched (fig 10).

More than half of global respondents believe that robo-advisory models will play an increasingly important role in helping retail investors to assess their wealth management goals and to build a suitable product portfolio. Robo-advisory techniques typically utilise an online questionnaire to evaluate an investors’ investment objectives and risk profile and then use computer-based optimisation to match these investment goals to a suitable model portfolio.

This view is particularly strong among Asia-based respondents, with 79% saying that robo-advisory strategies are expected to grow within their region; 55% of Australia-based respondents predict a rise in robo-advice and use of model portfolios to meet investment objectives in the Australian market.

This view is particularly strong among Asia-based respondents, with 79% saying that robo-advisory strategies are expected to grow within their region; 55% of Australia-based respondents predict a rise in robo-advice and use of model portfolios to meet investment objectives in the Australian market.

One additional statement stands out from respondents’ answers to this question. In the Australia survey, 48% of respondents said that investment advice is likely to remain the preserve of the wealthy, a figure that is replicated across the global survey. This is a message that asset management companies – and policymakers – must take on board urgently if they are to stay true to the objective of extending financial inclusion and providing affordable and effective investment solutions to a wider retail public.

Following recommendations from the Royal Commission inquiry, which published its findings in 2019, Australia-based respondents believe that it is time for change in that country’s investment advisory sector. Only 30% of Australia-based respondents indicate that investment advisers are likely to “continue as they are”, well below the 45% response returned across the global survey (fig 10).

Rather, as we have noted earlier in this report, respondents believe that Australia’s wealth management and investment advisory sectors will be subject to significant restructuring – and a drive for greater transparency, efficiency and more favourable investor outcomes as we move into 2021 and beyond.

© 2020 funds europe