The late stages of the credit cycle have traditionally been challenging times for high yield as central banks raise rates and companies increase their leverage. However, a strong macro backdrop has meant that a large pool of high yield companies with positive or improving credit fundamentals exists. As a result, high yield remains an attractive asset class for income investors. Furthermore – and counter to investor perceptions – when interest rates are rising, high yield tends to produce stronger returns than bank loans.

Five reasons to favour high yield:

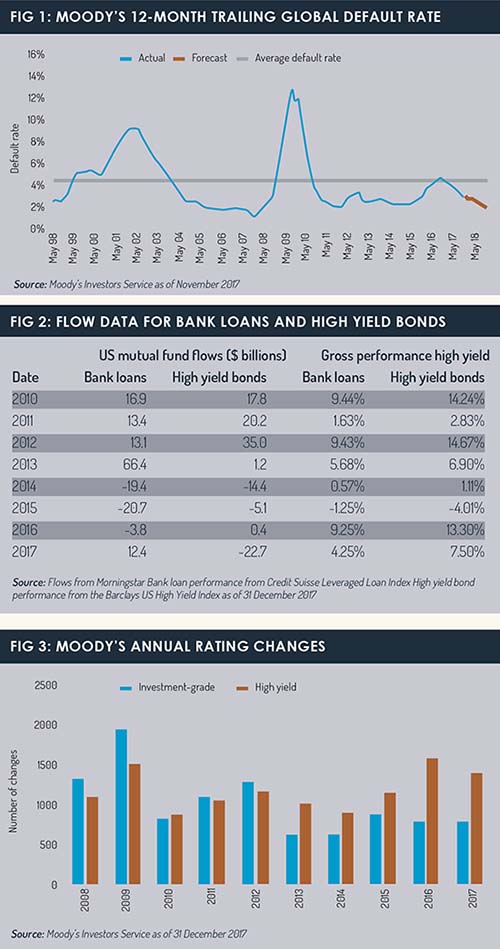

• Low expected defaults: High yield defaults peaked in 2016 and trend meaningfully below their long-term averages. Our view is for a high yield default rate of around 2% over the next 12 months, which matches Moody’s forecasts (see figure 1). This estimate is well below the long-term average default rate of approximately 4.25%.

• Muted refinancing risk: Despite less-accommodative monetary policy, this risk remains tame. In 2017, over 60% of new-issue proceeds for high yield companies were used to refinance existing debt, further pushing out the “maturity wall” and constraining net supply.

• Decreasing leverage: Ratios have declined over the past five quarters, after peaking in 2015. As earnings continue to grow against a backdrop of synchronised global growth, we do not expect leverage to increase in the next year.

• Improved ability to pay: Historically low rates have allowed companies to reduce their interest costs. These improvements have contributed to credit upgrades outpacing downgrades.

• Favourable tax treatment: The recent US corporate tax reform broadly supports high yield companies. The prevalence of domestic earnings in high yield suggests that it stands to benefit from corporate tax reform. Overall, we do not foresee the tax policy materially changing the near-term default outlook. Longer-term, we believe that the cost of debt increasing relative to the cost of equity will lead to declines in leveraged-buyout deal activity and highly levered balance sheets.

Disappointing bank loans returns

In the late stages of the credit cycle, investors tend to like the floating-rate, secured-asset characteristics of bank loans. Indeed, 2017 saw significantly greater retail flows (figure 2) and institutional search activity into bank loans compared to high yield bonds.

What investors have been surprised to learn is that bank loans may not provide the returns they thought they would be getting. In 2013 and 2017, when flows into bank loans were greater than those into high yield, high yield bonds outperformed bank loans. This is because bank loans lack call protection, which can limit their ability to maintain income when compared to high yield bonds.

A bank loan can be refinanced as soon as 30 days after issuance, but high yield bonds are typically not callable for three to five years. This creates an adverse selection issue for bank loans. When demand for bank loans is strong, good companies will continue to refinance their coupons lower and lower, reducing investors’ income. Weak companies, however, will be unable to refinance their loans, increasing the risk of a loss of principal. As a result, a decreasing coupon income is being used to offset a potentially larger loss of principal, reducing the asset class’s return potential.

A bank loan can be refinanced as soon as 30 days after issuance, but high yield bonds are typically not callable for three to five years. This creates an adverse selection issue for bank loans. When demand for bank loans is strong, good companies will continue to refinance their coupons lower and lower, reducing investors’ income. Weak companies, however, will be unable to refinance their loans, increasing the risk of a loss of principal. As a result, a decreasing coupon income is being used to offset a potentially larger loss of principal, reducing the asset class’s return potential.

This dynamic means that investors may be better served investing in bank loans when rates are falling, rather than during late cycle when rates are rising.

Nimble credit research is the key

We believe that active managers with strong, nimble research capabilities will deliver superior returns. Indeed, the ability to swiftly identify high-quality companies with positive or improving credit fundamentals has become increasingly important for high yield managers. Figure 3 shows that over the past five years, annual rating changes for high yield companies have exceeded those of investment-grade companies. This is remarkable when you consider that the number of high yield issues is roughly one-third that of investment-grade issues. The fact that ratings agencies change high yield company ratings so frequently, and tend to focus on the past, demonstrates an inefficiency in the market, and an opportunity for active managers to exploit.

At Principal Global Fixed Income, our investment process is structured to capture these opportunities. Being nimble also means quickly identifying and selling companies with deteriorating fundamentals or now-unattractive valuations. Over 50% of our internal ratings are different than the rating agencies’, tending to lead their changes. The average default rate of firms in our portfolio is 0.31% – meaningfully lower than the average high yield default rate of 4.19% over the past ten years.

Our independent research capabilities, coupled with our swift exit strategies, have contributed to our consistent outperformance in both up and down markets. This is the key to investing during the late stages of the credit cycle.

High yield remains attractive in 2018

In summary, high yield bonds should remain a strategic allocation in investors’ portfolios. Strong credit fundamentals have created a pool of quality high yield companies with attractive yields that can be harvested by nimble research and shielded by swift exit strategies. Investors considering bank loans should consider that their lack of call protection diminishes their ability to maintain income compared to high yield bonds.

The information in this document contains general information only on investment matters and has been derived from sources believed to be accurate as of March 2018. It does not take account of any investor’s investment objectives, particular needs or financial situation and should not be construed as specific investment advice, an opinion or recommendation or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding a particular investment or the markets in general. All expressions of opinion and predictions in this document are subject to change without notice. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that Principal Global Investors or its affiliates has recommended a specific security for any client account. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. Principal Global Investors leads global asset management at Principal®. Principal Global Fixed Income is a specialized investment management group within Principal Global Investors.

Mark Cernicky is a senior product specialist at Principal Global Fixed Income

©2018 funds europe