BlackRock was among the most significant casualties of outflows in June, which was described as the worst month for European funds in five years.

BlackRock suffered notable outflows from its passive equity products, with its European equity large-cap funds “particularly badly hit” as investors redeemed €638 million, according to Morningstar.

The European funds industry saw €10.5 billion of total net outflows during the month from long-term funds, which included exchange-traded funds.

Passive funds were said to have suffered more than active products. €3.6 billion left equity trackers, making June the first negative month for these products since May 2016.

Risk aversion was to blame for the figures.

Key data for June include:

• Bond funds had nearly €11 billion of net outflows;

• Equity funds saw around €6 billion exit;

• Investors particularly shied away from Japanese and European equities, and from emerging markets equities and bonds.

However, US equities continued to draw flows due to expectations for healthy earnings growth and ongoing fiscal spending, Morningstar said. Large-cap, global growth and technology funds attracted money.

Despite BlackRock’s outflows, its iShares ETF brand dominated asset gathering in passive with inflows of over €1.3 billion, helped in substantial part by its US large-cap equity blends.

Asset allocation funds saw positive inflows, but at the lowest levels in a one-month period since December 2016.

Ali Masarwah, regional director of editorial research at Morningstar, said: “Widespread selling of riskier assets was a dominant feature across the European fund market in June, contributing to a reversal of fortunes for the asset management industry.

“After market volatility staged a comeback in February, asset flows to European-domiciled funds progressively slowed down until April and dipped into negative terrain in May and June. This marks a sharp reversal following the year of record inflows during 2017.”

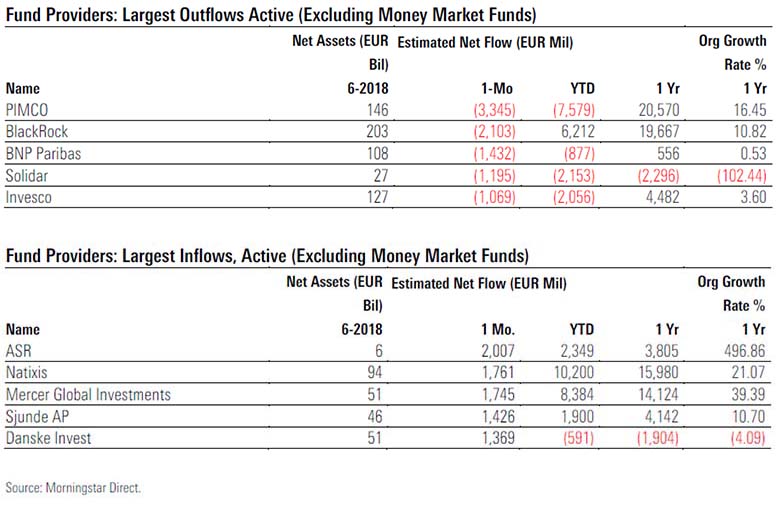

Dutch firm ASR and Natixis dominated active inflows. ASR saw success with its US large-cap equity blends and euro fixed income products.

©2018 funds europe