A survey by Funds Europe and Fundsquare highlights the role that APIs will play in driving new models of data communication and, ultimately, transition towards a new funds marketplace.

Use of APIs, or application programming interfaces, is taking on growing importance as the asset management industry drives for digital transformation. Close to 70% of respondents to this short survey of fund industry professionals indicate that they are already using APIs within their business applications or will do so within 12 months. However, the industry is constrained by lack of data standardisation and by weak understanding of how APIs can be used within a data ecosystem to facilitate efficient data communication.

These are key conclusions emerging from a survey on APIs and Data Transfer conducted by Fundsquare, the Luxembourg-based order routing and information services specialist, in partnership with Funds Europe.

What is an API?

The API provides a digital ‘gateway’ through which an organisation can provide access to data or services, establishing a standardised set of requirements that govern how one software application can talk to another.

By connecting through APIs, multiple companies can establish an API ecosystem, providing a framework for data sharing and co-operation, while ensuring standardisation and consistency of data transfers between them. This may be combined with cloud-based data management, including ‘data-as-a-service’ approaches, to deliver greater efficiency to data storage and data communication.

By connecting through APIs, multiple companies can establish an API ecosystem, providing a framework for data sharing and co-operation, while ensuring standardisation and consistency of data transfers between them. This may be combined with cloud-based data management, including ‘data-as-a-service’ approaches, to deliver greater efficiency to data storage and data communication.

Every time a developer releases or upgrades an application in a non-standardised environment, customised changes may be necessary to connect each user of the service. This may result in large numbers of users each using a customised version of the API to interact with the application. This is clearly not efficient. With standardisation, the developer can create a single standard API that will interface with each of these users and service partners. This brings huge benefits to the financial services industry in terms of interoperability, business opportunity and sound data governance.

Data-as-a-Service (DaaS) – like software-as-a-service, or SaaS – is a cloud-based strategy that involves delivering information to end users via a network, typically utilising APIs, rather than running applications on locally-based (‘on premises’) servers. Just as SaaS removes the requirement to install and manage software locally, data-as-a-service supports data storage, integration and processing operations from the cloud.

Use of APIs offers opportunities for financial services organisations to refine their product set and to rethink their delivery strategies, improving quality of data transfer to its customers while enforcing high standards of security around this process.

Promoting standardisation

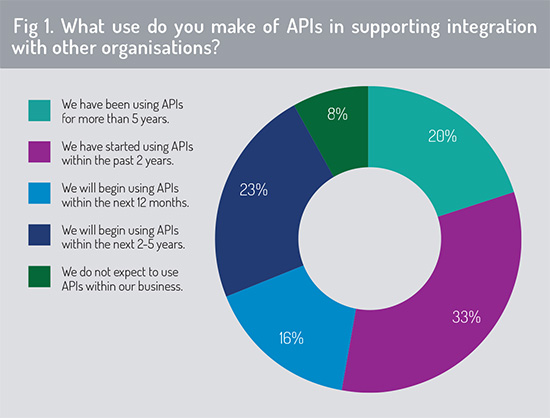

APIs have been available as an interface technology in the software industry for many years, but have been slow to penetrate some sectors of the asset management industry. The survey reveals that this is now starting to change, with more than half of respondent firms currently utilising APIs for data communication and 20% of these indicating they have been doing so for more than five years (fig 1).

Within 12 months, close to 70% of respondents expect to be utilising APIs within their business applications and this will climb to more than 90% within the next 2-5 years. Only 8% of firms indicated they do not expect to find a use for APIs within their business.

“These survey results confirm growing commitment across the asset management industry to utilising APIs to support secure transfer of data,” says Maxime Aerts, Managing Director and Chief Operating Officer at Fundsquare.

“However, the industry is currently at a crossroads, where some firms are enabled to support data communication via API, but a sizeable community ¬ despite the positive message communicated by these survey results – are still not ready.”

The survey highlights the importance of standardisation in delivering a common format for data exchange across the industry. “This drive for standardisation may come from financial regulators, from industry associations and key industry stakeholders or, most likely, from a combination of these sources,” says Aerts.

It is this ability to promote standardisation of data transfers that survey respondents said they value most in using APIs as part of their data ecosystem. The survey also highlighted the value of improved co-operation with other organisations through API connectivity, improved transparency and control over data transfers, and the benefit of real-time access across operating systems and data sources.

Two examples of standardisation initiatives that are ongoing at industry level are the European MiFiD template (EMT) and the European PRIIPS Template (EPT). These provide a common industry format for data exchange in accordance, respectively, with the European Union’s Markets in Financial Instruments Directive (MiFID II) and the Packaged Retail Investment and Insurance-based Products (PRIIPs) regulation.

Two examples of standardisation initiatives that are ongoing at industry level are the European MiFiD template (EMT) and the European PRIIPS Template (EPT). These provide a common industry format for data exchange in accordance, respectively, with the European Union’s Markets in Financial Instruments Directive (MiFID II) and the Packaged Retail Investment and Insurance-based Products (PRIIPs) regulation.

Under MiFID II, a fund manufacturer is required to specify a target market of end clients for each financial product that it sells. It must then take reasonable steps to ensure that the instrument is sold only to this target market and that risks associated with the product are monitored on an ongoing basis. This requires transfer of large volumes of fund transaction data and investor information along the distribution value chain (between asset manager, sales intermediaries, investors and other parties to the transaction) to meet this regulatory commitment.

The funds industry has worked collectively to establish a MiFID template (EMT) which provides standardised data fields for storing and communicating this data. EMT version 3.0 was introduced in January 2020 and the European funds industry aims to complete migration to the new EMT version by December 2020.

In support of these industry-level developments, Fundsquare has established a proof of concept for a ‘data hub’ service that will promote standardisation of data exchange across participants in the fund distribution value. Users can post data to, and receive data from, the data hub via API – but alternative channels will be available for those who are not yet API-enabled or for whom API connectivity is not compatible with their existing technology architecture.

This data hub service will launch later this year, initially to support transfers of MiFID II data utilising the latest version, v3.0, of the European MiFID Template “In preparing for subsequent stages of the data hub’s development, we invite industry players to discuss other areas where we can support efficient data exchange,” Aerts adds. “This may be for ESG (environment, social, governance) data, for example, or other priorities that are highlighted by the industry.”

This project highlights the wider potential that use of an API ecosystem can deliver to the industry in facilitating standardisation and collaboration across multiple participants. “Use of APIs on a standalone or bilateral basis can deliver important benefits, as the survey responses have illustrated – enforcing a consistent data format between participants, for example, and facilitating real-time data access across operating systems and data sources.”

However, beyond this, APIs are a means to enable something much bigger. Developments in interface technology are creating opportunities to establish new models for data exchange and service delivery. “We intend that this will involve participation from a wide community of industry players, who will agree on standards and, ultimately, establish new models for data communication that will be adopted across the industry. We view APIs as an interface technology that will power a new marketplace,” says Aerts.

Uneven readiness

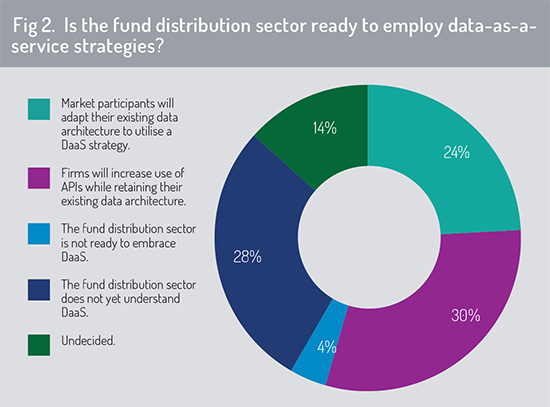

The survey results tell us that a level of flexibility is important to support an industry still at different stages of readiness for a data-as-a-service type data architecture (such as that offered by Fundsquare Data Hub) and for API-based data communication. Just under one quarter of respondents said that they will adapt their existing data architecture to utilise a DaaS-based data management strategy (Fig 2). However, a slightly larger percentage said they will make greater use of APIs for data transfer, but will do so while retaining their existing data architecture.

“Many firms are still committed to managing data in ‘on premises’ databases,” says Aerts. “But this can result in data inconsistencies and reconciliation challenges in working across multiple data locations, where each database is often maintained by a different team. By centralising this data in a common data hub – utilising a data-as-a-service model – the user has real-time access to a centralised golden source where this data is consistent and standardised.”

“Many firms are still committed to managing data in ‘on premises’ databases,” says Aerts. “But this can result in data inconsistencies and reconciliation challenges in working across multiple data locations, where each database is often maintained by a different team. By centralising this data in a common data hub – utilising a data-as-a-service model – the user has real-time access to a centralised golden source where this data is consistent and standardised.”

Barriers to adoption

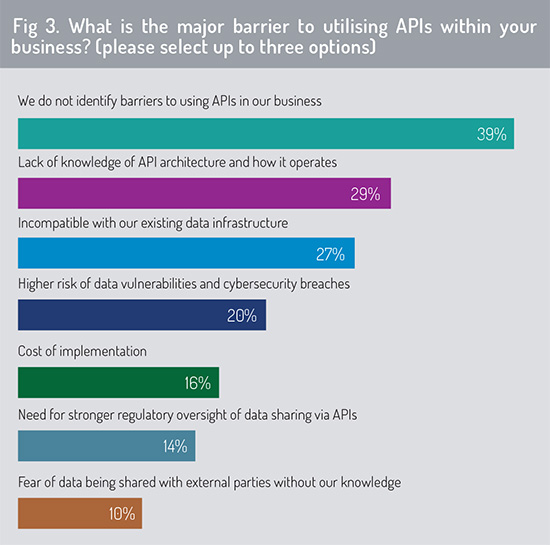

It may be encouraging that 40% of respondents do not identify significant obstacles to utilising APIs within their business. But if the industry is to extend usage, it is important to look beyond this group of current adopters and to identify the barriers that confront a wider body of potential users.

The major barrier to API utilisation, respondents tell us, is lack of knowledge of API architecture and how it operates (fig 3). There is clear need for technical information and education to assist financial services firms with their API deployment – particularly in communicating the possibilities offered by DaaS and an API architecture to business decision-makers.

“This is a conceptual barrier that we need to overcome,” says Aerts. “Senior managers on the business side may view APIs as a technology issue and therefore outside of their field of responsibility.”

However, the principle of an efficient interface that enables data transfer in standardised format in real-time is not difficult to understand – and this can deliver major benefit to the business. “We need to improve communication between IT specialists and business teams to provide better understanding of how an API ecosystem can be deployed to enable product development and process innovation,” concludes Aerts.

© 2020 funds europe