Managers of US bond portfolios were among the most-searched firms as investors examined fixed income funds during May, writes Global equities were the second-most searched investment in UK and Europe, reports CAMRADATA.

During May 2021, there was notable search activity for bonds on CAMRADATA Live. Global Broad Bond and US Broad Bond were in the top ten asset classes searched for by institutional investors, ranking sixth and eighth respectively.

UK-based investors – including consultants and pension funds – showed a preference for the Global Broad Bond category, whereas investors based in continental Europe and other parts of the world displayed a greater interest in US Broad Bond, albeit still with searches in the Global Broad Bond category.

There are currently 575 Broad Bond vehicles within CAMRADATA Live, of which 62% have a base currency in US dollars. There is a wide range of geographical focus for Broad Bonds. This includes UK, US, Emerging Markets, Asia, European and Global offered in pooled and separately managed accounts. Some of the styles included were absolute return, high yield, income, index-linked and strategies orientated towards convertibles.

Focusing on CAMRADATA’s IQ universe for US Broad Bonds only, for the three years ending March 31, the top-performing firm for this asset class was TCW with its vehicle TCW Core Plus Fixed income. This achieved an IQ score of 0.88, with the vehicle achieving an excess return of 1.36% over the benchmark whilst taking excess risk of 0.66%.

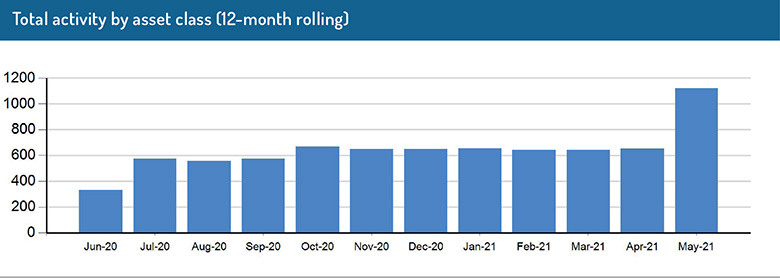

The search activity in the database has varied depending on the geographical focus of the vehicle. Global Fixed Income, as a searched asset class, stayed relatively the same throughout April 2021 to May 2021 on a 12-month rolling period – but the total search activity in CAMRADATA Live by the US Fixed Income asset class saw a significant increase from April 2021 to May 2021, again on a 12-month rolling period. This was potentially due to the US engaging with fiscal stimulus, meaning the country is expected to see growth for the economy and especially the corporate sector.

But the big question is about whether there still value to be had for fixed income investors as they move into the second half of 2021. It is clear asset managers are facing a tough task of trying to make money while preserving capital in this environment where there is so little value in the market to be had. However, the positive technical demand for bonds from central banks and investor positioning could continue to help drive yields lower, offering a more promising outlook for total returns going forward. Time will tell… but it is time for strategic bond managers to prove their worth!

*All figures are for the 12 months to May 31, 2021 unless otherwise stated.

© 2021 funds europe