Following a sluggish 2019 that saw the world economy grow by 2.9% year-over-year – its lowest growth rate for ten years – the Covid-19 pandemic triggered further contraction in Q1 2020 as travel restrictions and the closure of factories, education and retail outlets applied a handbrake to trade and investment.

This sent equities markets into sharp decline during March, before recovering strongly during Q2. The S&P 500 lost more than 30% of its value in the initial weeks of the crisis, sliding from close to 3400 in February to below 2300 on March 23. The UK FTSE 100 plummeted from 7600 in January to below 5000 in late March; while on March 12, the FTSE All Share Index dropped more than 10%, its largest single-day fall since 1987.

Emerging markets equities also suffered – particularly in the face of a US dollar that appreciated by more than 7% between March 6 and 23. The MSCI Emerging Markets index was down more than 23% over the quarter, despite a pick-up in the final week of March in reaction to central bank interventions in the US, UK and the euro area.

The initial flight for safety by investors pushed down yields for high-quality government bonds. US ten-year Treasury yields narrowed sharply from 1.92% to 0.63% during Q1, with yields on German ten-year bunds pushed further into negative territory (falling to -0.84% on March 10 before rising to -0.27 in June, according to data from Trading Economics).

The Bank of England describes how a sharp contraction in risk appetite at the start of the crisis translated into a ‘flight for safety’ and then a ‘dash for cash’. Investors were forced to liquidate even safe assets such as long-term government bonds to meet demand for cash and short-term highly liquid assets – required to cover margin calls on derivative positions and other risk hedges in conditions of high market volatility (Bank of England, ‘Interim Financial Stability Report’, May 2020, page 4).

“Selling pressures in bond markets became acute,” says the Bank of England, “with leveraged investors forced to sell assets and make redemptions from money market funds to access liquidity … while dealers stepped back from repo markets”.

Central banks and governments have stepped in with massive, timely policy interventions to counter a precipitous slide in consumer spending – which plummeted with lockdown – and to protect jobs and livelihoods for those unable to travel to work during this period. Asset purchases by central banks mollified pressures in bond markets, with the US Federal Reserve launching a comprehensive lending programme to support households, employers, state and local government, and financial markets.

With these interventions, the US Federal Reserve’s total assets surged past US$6 trillion for the first time. It also enabled other central banks to borrow almost $400 billion in US dollars to smooth swings in foreign exchange markets, establishing an overnight USD credit facility for a number of central banks that did not previously have swap arrangements with the Fed (enabling them to borrow against US treasuries provided as collateral).

US equities have recovered strongly, fuelled by this strong injection of liquidity from the Fed. By the end of July, the S&P was back close to the 3400 level it vacated at the start of its plunge in February and it has continued to push on towards 3500 during August. But some stocks in the S&P have been slow to come to the party. Investors are concentrating on a select cohort of particularly tech-based stocks they believe will deliver strongest and most sustainable gains – with Apple, Amazon, Alphabet, Facebook and Microsoft, the largest companies in the S&P 500 by market capitalisation, driving a big share of this recovery.

Low interest rate environment

In the US, the Federal Open Market Committee cut the target range for the federal funds rate (the rate that banks pay to borrow from each other overnight) from 1.5-1.75% down to 0-0.25% in the course of two meetings during March. The Bank of England’s Monetary Policy Committee reduced rates from 0.75% to 0.1% – and many expect policy rates to remain at near-zero levels for some time to come.

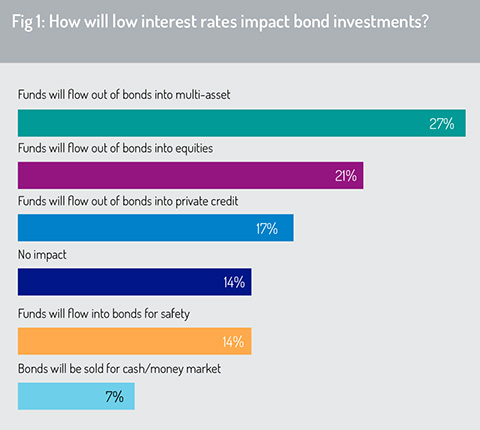

The survey finds that investment funds will flow out of bond markets (particularly low-yielding government bonds), with multi-asset products being the dominant beneficiary (27%, fig 1). Multi-asset funds aim to provide access to a diversified investment portfolio, including equities, fixed income and cash, utilising a spread of investment styles, sectors and regions intended to provide attractive returns in a wide range of investment conditions.

The survey predicts that funds will also flow out of low-yielding bonds and into equities (21%), private credit (17%) and other higher-yielding assets. With the onset of Covid-19, equities prices fell sharply but then rallied – with the MSCI World rising almost 19% during Q2 2020 – and there have been significant inflows into equity markets, particularly from retail investors.

There are demanding questions in the current climate about how far this equity rally will be sustainable. Some economic analysts forecast a V-shaped recovery (sometimes with a shortened right arm), others a U-shaped or W-shaped reaction. While the impact of huge interventions from governments and central banks will buoy equity markets for the time being, there are clear concerns around the economic impact as large-scale government employment support – for example via the US CARES Act and UK Coronavirus Job Retention scheme – is progressively wound down.

Faced with these challenges, Thomas Becket, chief investment officer at Punter Southall Wealth, indicates that he currently has a mixed view on equities: “They are certainly not cheap at present but there is a deficit of other investment opportunities,” he says. “Selective regions and themes are likely to be attractive, at present emerging markets, Asia and Japan plus healthcare, infrastructure and green technology, along with any areas supported by government spending. In the short term, the UK and Europe are not hugely attractive, but could be so in the medium term with the post-Covid reopening up of economies and businesses.”

© 2020 funds europe