Almost a quarter of a century after the Kyoto Protocol – which established a practical framework for implementing the United Nations Framework Convention on Climate Change – the financial industry’s progress in meeting commitments to environmental, social and governance principles has, arguably, been disappointingly slow.

Data from State Street Global Advisors (SSGA), collected in the firm’s 2018 Institutional Investor Survey, indicates that at that time, just 27% of investors in the US were incorporating ESG factors “into at least half of their investments”, while in Europe and the Asia-Pacific region, the equivalent figures were just 17% and 15%, respectively (SSGA, ‘Performing for the Future: ESG’s Place in Investment Portfolios’, 2018).

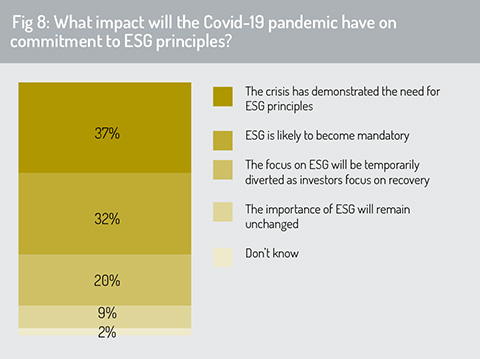

Nonetheless, it is encouraging that the largest group of respondents in this Funds Europe 2020 Investor & Adviser Survey say that the Covid-19 crisis has reinforced the importance of ESG principles (37%). A further 32% say that ESG is likely to become mandatory for asset managers as a condition for securing investment mandates in the next few years (fig 8). ;

It is also noteworthy that only about a fifth of respondents believe that commitment to ESG principles will be diluted as industry participants focus on recovery from the pandemic.

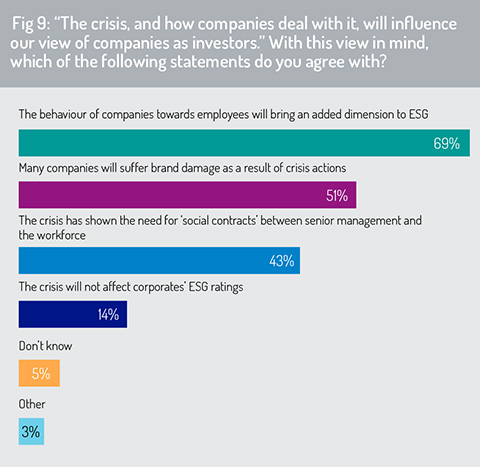

Looking into this issue in further detail, more than two-thirds of respondents say that the behaviour of corporates towards their employees during the pandemic will have a significant influence on how they are rated in ESG terms when it recedes (fig 9).

For those companies that have not managed their environmental, social or governance responsibilities well, more than 50% say that companies will suffer brand damage as a result of crisis actions taken during the pandemic. Only 14% of respondents believe that the Covid-19 crisis will have no impact on how ESG ratings are given to corporates.

Calastone observes that ESG investment used to struggle to gain real, mainstream traction among investors. This was primarily due to a lack of understanding and consistency around what ESG investment means and what ESG products offer. But it also reflects a perception that ESG investment may entail lower returns (Calastone, ‘Tracking Global Fund Flows: International Fund Flow Report, 2020’, page 12).

However, ESG funds are now capturing growing market share as investors opt for strategies that conform to their environmental and social concerns. “They remain small as a share of AuM (just 3.4% in the UK), but they have exploded in popularity,” says the Calastone report. “ESG funds are also benefiting from a large marketing push by the fund management industry, partly in response to very strong investor demand for ESG products and partly because they offer better margins for managers. Indeed, because ESG funds tend to be actively managed, they are also the one area of real strength for active equity funds, which are otherwise suffering at the expense of their passive counterparts. 99% of ESG fund flows in the UK are into active funds.”

However, ESG funds are now capturing growing market share as investors opt for strategies that conform to their environmental and social concerns. “They remain small as a share of AuM (just 3.4% in the UK), but they have exploded in popularity,” says the Calastone report. “ESG funds are also benefiting from a large marketing push by the fund management industry, partly in response to very strong investor demand for ESG products and partly because they offer better margins for managers. Indeed, because ESG funds tend to be actively managed, they are also the one area of real strength for active equity funds, which are otherwise suffering at the expense of their passive counterparts. 99% of ESG fund flows in the UK are into active funds.”

Elaborating on this point, Calastone’s Edward Glyn says: “There is evidently still a lot of work to be done in adopting and defining ESG principles, but it has already become a core area of strength for active managers. Across the Calastone network, we saw over £1 billion flow into UK-based ESG funds between April and July 2020. Over the coming year, fund managers will need to understand what is driving this demand and start to think carefully about how they structure and categorise this evolving area of collective investments.”

The Covid-19 crisis has highlighted inequality between those who can work from home and those who cannot; and those who have access to effective, affordable healthcare services and those who do not. According to US government statistics, 61.5% of workers with earnings greater than the 75th percentile have the ability to work from home, but only 9.2% of those earning below the 25th percentile have the ability to do so (US Bureau of Labor Statistics, ‘Job Flexibilities and Work Schedules – 2017-2018 Data from the American Time Use Survey’). To compound these inequalities, employees working predominantly in the informal economy, without regular working contracts, may be ineligible for support via government emergency measures such as the UK Job Retention Scheme.

Behavioural change as a result of the pandemic

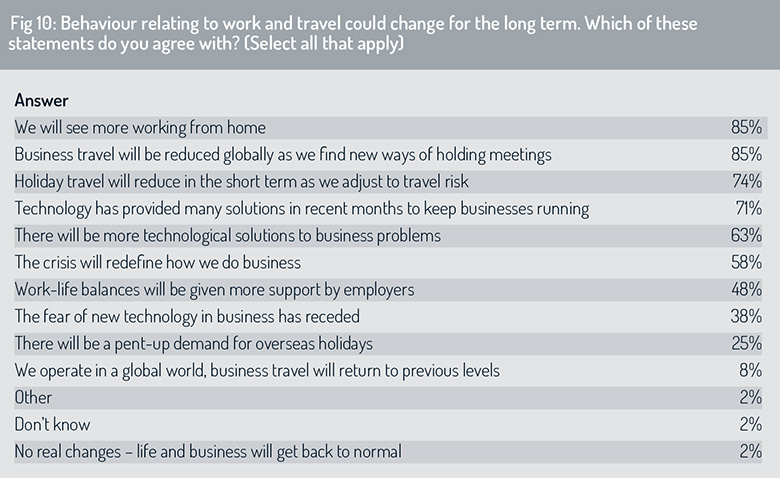

Exploring how companies will change their working practices after the pandemic (fig 10), the survey predicts that the asset management industry will make greater use of working from home in times ahead (85%). It will also reduce its business travel as the industry finds new ways of communicating and scheduling meetings (85%). Among the population at large, families may reduce their leisure travel through a desire to reduce health risk, limit environmental impact and explore opportunities to take vacations closer to home.

The crisis has shone a spotlight on the importance of technology in addressing problems during the pandemic. In fig 10, respondents tell us that technology has provided multiple solutions to keep business running during this period (71%).

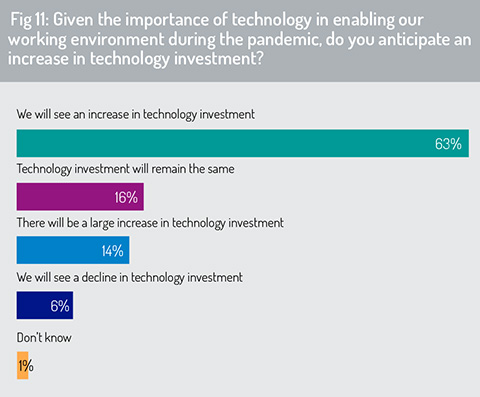

Close to two-thirds of respondents say the value demonstrated by technology in managing the pandemic will result in a rise in technology investment in times ahead (fig 11). This is four times the number that say technology investment will remain static (16%) and ten times as many as those who say it will decline (6%).

Providing further detail, one respondent said: “Technologies facilitating visual meetings and those facilitating contractual agreements and execution of other documents will improve and be used more frequently. Legislation is likely to be updated to facilitate this.”

Providing further detail, one respondent said: “Technologies facilitating visual meetings and those facilitating contractual agreements and execution of other documents will improve and be used more frequently. Legislation is likely to be updated to facilitate this.”

Another said: “AI, 5G and cloud technology will become so commonplace that it will not warrant mentioning – in the same way that the internet has become ubiquitous compared with 20 years ago.”

Adam Belding, chief technology officer at Calastone, comments: “The entire financial world has been flipped upside-down this year, with remote working driving even stronger demand for automation. This doesn’t mean that there has to be a big-bang approach to technological change, though – building out the industry of the future and driving solid business continuity programmes will be about well-thought-out, considered, incremental change.”

© 2020 funds europe