Respondents to our survey on tokenisation mostly think digital assets will have a transformative impact on investment funds, particularly for investment returns and liquidity.

One of the most significant innovations to impact asset management in recent years has been the development of blockchain technology, which has paved the way for tokenisation and the introduction of digital assets.

Blockchain is a distributed ledger technology (DLT) that allows data to be stored in linear ‘chained’, or linked, blocks that can record and verify information. It has been particularly useful for the financial services industry as it permits the recording of transactions that are immutable – and cannot be altered later.

The arrival of blockchain technology has also helped pave the way for tokenisation and the launch of a new wave of tradable digital assets. Not only has it enabled entirely new digital-native assets such as cryptocurrencies and non-fungible tokens (NFTs), but it is also being utilised for traditional assets.

Increasingly, less liquid traditional assets, such as real estate, are being converted into digital tokens that can be stored and transferred securely using blockchain technology. As well as providing greater liquidity, tokens can offer fractional ownership and greater accessibility.

Regulators around the world are also turning their attention to facilitating the roll-out of digital assets via tokenisation to protect investors. One of the most recent regulatory initiatives is the European DLT Pilot Regime, which came into force in March 2023 and will allow operators of market infrastructure to test DLT in the issuance, trading and settlement of tokenised financial securities for an initial three-year period. The UK Financial Conduct Authority, for example, is also experimenting with tokenisation through its proposed Digital Securities Sandbox, which will facilitate the testing and adoption of digital securities across financial markets.

As tokenisation and digital assets become more widely adopted, a brand-new investment opportunity is emerging. The size of the market is set to grow to around $4-5 trillion by 2030, according to investment bank Citigroup. As such, they will likely play an increasingly important role in portfolios in the years to come.

How many have heard of them?

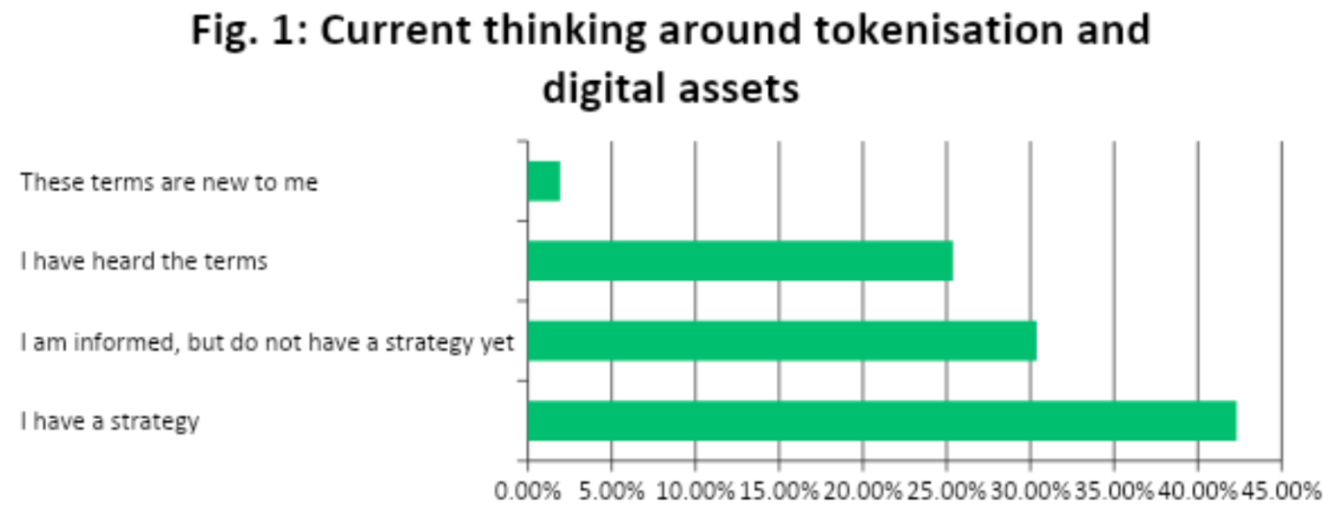

Encouragingly, almost all (98%) respondents have already heard of digital assets and tokenisation. However, respondents are at different stages of preparedness for how they tackle this burgeoning asset class.

Under half of respondents (42.3%) have a strategy in place to incorporate or utilise digital assets and tokenisation within their portfolios (Fig.1). And a further 30.4% of respondents are informed about digital assets and tokenisation but do not yet have a strategy in place.

UK respondents seem to be the most prepared, with 56% having a tokenisation and digital assets strategy in place, followed by 53% of German respondents and 40.5% of Dutch respondents. At the other end of the spectrum, just 21.3% of Swiss and 39.6% of French respondents have a strategy in place.

While many asset owners and investors still need to develop an approach or strategy for digital assets and tokenisation, there are some encouraging signs that they are starting to have more informed discussions.

Token discussions

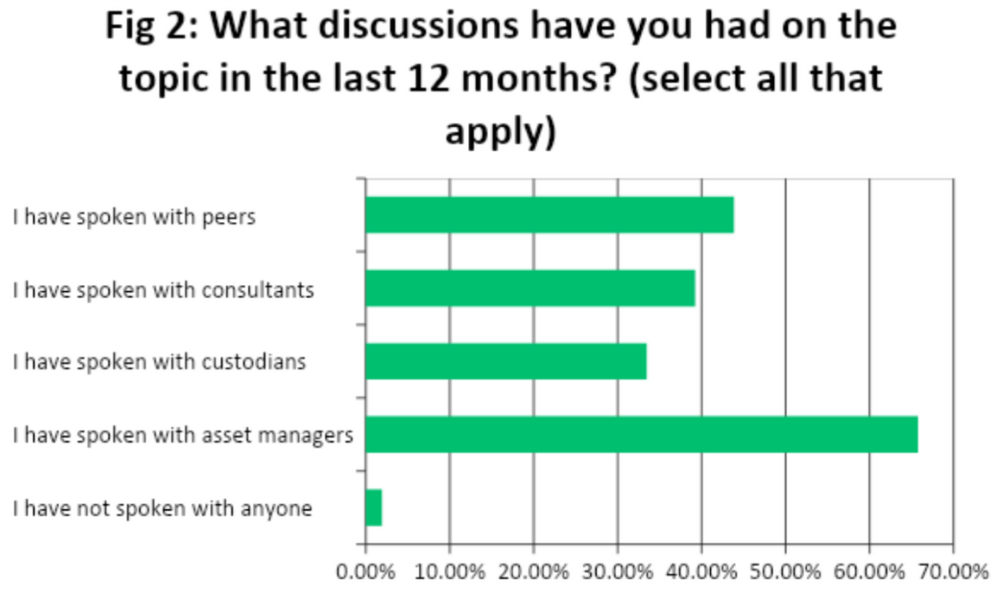

There is certainly a buzz growing around this sector, with 43.9% of respondents admitting to having discussed digital assets and tokenisation with their peers over the past 12 months (Fig. 2). There are also some signs that their approaches and strategies are starting to evolve.

Many of our respondents have taken it a step further, with almost two-thirds (65.8%) having discussed tokenisation with asset managers, and 39.2% with consultants, suggesting that they are becoming more open about investment in digital assets. Some asset managers have already started to launch tokenised funds.

Furthermore, one-third of respondents (33.5%) have spoken with custodians, suggesting they are already looking at ways to incorporate digital assets into their portfolios.

“That 42.3% of respondents have a clear strategy on tokenisation, and digital assets are incredibly high,” said Arnaud Misset, chief digital officer at CACEIS. “But it is quite surprising that so few asset owners and investors are talking to custodians because they are a key link in the value chain.

“If you don’t talk to custodians, you may not know how to handle digital assets because they require a brand-new way of doing things. It is a completely different way of safekeeping and settlement.”

“We believe traditional custodians are the best option for asset owners and investors when it comes to digital assets as they can provide clients with a high degree of confidence and security – it’s what custodians already do with traditional assets.”

Just over half (52.3%) of French respondents have already spoken with custodians, and just under half (46%) of German respondents have done likewise. Dutch and Swiss asset owners and institutional investors are more likely to have spoken with asset managers, with 85.7% and 76.6% having discussed the topic over the past 12 months.

Level of information

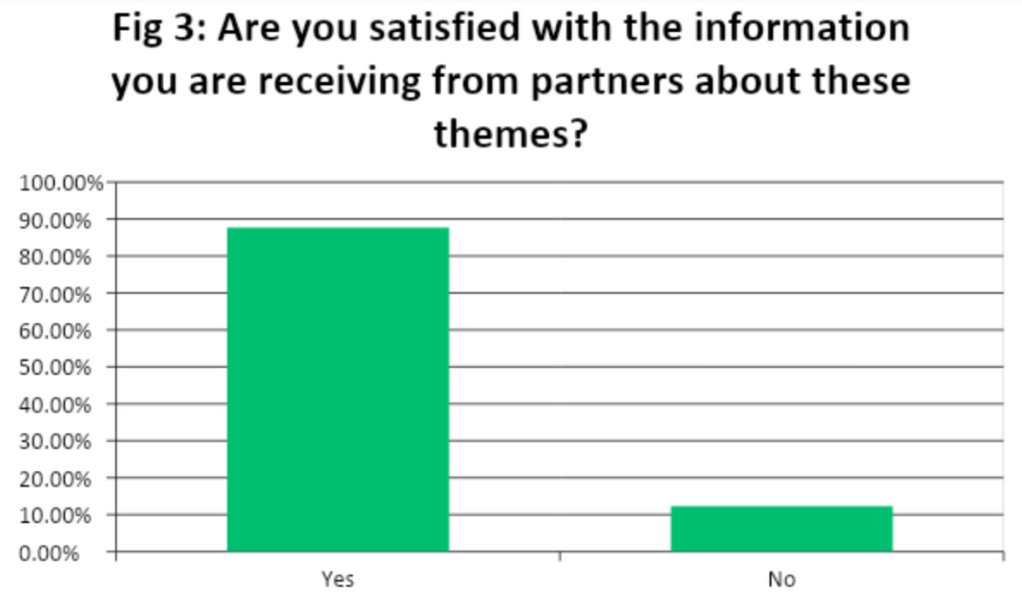

Respondents were generally satisfied with the level of information they are receiving from their partners – 87.7% satisfied vs. 12.3% dissatisfied (Fig.3).

As investors’ understanding of the benefits of tokenisation and digital assets evolves, many want more detail to help them have more sophisticated conversations.

Several respondents said some of the information shared was “entirely superficial” or did not give “a conclusive answer for what I should invest in”. Other respondents said their partners were not as informed.

“Those with a strategy or a digital assets team in place will likely already have access to the research and details that they need to make investment decisions,” noted CACEIS’ Misset.

Nevertheless, the information that respondents have received has informed how they view the potential impact of digital assets and tokenisation on their portfolios.

“Transformative impact”

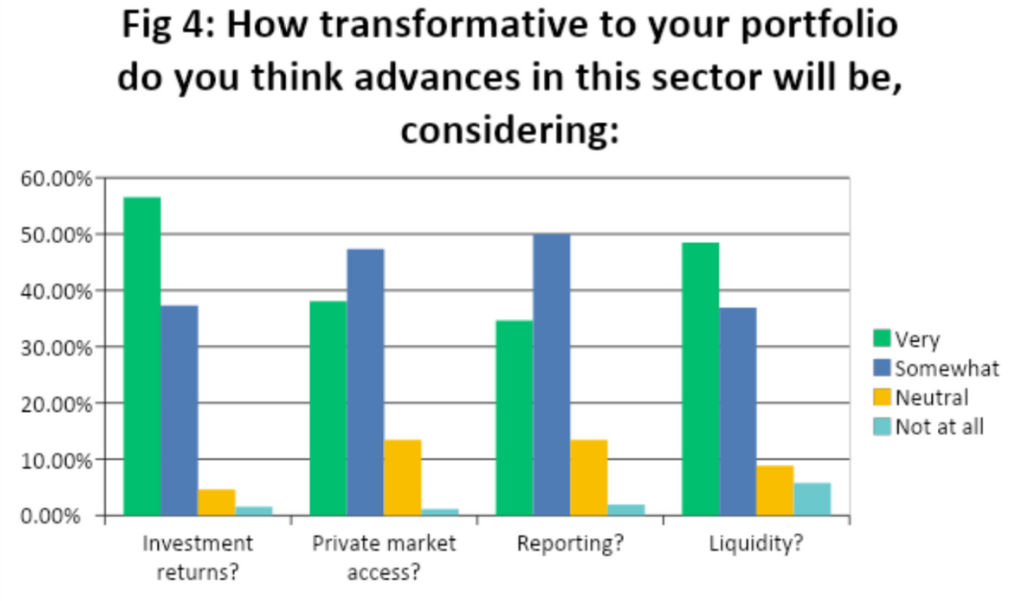

Respondents were most optimistic about the potential for investment returns, with 93.9% saying the digital assets sector would have a very or somewhat transformative impact (Fig 4). Respondents were also highly confident that the sector could have a transformative effect on providing liquidity in areas like private markets.

Operationally, tokenisation will also have a big impact on reporting for asset owners and other investors as the blockchain technology behind some digital assets makes record-keeping easier.

“Everyone seems to be convinced that not only will tokenisation impact the industry, but it will impact it strongly,” said CACEIS’ Misset. “What is interesting is how tokenisation will make illiquid assets more liquid and permit the fractionalising of other assets. Reporting will likely change significantly as everybody will have access to the same information at the same time. These are key benefits of the underlying blockchain technology.”

*These findings are from the ‘Reshaping Investment: Tokenisation, ETFs and Sustainability’ report, based on survey results to be published in full shortly. More than 250 asset owners, investment consultants, family offices and sovereign wealth funds from all over Europe took part.

© 2023 funds europe