ESG risk management is taken seriously in a number of European countries. But there remains a divergence on the issue, finds the second part of our exclusive Funds Europe/Caceis research among 250 asset owners.

Greater focus on sustainability and ESG has been one of the biggest drivers of asset allocation in recent years, as investors have pledged increasing proportions of their portfolios to strategies that aim to have a positive environmental or social impact.

Such is the enthusiasm for this area of investing, that institutional assets under management are forecast to rise to $33.9 trillion by 2026 from $18.2 trillion in 2021, according to PwC.

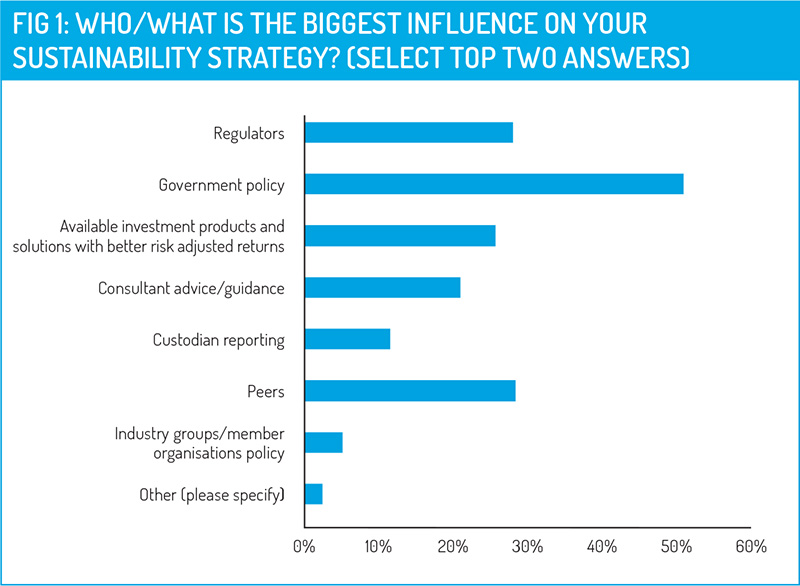

Unlike other themes, such as digital assets where conversations have been driven by investors or the wider industry, the biggest influence on sustainability investment strategy is government policy.

Funds Europe research*, in partnership with Caceis, finds that more than half (51.2%) of respondents said policies, such as ambitious net zero targets to reduce carbon emissions, have informed their investment approach (Fig 1).

“It is pretty clear that the key driver of asset allocators’ sustainability strategy is a mixture of government policy, legislation, and the net-zero agenda from regulators,” said Scott Foster, head of digital & governance products at CACEIS. “Investment managers are designing the products, consultants are advising schemes on how to meet their goals and targets, and their peers are providing benchmarks.”

ESG risk now fully recognised

Environmental and social risks were for a long time considered as non-financial risks. But over the years, as ESG crept up the agenda, investors came to see how oil spills or collapsing factories that kill workers in a company’s supply chain can be disastrous for the financial bottom-line.

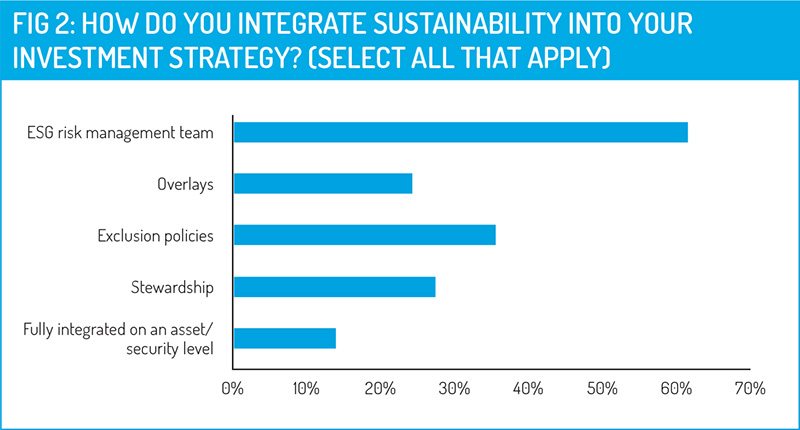

There are several ways for respondents to integrate sustainability into their investment strategy, but the most common for respondents was through maintaining a dedicated ESG risk management team (61.5%). Exclusion policies are used by 35.4% of respondents, while stewardship and overlays were also common (Fig. 2).

The preference for maintaining dedicated teams arguably shows how ESG risk management has developed into a discipline.

“These results show respondents have rightly identified ESG as a risk,” says Foster. “Even though policies and strategies are being driven by regulators and government legislation, it is not a tick-box exercise. Asset allocators have identified that climate change holds various risks for their portfolio, including transition risks, decarbonisation risks and physical risks.”

“Overlays can be useful, but exclusion policies may become more common to determine what pension funds invest in, Foster says. He adds that CACIES sees pension schemes using exclusion-based reporting to identify their look-through exposure to revenue connected to ‘sin’ products, such as alcohol, tobacco, and oil and gas within their portfolios. Schemes want more transparency across all responsible investment areas.

“Overlays can be useful, but exclusion policies may become more common to determine what pension funds invest in, Foster says. He adds that CACIES sees pension schemes using exclusion-based reporting to identify their look-through exposure to revenue connected to ‘sin’ products, such as alcohol, tobacco, and oil and gas within their portfolios. Schemes want more transparency across all responsible investment areas.

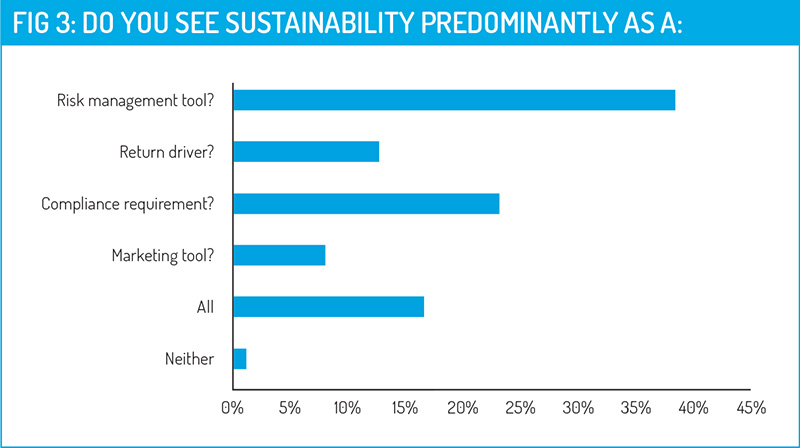

The soaring popularity of applying sustainability factors is not just due to regulatory requirements or marketing. More than a third (38.5%) of respondents said sustainability was a risk management tool, compared with 23.1% who said it was the result of a compliance requirement (Fig 3).

At the country level, there were some notable differences between respondents. French, British and German respondents were most likely to view sustainability predominantly as a compliance issue. Dutch and Swiss respondents, meanwhile, were more likely to consider sustainability to be a risk management tool.

Foster said sustainability risks should be viewed in the same way as financial risks – and should be fully embedded in governance processes.

“Risk management teams are in charge of the integration of sustainability into respondents’ investment strategies, but French, British and German respondents do not primarily see it as a risk management tool,” said Foster. “The fact that initiatives such as TCFD reporting has only been rolled out in the UK within last year or two, as well as the arduous complication of SFDR and EU taxonomy reports, could explain why many think of it primarily as a burdensome compliance requirement.

“Over time, once the regulatory reporting element is stabilised, asset owners and other investors will start to appreciate the facts and figures, identify trends, and the impacts these new metrics have on long term investment performance. The integration of accurate sustainability data, ESG reporting, and scenario analysis will eventually feed more into the risk management mindset.”

A challenge for private markets

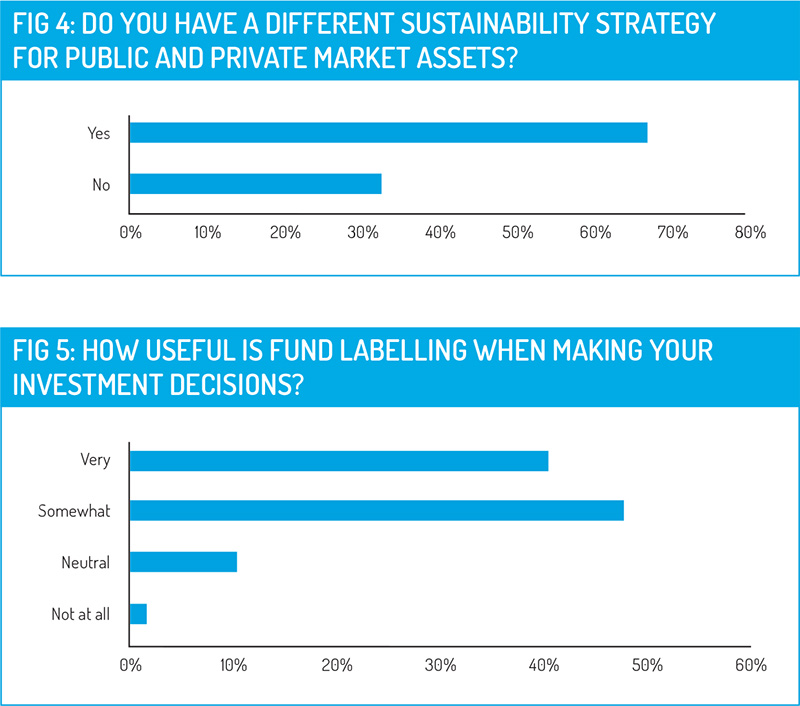

While it has been easier to compare the sustainability of traditional asset classes, such as publicly listed equities and bonds, it has been more challenging for private assets, which can be less transparent. Just over two-thirds (67.3%) have a different strategy for public and private market assets (Fig 4). Respondents said they operate different strategies for different asset classes, but they often have an overarching approach to sustainability and ESG that guides these strategies.

“Private equity businesses can hold greater emphasis on financial returns than ESG factors, although this is changing as sustainability becomes increasingly important,” said one of the respondents.

The respondent adds: “Public markets are subject to stricter reporting and transparency guidelines, some of which may specifically target sustainability.

“Private market investments may focus on long-term impact and customisation, while public market investments provide liquidity, transparency and scalability.”

The popularity of sustainable funds means asset managers have been very active in marketing their ESG strategies to investors. However, accusations of greenwashing have prompted regulators to act and introduce fund labelling to ensure investors are not misled. The EU’s SFDR and forthcoming SDR from the UK Financial Conduct Authority aim to level the playing field.

Fund labelling ethos

Fund labelling was extremely popular with respondents, with 88.1% making use of labels when making investment decisions.

“The ethos of fund labelling is correct, and we should be doing it to prevent issues including greenwashing, to make it clear to consumers what they are buying,” said Foster. “The biggest issue will be divergence in fund labelling regimes globally. You could end up with one classification in Europe and a completely different one in the US or the UK. That will only add confusion to the market, and amongst investors.”

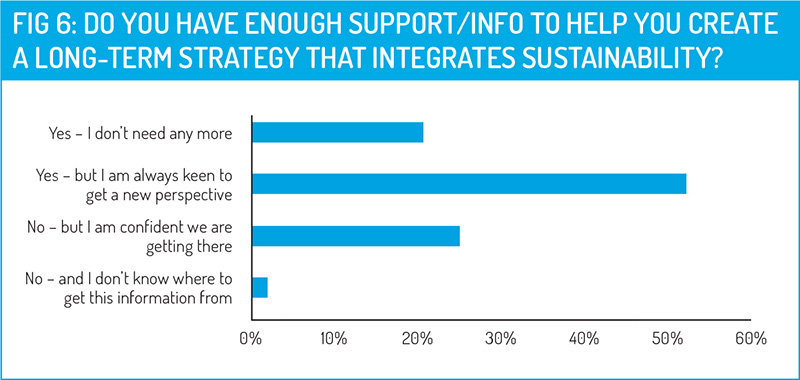

When considering their ability to create a long-term sustainability strategy, most respondents were confident they had the right information and support in place. Some 20.8% said they didn’t need any more help, while 52.3% said they were keen to get new perspectives (Fig 6). While one-quarter of respondents said they did not have enough support or information, they were confident they would receive this in the long term.

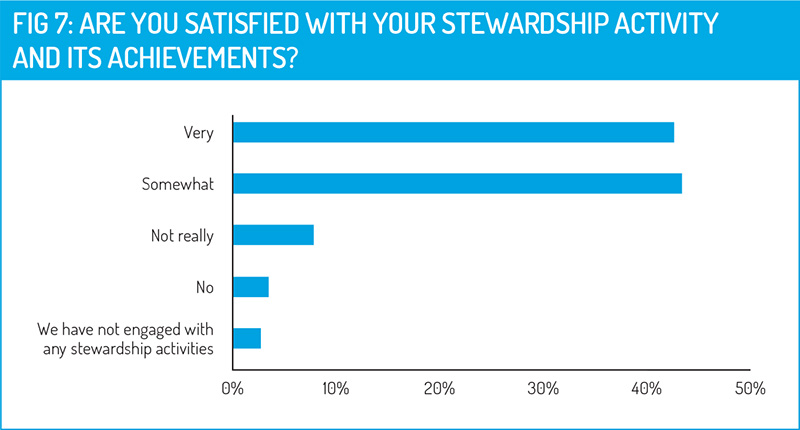

As more asset owners and investors embrace sustainability in their investment approach and make decisions that have a real impact on the world, they will likely become more involved in stewardship. It is an area where the respondents have a high degree of confidence, with 42.7% very satisfied with their engagement and achievements (Fig 7). There was some room for improvement, however, with just 43.5% saying they are only ‘somewhat’ satisfied with their achievements. A further 11.2% are dissatisfied with their stewardship approach.

Voting with their feet

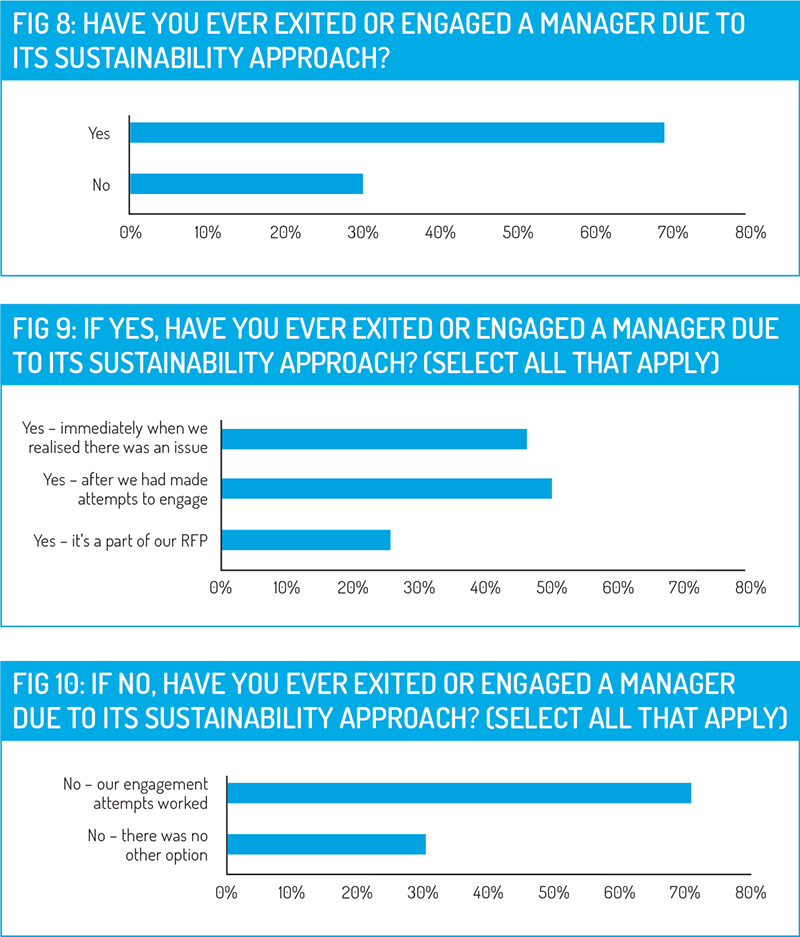

Increasingly, respondents are not afraid to vote with their feet by backing fund managers with strong sustainability credentials, or challenging those who do not align with their sustainability approach. More than two-thirds (69.6%) of respondents said they had engaged or exited a fund manager because of its sustainability approach (Fig 8).

Of those that had exited a fund manager, 45.9% had exited immediately when they became aware of an issue and 49.7% had left after attempting to engage with the fund manager (Fig 9).

For those that had never exited, 70.9% said their attempts at engagement had worked. However, a significant proportion said they had not exited only because there was no other option available to them.

Finally, when asked to share their biggest data-related challenge, respondents highlighted a range of issues impacting their ability to implement their sustainability strategy. While there were many concerns raised by respondents, a lot of them centred on the lack of standardised ESG data, which continues to make it difficult to compare funds and managers.

“At present, different data providers use different evaluation methods and indicators, making it difficult for me to compare and evaluate the sustainable performance of different companies,” said one respondent. “In addition, some companies do not disclose ESG data publicly, making it difficult for me to obtain comprehensive information.

“Therefore, establishing a more standardised ESG data system and improving the transparency of companies’ ESG disclosure are the main data challenges I currently face.”

*These findings are from the ‘Reshaping Investment: Tokenisation, ETFs andSustainability’ report, based on survey results to be published in full later this year. More than 250 asset owners, investment consultants, family offices and sovereign wealth funds from all over Europe took part.

© 2023 funds europe