The most searched asset class in the third quarter was US Equity with more than 600 vehicles, finds CAMRADATA.

CAMRADATA’s proprietary IQ scores – one of the primary analytical tools used to showcase manager rankings across different asset classes – show that in the third quarter of 2021, there were more than 38 universes. These are created from a set of criteria that vehicles must meet to be part of an IQ universe. The latest IQ report presents the top 20 asset managers with their best-performing products for each universe.

The CAMRADATA IQ scores system is a ranking that reflects five statistical factors measured over a three-year period. These are Excess Return, Information Ratio, Wins-Losses, Hit Rate and Drawdown Strength.

Search activity – which consists of searches by consultants, insurers and pension funds – in the third quarter shows the top asset class by investor research activity was US Equity. This asset class has more than 600 vehicles within the database.

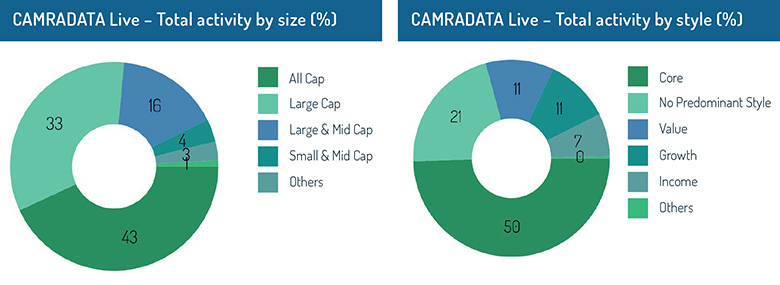

The total activity by size was All Cap (43%), Large Cap (33%), Small cap (16%), Large and Mid-Cap (4%) and Small and Mid-Cap (3%). The total activity by style was predominantly Core at 50%.

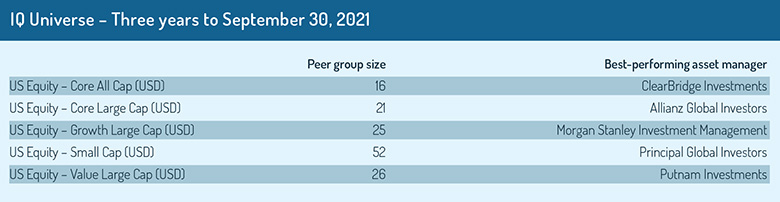

The IQ report showcases US equity broken down into subcategories, such as Core Large Cap and Value Large Cap.

This largest peer group was US Equity – Small Cap (USD) with 52 vehicles within this universe. The best-performing manager was Principal Global Investors with its product CCI Small Cap Growth Composite. This vehicle achieved an excess return of 18.03% over the benchmark whilst taking excess risk of 11.83%.

The CAMRADATA IQ Awards will be held in February 2022, and it’s the fourth quarter 2021 IQ scores that determine which asset manager is the winner and runner-up for each IQ universe. CAMRADATA is always keen to increase exposure for asset managers across the institutional marketplace. With increasing numbers of products in our database, we see a potential uptick in new universes being added to IQ reports in the future.

*All figures are to 12 months to September 30, 2021 unless otherwise stated.

© 2021 funds europe