Short-term issues – weaker growth and high inflation – are putting pressure on Latin American economies. The key question is whether managing these jeopardises longer-term reforms, says Joaquin Thul, an economist at EFG Asset Management.

Most Latin American economies will see weaker growth in 2023 than they did in 2022 and in the pre-Covid period. The two main headwinds are higher interest rates and potentially weaker commodity prices.

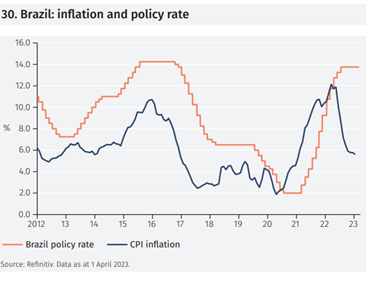

In Brazil, the policy interest rate was raised to 13.75% in August 2022 and has been maintained at that level (see Figure 30). Inflation is above the central bank’s target, although not by as wide a margin as seen in most advanced economies: it was 5.6% year-on-year in February compared with a target of 3.25%. There is some pressure on the central bank to raise the inflation target. That would reduce the urgency of keeping interest rates so high. President Lula has described the high real interest rates as unjustifiable.

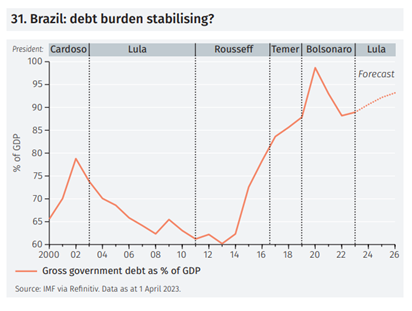

High real rates reflect, however, the risk premium on Brazilian assets. This has been pushed higher by concern about the direction of fiscal policy. Even before President Lula’s term started on 1 January, a one-year exemption of the fiscal spending cap (which limits increases in spending to inflation) was approved by Congress. The cap had also been lifted during Covid. So, there is some concern that government spending will not be as tightly controlled. Admittedly, with the favourable winds of higher commodity prices, Lula’s first two terms of office (see Figure 31) saw government debt levels fall substantially. That seems unlikely to be repeated, according to the IMF’s forecasts, but help in reducing the ratio will come from higher nominal economic growth.

High real rates reflect, however, the risk premium on Brazilian assets. This has been pushed higher by concern about the direction of fiscal policy. Even before President Lula’s term started on 1 January, a one-year exemption of the fiscal spending cap (which limits increases in spending to inflation) was approved by Congress. The cap had also been lifted during Covid. So, there is some concern that government spending will not be as tightly controlled. Admittedly, with the favourable winds of higher commodity prices, Lula’s first two terms of office (see Figure 31) saw government debt levels fall substantially. That seems unlikely to be repeated, according to the IMF’s forecasts, but help in reducing the ratio will come from higher nominal economic growth.

Soy and malbec dollars and pesos

In Argentina, strict capital controls and pressures on the agricultural sector, recently aggravated by drought, have seen the introduction of parallel exchange rates. The “soy dollar” and “malbec dollar” provide more favourable exchange rates for exporters of these products. Dual exchange rates of this nature, however, produce distortions by manipulating relative prices in an economy and favouring particular sectors. Eliminating dual exchange rates generally leads to a more efficient allocation of resources. With a general election in 2023, however, any change will not be imminent.

Long-term opportunities

Latin America, with its rich resource endowment has, of course, enormous potential. Moreover, that potential can be tapped to meet the needs of the modern global economy. President Lula, two weeks after being elected, attended the COP27 climate summit and environmental protection issues are high on his government’s agenda. Argentina has huge scope to expand tourism (notably eco-tourism) in the post-Covid world. The discussion of a potential currency union between Brazil and Argentina, even though ambitious, reflects a new spirit of cooperation between those two economies. Longer-term opportunities, however, often come up against the need for shorter-term expedient measures.

*Joaquin Thul is an economist at EFG Asset Management

© 2023 funds europe