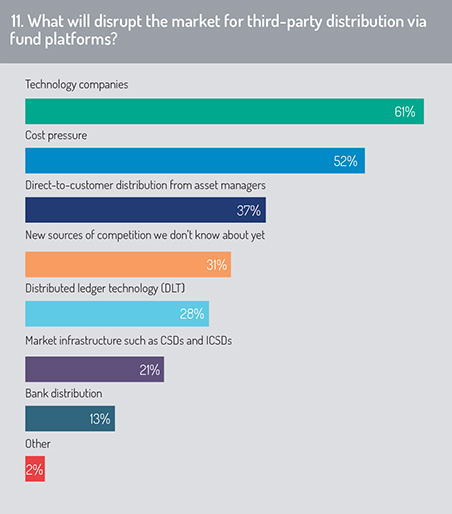

When asked to identify what the major sources of disruption will be to the fund platform marketplace (fig 11), respondents said that technology companies will be the primary challengers to the platform operators’ current business models (61%).

Cost pressures on platform operators will also be important (as noted from respondents’ answers to earlier questions), prompting some operators to review their position in the market while providing opportunities to others to provide an efficient service in an environment where established distribution parties are being forced to review their current business strategies.

The survey suggests that this market is potentially ripe for disruption, with asset management companies expected to extend direct-to-consumer sales (37%) – thereby disintermediating some existing distribution partners. We are also likely to see new entrants stepping in to compete in this space (31%), along with market infrastructure entities (such as CSDs and ICSDs) playing an integral role in distribution support (21%).

A number of technology companies have established partnerships with service providers in the asset management sector, deepening their understanding of the market and refining their product set to meet the requirements of asset management and asset servicing companies. As financial services companies manage their data services in the cloud – and potentially make greater use of cloud-based delivery channels (e.g. software as a service, platform as a service, infrastructure as a service) to meet their service requirements – BigTech firms such as Amazon Web Services, Microsoft Azure and Google Cloud are being integrated more fully into the financial services architecture.

For large online retailers-cum-technology specialists such as Amazon and Alibaba, there may be opportunities to extend their supply chain management, retail distribution and technology expertise into the world of fund distribution. But we need to ask the question, will they want to? The world of mutual fund and ETF sales is heavily regulated and has specialised delivery channels that differ significantly from the service channels in which BigTech companies and large online retailers have operated since their inception. A large-scale entry of BigTech is far from inevitable, at least in the near term, and some of these firms may identify other industrial sectors where they find better opportunity for revenue generation before they commit themselves to the world of investment fund distribution.

Who should pay?

With regulatory interventions (RDR, MiFID II) prompting a review of distributor commission arrangements in a range of markets around the world, fund platform operators are reviewing their business strategies and the mechanisms they have in place to charge for their services. For B2B relationships, this may typically be via an ad valorem charge to asset management companies (based on assets under administration on the platform) and either a negotiated fee or a slice of the commission flow (if applicable) paid by the distributor.

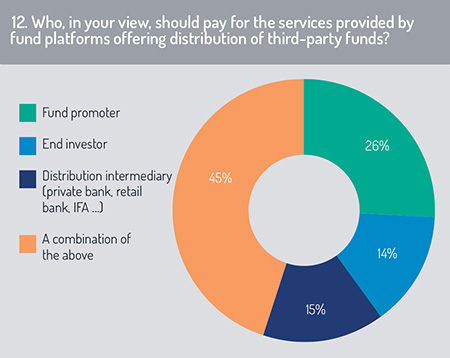

In light of this review process, the survey asked respondents who should pay for the services offering by fund distribution platforms. The dominant opinion was that these should be shared between fund manufacturer, distributor and end investor (45%, fig 12).

A wider question for our industry is how commission arrangements and distribution contracts will be managed. Previously, many larger distributors were content to manage commission flows in-house – they made significant income from managing distribution fee payments on fund sales and had little interest in outsourcing this activity to an external provider who would demand a slice of this income stream.

A wider question for our industry is how commission arrangements and distribution contracts will be managed. Previously, many larger distributors were content to manage commission flows in-house – they made significant income from managing distribution fee payments on fund sales and had little interest in outsourcing this activity to an external provider who would demand a slice of this income stream.

In some locations, sales intermediaries are now reviewing this approach. With sales volumes gradually shifting from commission-paying to clean share classes, distributors are less willing to manage resource-intensive distribution commission and contract management arrangements and are becoming more open to sourcing this service from an external provider. This is providing opportunities for market infrastructure entities that provide fund platform services (such as Clearstream’s Vestima, for example) to extend their activities in this segment of the distribution support arena. Inter alia, MiFID II has thrown a spotlight on transparency and cost efficiency and many distributors no longer wish to be managing commission flows through to downstream sales intermediaries with limited financial compensation for doing so.

Robo-advisory and fund platforms

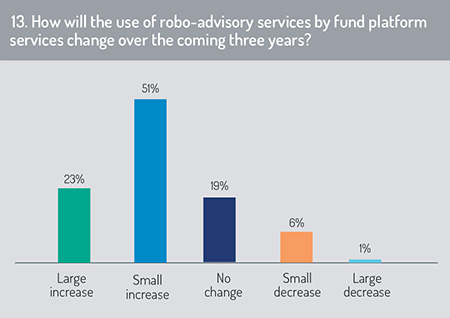

Provision of robo-advisory services on platforms is expected to rise substantially during the coming three years, with three-quarters of respondents predicting the growth of robo-advisory and 23% of these saying this will be a large increase (fig 13).

Robo-advisory platforms have typically targeted retail customers either through D2C marketing or via a B2B service that is intermediated by another distributor (often as a white-labelled service). Robo-advisory platforms may offer different levels of human involvement, ranging from a fully automated product (algorithmic matching of a diversified suite of investment products to a customer’s investment preferences) to a hybrid service (investor engagement with a sales adviser, supported by algorithmic matching). To enable this process, asset management companies and distribution partners are applying client segmentation analysis to their investor base, attempting to identify clusters with similar investment preferences and wealth management goals. It is then a short step to apply a robo-advisory type service to match these investment preferences to a model portfolio or diversified basket of investment products.

Robo-advisory platforms have typically targeted retail customers either through D2C marketing or via a B2B service that is intermediated by another distributor (often as a white-labelled service). Robo-advisory platforms may offer different levels of human involvement, ranging from a fully automated product (algorithmic matching of a diversified suite of investment products to a customer’s investment preferences) to a hybrid service (investor engagement with a sales adviser, supported by algorithmic matching). To enable this process, asset management companies and distribution partners are applying client segmentation analysis to their investor base, attempting to identify clusters with similar investment preferences and wealth management goals. It is then a short step to apply a robo-advisory type service to match these investment preferences to a model portfolio or diversified basket of investment products.

The survey indicates that this component of the self-directed investment market will be an important growth option for some wealth management companies. However, this journey is taking time to gather momentum in some locations. Funds Europe has consulted with a number of service providers in Europe and the Asia-Pacific region during this survey that have already closed or sold off their robo-advisory services owing to limited demand at the current time.

© 2020 funds europe