As the asset management industry focuses on delivering “better solutions” to the investor (rather than simply “better products”), one fundamental component in this package is how investors will meet their requirement for investment advice.

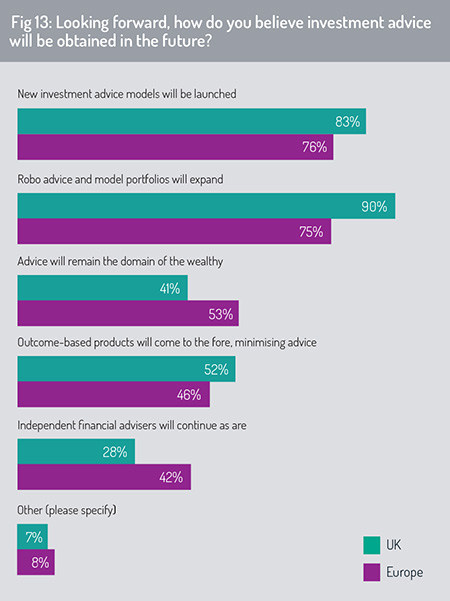

The survey finds that new models for advice provision will be launched across Europe, with robo-advice and the use of model portfolios likely to expand, particularly in the UK market (fig 13).

52% of UK-based respondents and 46% of respondents in Europe (ex UK) believe that “outcome-based” products will become more prominent – delivering investment solutions tailored to meet predefined investment objectives set by the investor.

However, a comparable number believe that lower-income sections of the investment community will struggle to access suitable investment advice. Somewhat disturbingly, 41% of UK-based survey constituents and 53% of those based in Europe (ex UK) believe that investment advice will remain the “preserve of the wealthy”. This is a message that asset management companies – and policymakers – must take on board urgently if they are to stay true to the objective of extending financial inclusion and providing affordable and effective investment solutions to a wider retail public.

For respondents that selected “other”, the survey asked them to provide additional detail. One respondent indicated that investors will play an increasingly important role in dictating the way that investment advice is constructed and delivered in times ahead. There will be a transition period, where existing players remain in the loop, but the industry will need to adapt to the different expectations that millennials (and subsequent generations) have in terms of how finance and investment advice is delivered. “There will be a need for flexibility and humility from current market incumbents if they are to survive during these changing times,” says the respondent.

Another respondent predicted that asset management companies will extend the advisory capability that they can offer from their own investment platforms, particularly as fund companies extend their D2C sales capability in the UK and other European markets. This will be accompanied by “greater vertical integration” in the asset management industry, where fund promoters “widen the range of channels that they employ to acquire investor clients, rather than relying on advice alone”.

Another respondent predicted that asset management companies will extend the advisory capability that they can offer from their own investment platforms, particularly as fund companies extend their D2C sales capability in the UK and other European markets. This will be accompanied by “greater vertical integration” in the asset management industry, where fund promoters “widen the range of channels that they employ to acquire investor clients, rather than relying on advice alone”.

A further respondent predicts that investment will become a “do-it-yourself process for retail investors, with more investors taking more direct control of their investment decisions and product selection”.

Business development

To identify where survey respondents see the potential for business expansion, we asked them to highlight which regions and markets are most important to their current business development activities. They could select more than one response.

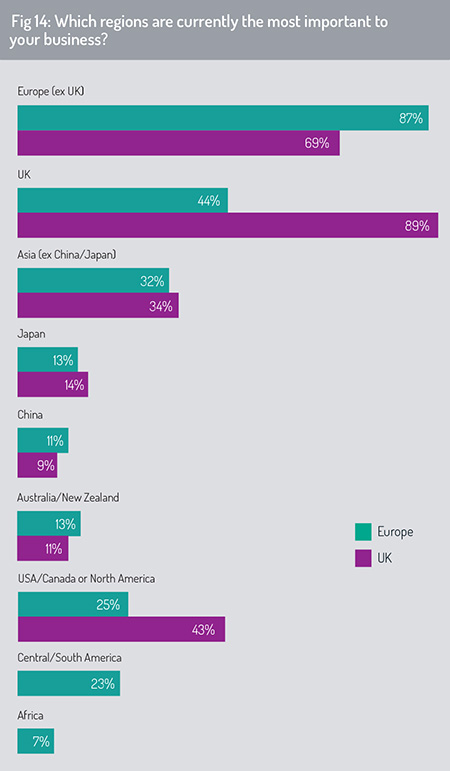

The results reveal a strong focus on the domestic market or their local region. For respondents based in Europe (ex UK), 87% indicated that Europe is their principal focus, with 44% indicating that they are exploring business options in the UK (fig 14).

For UK-based respondents, 89% said that the UK market is their primary focus, with 69% saying they are pursuing development objectives in continental Europe.

Looking outside of Europe, Europe (ex UK) respondents said that their primary development focus lies currently in Asia ex China/Japan (32%), in North America (25%) and in Central or South America (23%).

Only 11% of European (ex UK) respondents identified China as a current development priority, ranking lower than Japan (13%) in their current focus list. This is likely to be indicative of the impact that China’s economic slowdown and US-China trade tensions have had on growth opportunities in China.

Only 11% of European (ex UK) respondents identified China as a current development priority, ranking lower than Japan (13%) in their current focus list. This is likely to be indicative of the impact that China’s economic slowdown and US-China trade tensions have had on growth opportunities in China.

For UK-based respondents, the US and Canada represent the dominant non-European markets for their development activities (43%), with Asia-Pacific markets (ex China and Japan, 34%) and then Japan (14%) identified as important.

Respondents that identified Europe as being most important to their current business activities were asked to nominate their top three European markets for business expansion. Germany was top of the list (51%), with Switzerland second (47%) and France third (44%).

Beyond these three target markets, Italy (37%), Luxembourg (36%) and Ireland (20%) attained a response of 20% or higher from our respondent group.

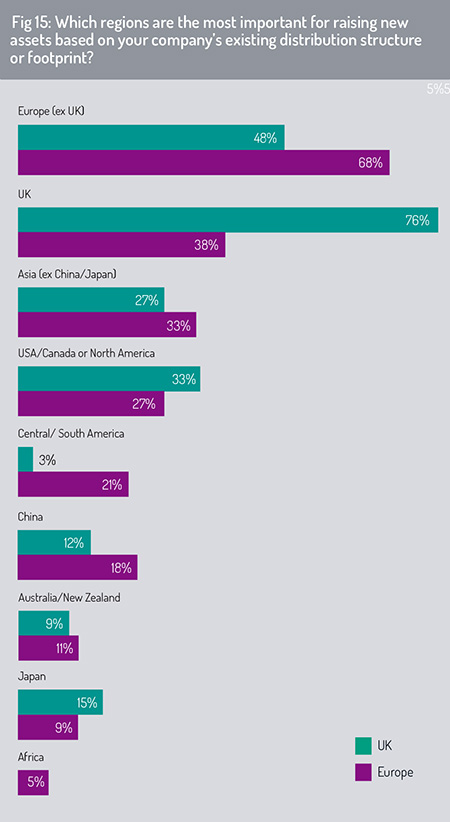

To cast further light on the factors that are shaping the development priorities of Europe- and UK-based asset managers, we asked which markets and regions are most important for asset gathering based on their existing distribution structure (fig 15).

For UK-based respondents, the UK fund market is unquestionably dominant as a source of new assets (76%). Investment fund markets in Europe (ex UK, 48%) and the US/Canada (33%) are also important. Some 27% of UK-based respondents indicated that Asia-Pacific markets (ex China and Japan) hold significant potential, although China and Japan again feature well down the list.

Europe-based (ex UK) respondents said that continental Europe (ex UK) is their priority for asset gathering (68%), with the UK (38%), Asia (ex China and Japan, 33%) and the US/Canada (27%) ranking next in order of importance.

Europe-based (ex UK) respondents said that continental Europe (ex UK) is their priority for asset gathering (68%), with the UK (38%), Asia (ex China and Japan, 33%) and the US/Canada (27%) ranking next in order of importance.

For respondents that identified Europe as being most important for raising new assets, we asked them which European markets offer best opportunities. Again, Germany was the prominent response (55%), with Switzerland second (43%), slightly higher than Italy and France in equal third position (42%).

Luxembourg (27%) and Spain (23%) were the other two markets to achieve a response rate of 20% or more from survey participants.

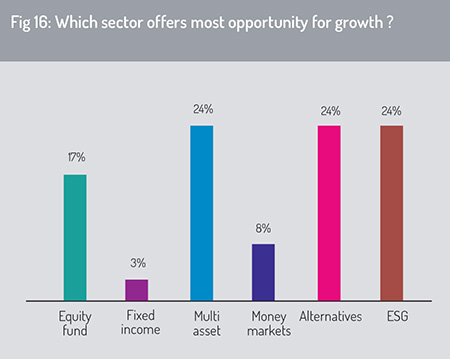

In terms of product type (fig 16), respondents expect to see the greatest opportunity for growth in three areas: in multi-asset strategies (24%), in alternative assets (24%) and in ESG (environmental, social and governance) strategies (24%). They also identify growth potential in equity investments (17%), although confidence in equity strategies has slightly weakened from last year’s survey (down from 20% in 2019).

© 2020 funds europe